Alice blue automated trading

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.

Algo Trading is nothing but a computer program that follows a particular trading strategy that places buy and sell orders. These orders are placed at a speed that cannot be matched by any human being. What is Algo Trading? It is nothing but a computer program that follows a particular trading strategy and places buy and sell orders. There are companies that provide ready-made Algo strategies or help you in coding your own strategies.

Alice blue automated trading

Open Instant Account online with Alice Blue and start trading today. It alsofacilitates the integration of your trading platform with third-party tools like MT4, Amibroker, or website to get data and punch orders. Alice Blue APIs provide a confidential key that helps traders establish a connection between their algorithm and Alice Blue's trading platform to obtain real-time market data and live market order placements. Alice Blue API is available free of cost. Alice Blue does not provide historical data API. ANT Plus API gives users programmatic access to the trading platform of Alice Blue that helps faster trade execution, multiple order placement, managing user portfolio, live market feeds, and much more. Alice Blue Interactive APIs are the trading APIs that help to place, modify, and cancel trading orders of different types like regular orders, after-market orders, basket orders, and bracket orders. Alice Blue API can help users with algorithmic trading. Using Alice Blue API, you can convert your trading ideas into trading strategies and build your own algorithmic trading system for systematic trading using Alice Algo. The WebSocket API allows you to receive market data for multiple instruments across exchanges in the live market. You can either get the Compact or Full Market snapshot as desired. Alice Blue API makes trading easy and convenient for traders. Alice Blue Algo trading helps speedy order placement, which is very important for trading considering the dynamic markets that change every millisecond. For example, you decide to buy Nifty when it is trading at However, while you place an order, the Nifty price increases to

Best Beverage Stocks In India.

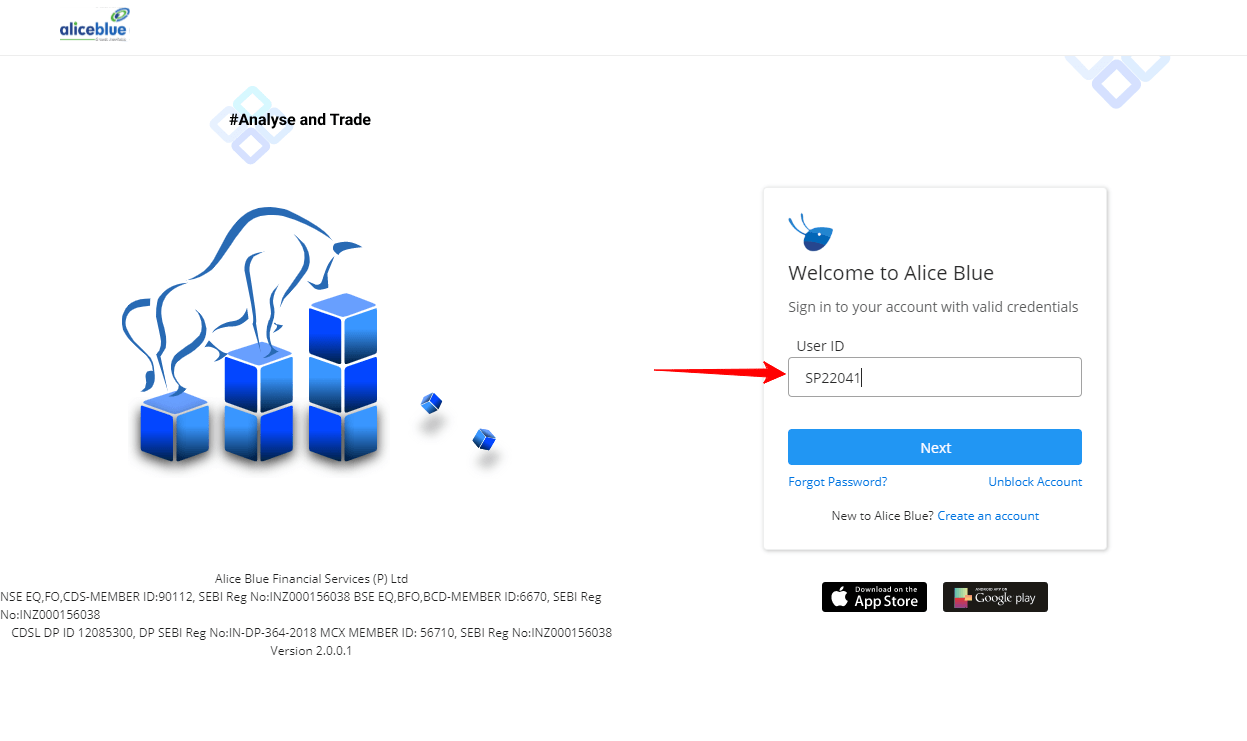

Execute orders in real-time, manage user portfolios, stream live market data using Websocket , and more, with the easy-to-understand API collection. You can use a redirect URL which will be called after the login flow. It is highly recommended that you do not include the apiSecret in your code while sharing in public places like GitHub. It will make your app vulnerable to threats and potential issues. In this article, We shall discuss How to create an app in the Developer Console. Step 1: Head over to the Developer Console. Use Your credentials to login there.

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w. September 1, Corporate Office: No. Registered Office: Old No. Benefits: Effective Communication, Speedy redressal of the grievances. Click on the provided link to learn about the process for submitting a complaint on the ODR platform for resolving investor grievances. Investment in securities markets are subject to market risks, read all the related documents carefully before investing. Brokerage will not exceed SEBI prescribed limit.

Alice blue automated trading

Open Instant Account online with Alice Blue and start trading today. It alsofacilitates the integration of your trading platform with third-party tools like MT4, Amibroker, or website to get data and punch orders. Alice Blue APIs provide a confidential key that helps traders establish a connection between their algorithm and Alice Blue's trading platform to obtain real-time market data and live market order placements. Alice Blue API is available free of cost. Alice Blue does not provide historical data API. ANT Plus API gives users programmatic access to the trading platform of Alice Blue that helps faster trade execution, multiple order placement, managing user portfolio, live market feeds, and much more. Alice Blue Interactive APIs are the trading APIs that help to place, modify, and cancel trading orders of different types like regular orders, after-market orders, basket orders, and bracket orders. Alice Blue API can help users with algorithmic trading.

Moxymary

Now, the main dashboard will appear —. Can algo trading be profitable? One such downside is the potential for mechanical failures. My wish list includes parameterisation of this strategy peice as well. Now you might say, I am not a programmer, Algo Trading is not for me. But there is more to learn and explore when it comes to the stock market, and hence we bring you the important topics and areas that you should know:. The APIs are available in multiple languages and offer a secure trading experience. Mandatory Member Details. DND Policy. Use Your credentials to login there. As you can see in the below image, RSI has two lines, one is 80, and the other is How to Videos. No need to issue cheques by investors while subscribing to an IPO. The WebSocket API allows you to receive market data for multiple instruments across exchanges in the live market.

.

Best Discount Broker in India. Know More. For queries regarding account opening or activation, email to [email protected] and for fund updates, email to [email protected] Disclaimer : Prevent unauthorized transactions in your account. Related Posts. The WebSocket API allows you to receive market data for multiple instruments across exchanges in the live market. What is Equity Delivery Trading? Annual Returns. Bull vs Bear Market. What is Corporate Action? Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. Step 1: Head over to the Developer Console. But How does it work?

Precisely, you are right