10 lpa in hand salary

CTC vs In Hand Salary is the tricky truth of Corporate Economics which is relevant to every individual who is the part of the corporate sector specifically in India. Cost to company 10 lpa in hand salary is a term for the total salary package of an employee. Tax is also deducted from the cash amount the employee receives directly. The term CTC is used by companies to more accurately reflect the incremental spend per employee the concept of Direct Cost from the perspective of an organisation.

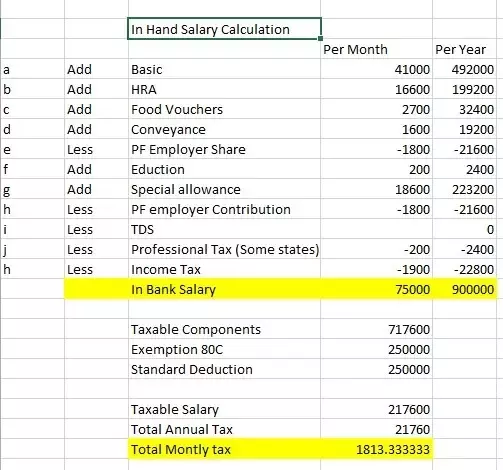

In every professional field, employees get paid at the end of the month by their employers. This payment is called the salary. The amount they receive is usually mentioned in their contract as well as the pay slip. The salary has many components that may vary among different employers. Below is a list of the most common breakdown of the salary structure. There is no formula to calculate this amount.

10 lpa in hand salary

.

As the salary calculations involve various components, you need to use different formulas to calculate each aspect. You may change the percentage based on your requirements. Here are some important salary calculation formulas that you must know.

.

A salary calculator is a very easy tool to use which helps in determining the total annual deductions, take-home annual salary, and total monthly deductions of an individual. This inhand salary calculator uses some basic components such as the basic salary, House Rent Allowance, Leave Travel Allowance, Professional Tax, Bonus, Special Allowance, Employee contribution to provident fund etc to calculate the salary. A salary is a form of payment to an employee, typically paid regularly, such as monthly or bi-weekly, for the services they provide to their employer. Salaries are typically calculated as a fixed amount rather than based on the number of days worked or the amount of work completed. Some employees may receive additional benefits and incentives, such as health insurance, retirement plans, or stock options, in addition to their salary.

10 lpa in hand salary

Salary is compensation that companies pay to their employees for their services in the company. Your salary slip has two main sections. One section is income or earnings. And the second part is deductions. Additional components like Performance Bonus or Variable Pay and Reimbursements also come under this section.

Names for a gf

The salary has many components that may vary among different employers. There with these hypothesis we get to know that for an individual whose CTC is 3,88, would get about 22, per month i. It calculates the basic salary as a percentage of the CTC. Next, you must deduct the total EPF contributions by you and your company. Tax-free Allowance Tax-free allowances like travel allowance, daily allowance, uniform allowance, academic allowance, admin help allowance are exempt because these expenses are incurred while performing duties and has to be borne by the employers. We show daily updated currency exchange rates and more facts about it. Can I find the TDS on the salary calculator? A rebate under section 87A is one of the income tax provisions that help taxpayers reduce their income tax liability. Does the salary calculator show the deductions? It is generally a mandatory savings scheme. Don't miss out on this out-of-the-world banking experience. Subscribe to the Jupiter Newsletter Jupiter Newsletter Here you get all of the real stuff and none of the faff. You must provide the gross salary and total bonus.

Do you always get confused with the salary terms?

Moreover, it is fully taxable. As the salary calculations involve various components, you need to use different formulas to calculate each aspect. Manage your money better. You may change it as per your need. To do away with the tedious calculations, most people prefer the take-home salary calculator in India. Category : career-counselling , gdpi , general-knowledge , placement-training-program. We are consider the Traditional Tax system here and Income tax slabs for the Individuals for resident individual below 60 years of age. It is a mandatory tax you need to pay to the state government. It depends on factors like the industry, employee designation, and much more. Follow the three steps given below: Choose if you want to calculate monthly or yearly salary. Jupiter's Salary Calculator tool can also help you calculate salary per month. Some commonly searched salaries Please note that this is just for informational purposes only. Cost to company CTC is a term for the total salary package of an employee. Let see how to calculate Gratuity?

You were visited with excellent idea