After hours stock

Use limited data to select advertising.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

After hours stock

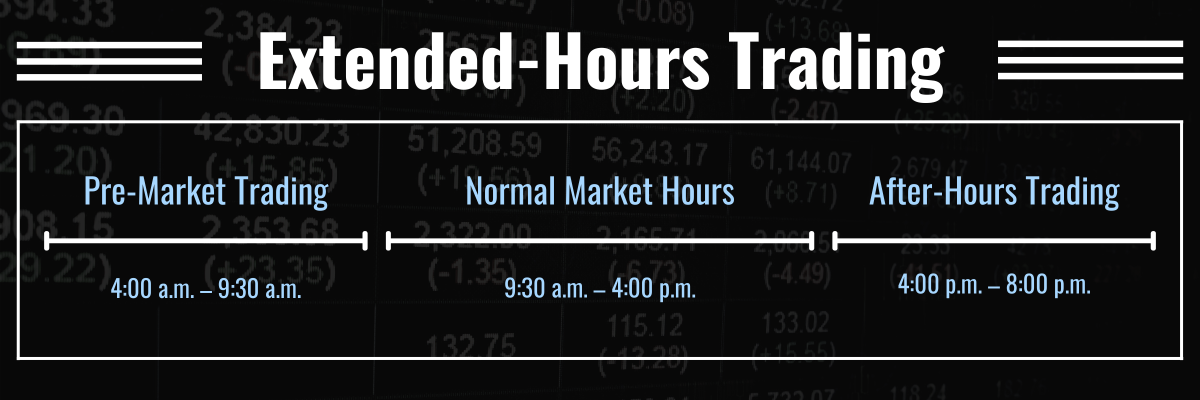

Learn more about TD Direct Investing. Did you know that you can trade outside of regular market hours? With extended-hours trading, you can trade before markets open and after they close. If you're someone with a busy schedule, pre-market and after-hours trading may work for you. As an investor, it's helpful to know that most stock exchanges in North America are typically open for hours on weekdays. ET, Monday to Friday, except stock market holidays. The economy, however, is not bound by these hours and important market shifts can occur at any time. This factor, as well as advancements in electronic trading have encouraged markets to enable trading beyond regular hours. Trading outside regular hours is called pre-market and after-hours trading, with pre-market trading hours usually taking place between 8 a. ET on weekdays and after-hours trading starting at 4 p. ET on weekdays as well. The relative shortness of regular trading hours can lead to more efficient markets and less volatility — shorter trading periods give investors more time to analyze business news and information before markets open, which can help prevent rushed trading decisions. However, as trading activity is compressed into a smaller period of time, it can lead to increased liquidity and smaller spreads.

With lower liquidity and higher volatility, the spread may be wider during pre-market and post-market hours. The spread is the difference between the bid and the ask prices.

.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

After hours stock

.

Safe animal shelter 2913 county rd 220 middleburg fl 32068

Financial Industry Regulatory Authority. Compare Accounts. In addition, each brokerage firm that offers after-hours trading may have varying hours, so ensure you understand when after-hours trading is allowed. Due to the low volume of trading that occurs after-hours, traders may find better prices in the pre-market or may experience greater pricing swings due to the lack of available shares to trade. For example, they may be occupied from a. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information. Trading Session: Find Out When Various Markets Are Open A trading session is measured from the opening bell to the closing bell during a single day of business within a given financial market. What are the pre-market trading hours? For example, limit orders may not be available, and market orders may only be partially filled due to illiquidity of the order book. ET to p. Pros May allow investors to take advantage of being early to an opportunity Offers greater convenience to traders instead of restricting trades to select hours May present greater profit opportunities due to higher volatility Allows investors to move when new market information is presented. If this isn't possible, a broker may find it necessary to cancel all orders entered for the after-hours session.

.

If they can't, trades remain unfilled. Develop and improve services. Book an appointment. Opening Price: Definition, Example, Trading Strategies The opening price is the cost of a security at the opening of an exchange. However, the risks of engaging in after-hours trading can be significant. This can spark volatility and the potential for greater than normal losses for less experienced investors. This presents both opportunities and risks, which we discuss below. Note that different exchanges may have varying hours and varying trade data posting times. These choices will be signaled to our partners and will not affect browsing data. Would you leave us a comment about your search? ET on weekdays and after-hours trading starting at 4 p. View more helpful related questions. Lower trading volume and less liquidity results when fewer traders and investors are in the market. Back to TD Bank. To trade stocks after hours, you need to have an account with a brokerage firm that offers after-hours trading.

I can suggest to come on a site where there are many articles on a theme interesting you.

What necessary phrase... super, magnificent idea

Prompt, whom I can ask?