Adc tid meaning in banking

Lost your password? Please enter your email address. You will receive a link and will create a new password via email.

Alternative Delivery Channel ADC : Alternative delivery channels, defined as those channels that expand the reach of services beyond the traditional bank branch channel. Alternative Delivery Channels denotes a broader range of options through which a customer can now access financial services without visiting a branch. The evolution of Alternate Delivery Channels has changed the dynamics of the branch network. The traditional branch services have been converted in to electronic services which are being delivered by ADC and this department is meeting the organizational objectives by satisfying the customers more effectively and efficiently. A debit card is a plastic payment card that can be used instead of cash Widrawal.

Adc tid meaning in banking

Channel means the system of intermediaries between the producers, suppliers, consumers, etc. Their advancement is no longer measured by their strength and readiness, but rather by their technological competence. A channel is a gateway for execution of a service. A channel can be an office, media, tool, or an application; it can be manipulated by human interaction or through a systematic front-end interface. ADCs have evolved gradually and adapt to serve consumer needs at their convenience. ADC serves as an alternate to complement the existing delivery channels. At this stage, it cannot be considered as a replacement to the existing structured delivery channels, but rather as an advanced interface to leverage the use of any service that is also being offered through conventional channels. In the banking sector, Alternate Delivery Channels are channels and methods for providing banking services directly to the customers. These channels have enabled banks to reach a wide consumer-base across geographies. ADCs ensure the smooth flow of regular transactions and provide banks with higher profits with lower operational expenses and transaction costs. The evolution of ADCs has changed the dynamics of the branch network. This exponential expansion of services has now made the customers more inclined towards ADCs. With inclusion of thousands of mobile applications, mobile banking applications are now also becoming the part of the regular services provided by the bank. Customers are now expecting m-banking as a default service from the banks.

Convenient Banking Convenience is defined by the simplicity of design and the ability to access or open and manage accounts online or with a mobile device. What is CFT in banking?

.

October 10, 9 min read Articles Payment Technology Terminal ID Number In a Nutshell Why would you — or your processor, for that matter — need to know on which terminal you processed a payment? This article will break down what terminal ID numbers are used for and where you can find them. Do you have a transaction receipt handy? One of these is your terminal identification number or TID. But, while this eight-digit number is only really relevant to specific situations, many merchants confuse their TID number for identifiers like their merchant ID or taxpayer identification numbers. How do you tell these numbers apart? What does your terminal ID tell you?

Adc tid meaning in banking

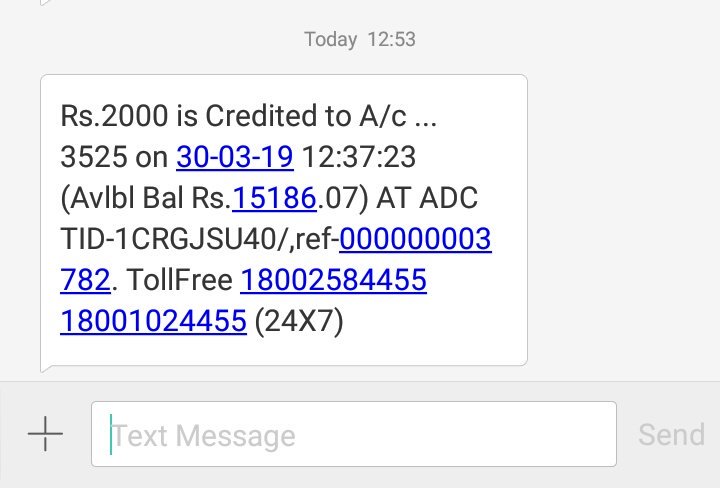

A terminal ID number, also known as a terminal identification number or TID is an eight-digit sequence of characters that financial institutions use to monitor which terminal has been used to process each transaction. TIDs make it easy for merchants to find specific transactions to initiate a refund or counter a dispute. They make it possible to see which terminal processed which payment. Every TID can be found on its corresponding transaction statement or receipt. Still, its precise location will vary according to each payment gateway or payment processor used in the transaction. But the words "merchant terminal number" will be located on the transaction. Some processing companies will keep this information near the account or settings tab, while others might place it closer to the transaction information. However, no matter where it's located, your TID will be marked so you can find it effortlessly on your receipts or transaction statements.

Hqpornet

You are now aware of the TID full form in banking. This exponential expansion of services has now made the customers more inclined towards ADCs. Home TECH. You will receive a link and will create a new password via email. Unbanked customers have more potential to drive wallet transactions through P2P, bill pay, and retail payments. Alternative Delivery Channel ADC : Alternative delivery channels, defined as those channels that expand the reach of services beyond the traditional bank branch channel. World Trend in ADC An example of Kenya Engaging customers at the receiving end of remittance flows is perhaps the most important factor in driving Financial Services transaction volume. Challenges of ADC While banks have succeeded in leveraging available technology and provide alternate avenues to customers for banking services, the challenge it faces today is optimizing the usage of these channels. They should also constantly educate the customers on safe keeping of the plastic cards, securing USER ID and password, periodically changing the passwords, not sharing the passwords with any one, known or unknown, etc. ADC serves as an alternate to complement the existing delivery channels. Related Articles. Bank and payment platforms can also keep records of how many transactions take place at any given moment because of TIDs. Customer education plays an important role to induce customers to use ATMs, e-banking, mobile banking, etc. They should remove the fear of cyber frauds from the minds of customers by educating them on proper use of the technology.

Alternative Delivery Channel ADC : Alternative delivery channels, defined as those channels that expand the reach of services beyond the traditional bank branch channel. Alternative Delivery Channels denotes a broader range of options through which a customer can now access financial services without visiting a branch.

In contrast to Best Price! Open banking is a global phenomenon whose merits are felt in virtually every time zone, including those in the Asia-Pacific region. While the options on this channel are still limited, this is indeed the first step towards utilizing a high potential and increasingly popular platform. Convenient Banking. The main objective behind integrating banking services with technology is, undoubtedly, convenience. I was unable to understand the cause of the transactions failing despite having enough cash in my bank account. Customer education plays an important role to induce customers to use ATMs, e-banking, mobile banking, etc. These numbers will likely continue to grow year-over-year. For example in Kenya, in , only

Very amusing information