1035 exchange real estate

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content.

Financial planning often includes purchasing a life insurance policy to provide a source of income and financial security for surviving dependents. While there are many different kinds of life insurance policies, two of the most common products are term life and whole life policies. Meanwhile, variable and variable universal life insurance policies, differ from their more commonplace counterparts in that the cash value of these policies is used to invest in a portfolio of securities chosen by the policyholder. Policyholders can exchange their life insurance policies for another by completing a exchange. Below we look at how the exchange process works and how policyholders can avoid paying capital gains taxes when they exchange existing insurance policies for new ones. With a exchange, policyholders can swap life insurance policies for new ones and avoid paying capital gains taxes on any proceeds that have been realized from their investments. There can be some drawbacks as well, such as early termination penalties, higher premiums, and a contestability window if death happens within the first few years of the new policy being issued.

1035 exchange real estate

This page is a digest about this topic. It is a compilation from various blogs that discuss it. Each title is linked to the original blog. Get matched with over K angels and 50K VCs worldwide. We use our AI system and introduce you to investors through warm introductions! We help large projects worldwide in getting funded. We work with projects in real estate, construction, film production, and other industries that require large amounts of capital and help them find the right lenders, VCs, and suitable funding sources to close their funding rounds quickly! We help you study your market, customers, competitors, conduct SWOT analyses and feasibility studies among others! Get a FREE list of 10 potential customers with their names, emails and phone numbers. Section exchange is a provision in the Internal Revenue Code that allows policyholders to transfer the cash value of one insurance policy to another without incurring any tax liability. In simpler terms, it is a tax-free exchange of an existing annuity or life insurance policy for a newer one. This provision can be an excellent option for policyholders who want to exchange their existing policy for a new one, either to reduce premiums, increase coverage, or change investment objectives. However, not all policies qualify for a Section exchange. To qualify for a Section exchange , the following conditions must be met:. The exchange must be between the same policy types: This means that a life insurance policy can only be exchanged for another life insurance policy.

Benefits and Replacement Deferred Gain on Sale of Home was a tax regulation, repealed inthat allowed some of the tax on the profits of the sale of a home to be delayed by certain taxpayers, 1035 exchange real estate. Defer taxes by reinvesting the entire amount of your proceeds into the purchase of a replacement property.

