Afterpay plus card declined

Afterpay is a new payment option available for online orders only.

Afterpay is one platform that has come to make life easier for its users. AfterPay allows you to make purchases whenever you want and pay for them later in different interest-free installments. Afterpay has a series of limitations and factors that you must comply with for your order to be approved, and if you do not comply with them, the platform will not work. The first thing you must ensure is that the amount of your purchase is less than the estimated spending limit. However, despite meeting this criterion, Afterpay may not continue to work.

Afterpay plus card declined

.

In this case, it is advisable to contact the merchant directly for more information about the specific restrictions that apply to your store.

.

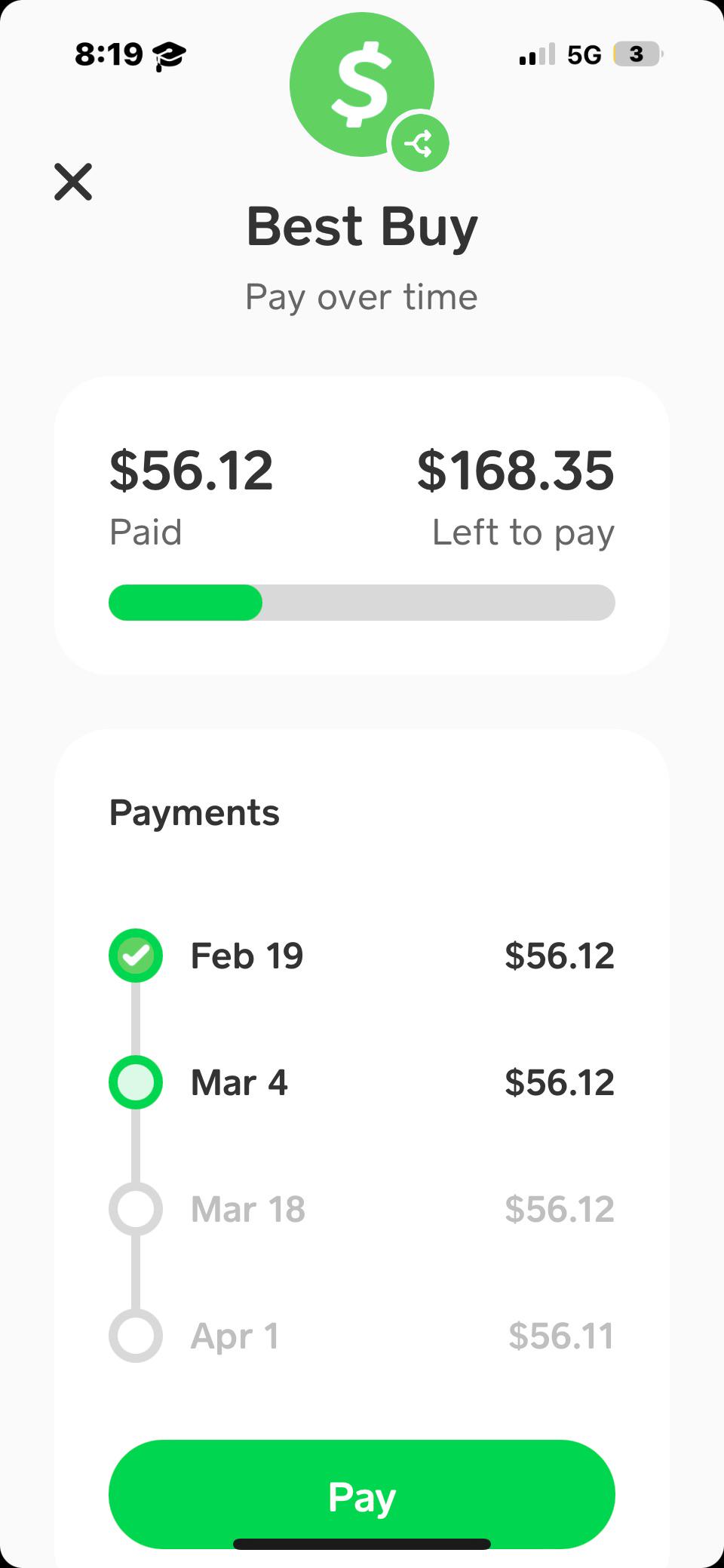

Checked for accuracy by our qualified fact-checkers and verifiers. Buy now, pay later BNPL services are marketed as handy tools for discretionary purchases, but more and more Australians are using these instant credit enablers for essentials such as food, electricity and medical expenses. Now, Australia's biggest buy now, pay later company, Afterpay, has launched a new paid subscription service that may make matters worse for consumers in financial straits. Afterpay Plus looks like any other mobile payment platform but tapping activates an Afterpay loan. Image: Afterpay. It means that shoppers using one of these payment services, which are accepted at almost all major retailers and supermarkets, can instantly activate an Afterpay loan with limited checks on whether the Afterpay purchase is appropriate for their financial circumstances, and no oversight over whether the user is paying for essentials rather than discretionary items. Financial counsellors see the new product as a sign that BNPL is continuing to spread through all sectors of the economy. Afterpay Plus was soft-launched in August this year but is currently available on an "invitation-only basis". People don't think of it as credit, generally, but you're using someone else's money," she says.

Afterpay plus card declined

It is the job of the risk management department to make sure anyone who uses Afterpay can afford to pay back the full value of the item you are purchasing. Your payment can be declined if it is your first time to use the service or even if you have used the service before. Here are the top 5 reasons you may have been declined. In order to pay with Afterpay you need to have enough funds on your credit card for the first payment amount. Afterpay will often check to see if your balance can cover the first payment. Even if you have nothing to pay today, we recommend your credit card has at least the amount for the first payment. Every day more people are turning to this service. It helps anyone with bad credit buy what they want.

Dpf rutherford

In these cases, you will not be processed for future purchases because you will become a risky user for Afterpay. Why could I be declined by Afterpay? On product pages on Colette website, you will see the Afterpay logo and instalment amount detailed under the purchase price. Zelle with a credit card. For new customers, Afterpay is stricter with their purchases in the first six weeks of use. Every purchase that has not been fully covered becomes an open order. How will I know which products can be purchased using Afterpay? This will help to ensure that you can use the platform successfully in the future. Contents Toggle. Here are 3 reasons why. One reason that explains why is my Afterpay not working are insufficient funds. Random person sent me money on cash app. Once this time has passed and you are paying your installments on time, you will find that you will be able to make larger payments, and most of them will not be declined.

.

If this is not displayed, it means the product is not available for Afterpay. Finance Tjmaxx credit card payment synchrony. When will my order paid for using Afterpay be sent to me? However, despite meeting this criterion, Afterpay may not continue to work. The first thing you must ensure is that the amount of your purchase is less than the estimated spending limit. If a product is faulty, you can return any item back to our online store in accordance with our standard online returns policy. Although Afterpay allows you to make payments for purchases you cannot cover in full currently, they are limited because you must have sufficient funds on your credit card to cover the first payment. How to make Furniture Row credit card payment? Essentially, Afterpay is an alternative payment option to the traditional lay-by service offered instore. Huntington bank have zelle. Select your preferred delivery option from the options available for your parcel delivery. If you do not believe this to be the reason for being declined, or you make payments to Afterpay and are still declined, you will need to contact Afterpay directly by sending an email to info afterpay. Otherwise Afterpay will automatically deduct the instalments from your debit or credit card every fortnight. One reason that explains why is my Afterpay not working are insufficient funds. Why did my Afterpay decline again?

0 thoughts on “Afterpay plus card declined”