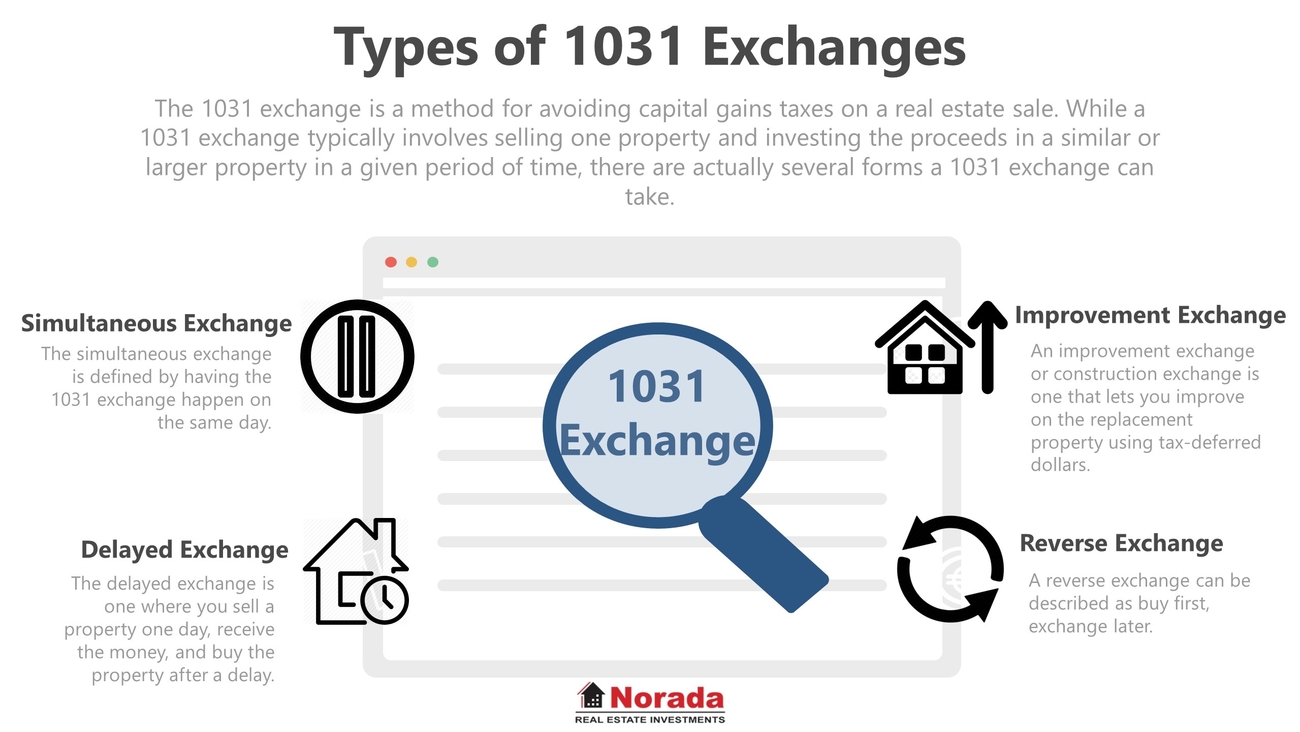

February 25, 8-minute read. Author: Melissa Brock. For real estate investors , taxes are just part of the deal. But exchanges, named after Section of the IRS tax code, allow you to sidestep capital gains tax in some cases. A exchange is a real estate investing tool that allows investors to exchange an investment property for another property of equal or higher value and defer paying capital gains tax on the profit they make from the sale. This method is popular with investors looking to upgrade properties without paying taxes on proceeds.

Investing in real estate can be a highly profitable enterprise. Unfortunately, real estate investors know that it comes with the same cost as most other forms of investment: taxes. Fortunately, unless Congress changes the exchange rules, which have been in existence for more than years, there is a way for savvy real estate investors to defer payment of capital gains taxes indefinitely: the exchange. Named after the section of the Internal Revenue Code that defines its many rules and regulations, the exchange permits an investor to defer tax payment by following a series of strict rules. What follows is a list of what you need to know in order to take full advantage of a exchange.

1035 exchange real estate

A exchange can be a complex process, but it essentially involves transferring the cash value of one insurance policy to another policy without incurring tax consequences. This can be particularly useful for those looking to upgrade their insurance coverage or change their investment strategy. Planning a exchange could be difficult, though, so be sure to pay close attention to the details. Do you have questions about tax maneuvers like this one? Speak with a financial advisor today. A exchange, also known as like-kind exchange, is a legal way to swap one insurance policy, annuity , endowment or long-term care product of like kind without triggering tax on any investment gains associated with the original contract. These exchanges are tax deferments, which are distinct from tax deductions and credits.

Showtimes tv

Give a form to the seller or exchanger and the IRS if needed. Hypothetical example s are for illustrative purposes only and are not intended to represent the past or future performance of any specific investment. First Name. However, if you rented it out for a reasonable time period and refrained from living there, then it becomes an investment property, which might make it eligible. They can be charged as a flat fee or as a percentage of the amount paid into the contract. However, real property cannot be exchanged for personal property, such as equipment, furniture, or vehicles. Use professional appraisals and property valuations to determine fair market values, especially in situations where the properties exchanged may have differing values. Calculators Refinance Calculator. Additionally, by exchanging properties instead of selling them, investors can avoid paying taxes on the sale and then using the remaining funds to purchase a new property. Keep complete records for the seller.

Additionally, our website URL—realized

For a exchange, the identification of replacement properties must be made within 45 days from the sale of the relinquished property. However, it's important to note that the tax liability is not eliminated but deferred until a future taxable event occurs, such as the sale of the replacement property. While such exchanges are generally tax-free, there are some situations where you may be subject to taxes or penalties. Investors must carefully consider their options and work with experienced professionals to ensure that they are following all of the rules and regulations set forth by the IRS. Use profiles to select personalised content. A Section exchange can be a powerful tool for real estate investors looking to minimize their tax liabilities and grow their portfolios over time. Unlike a exchange, a exchange is specifically designed for insurance and annuity products. Qualified intermediary: The investor cannot take possession of the proceeds from the sale of the original property. The following chart provides additional information. What Is A Qualified Intermediary? They showcase the diverse scenarios in which and exchanges can be applied, offering inspiration and guidance for those considering similar exchanges. Changes to Rules. Get The Bible In Your Inbox Download our whitepaper to learn how sophisticated investors, family offices, and even former US Presidents have created immense wealth through the power of compounding. Because of its strict requirements and deadlines, a exchange can be a complicated process. Will I pay a surrender fee to exchange annuities?

Just that is necessary. Together we can come to a right answer. I am assured.

I apologise, but, in my opinion, you are mistaken. Let's discuss. Write to me in PM, we will communicate.