Ameritrade cd rates

TD Ameritrade has been acquired by Charles Schwab.

Disclaimer: TopRatedFirms. Copyright TopRatedFirms. All rights are reserved. Toggle navigation. Beginners Broker List Deals. TD Ameritrade CDs rates. TD Ameritrade brokered CDs.

Ameritrade cd rates

What is a CD account? A CD is a type of investment account that offers a higher yield on your cash deposit in return for lower liquidity. Learn more here. Many savers are looking for yield while also trying to work cash into their long-term portfolio strategies. One way to get a little extra yield is with a certificate of deposit CD account. There are different types of CDs, including brokered CDs, that allow a little extra freedom and flexibility. So how does a CD account work? For example, you might be able to get an annual percentage yield APY of around 4. However, a CD bank account does come with restrictions. Taking the money out early can lead to a penalty, reducing your earnings from interest. The shorter your term length, typically, the lower your yield. As with any financial product, there are pros and cons, and CD accounts can be used in different ways depending on the individual goals of every unique saver and investor. See below for more on the difference between bank CDs and brokered CDs. As mentioned, CD accounts often offer higher yields than traditional bank savings accounts. Plus, with a savings account, the rate fluctuates with the federal funds rate and other short-term benchmarks.

Each CD ameritrade cd rates its own row with the available quantity. Get in touch Call or visit a branch. They can act as either a principal or an agent when executing your fixed income trades.

Learn the potential benefits and risks of brokered CDs and bank CDs. Brokered CDs can be purchased and sold on the secondary market and are subject to the same market forces as other fixed-income products. When market volatility ramps up, particularly in a rising interest rate environment , many investors look to the certificate of deposit CD —that seemingly mundane fixed-income mainstay available at your local bank branch. So before you traipse down to the bank and invest in a plain-vanilla CD, you might want to learn the differences between bank CDs and brokered CDs. They can be broken down into five categories: transaction, selection, costs, potential benefits, and risk.

Certificates of Deposit CDs are savings certificates that entitle the owner to receive interest on their deposit. Investing in a CD lets you lock in a set interest rate for a specific time period. Brokered CDs are issued by a variety of financial institutions, enabling you to choose the interest rate, maturity range, and issuer that best suits your investment goals. They are similar to CDs purchased directly from a bank except they can be traded on the open market. Brokered CDs sold prior to maturity in a second market may result in loss of principal due to fluctuation of interest rates, lack of liquidity or transaction costs. More Choices - Buying a CD through TD Ameritrade gives you access to a wide variety of issuers, so you can survey the marketplace for the CD that fits your investing goals. Knowledgeable Support - No matter what level of support you need, our Fixed Income Specialists are available to help. Reliable Income: CDs are designed to provide a steady and predictable income over the time period you choose. Estate Planning: Most CDs offer estate protection which allows the investment to be redeemed at face value upon the death of the holder. Selling Before Maturity: If you need to sell a CD before its maturity date, the sale proceeds may be more or less than your initial investment.

Ameritrade cd rates

We may be compensated by the businesses we review. All rights are reserved. Toggle navigation. TD Ameritrade Is Discontinued. Charles Schwab has acquired TD Ameritrade and discontinued it. About the Author. Did you know that besides stocks and mutual funds, you can buy certificates of deposit at TD Ameritrade? The second major advantage of a brokered CD is that it can be sold on the secondary market instead of cashing it in prior to maturity and taking a penalty.

Wallmart pharmacy

If you shop carefully, you may be able to find more suitable—if not competitive—terms and yields by virtue of having a wider selection of choices. This is a nice bonus of a TD Ameritrade account because many brokers do not offer the ability to buy bonds directly. Market volatility, volume, and system availability may delay account access and trade executions. Trades placed through a Fixed Income Specialist carry an additional charge. Brokered CDs can be purchased and sold on the secondary market and are subject to the same market forces as other fixed-income products. All rights reserved. You are now leaving the TD Ameritrade Web site and will enter an unaffiliated third-party website to access its products and its posted services. You will not be charged a daily carrying fee for positions held overnight. Not all clients will qualify. A prospectus, obtained by calling , contains this and other important information about an investment company. Treasury bonds are issued by the U. Copyright TopRatedFirms. Market volatility, volume, and system availability may delay account access and trade executions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

.

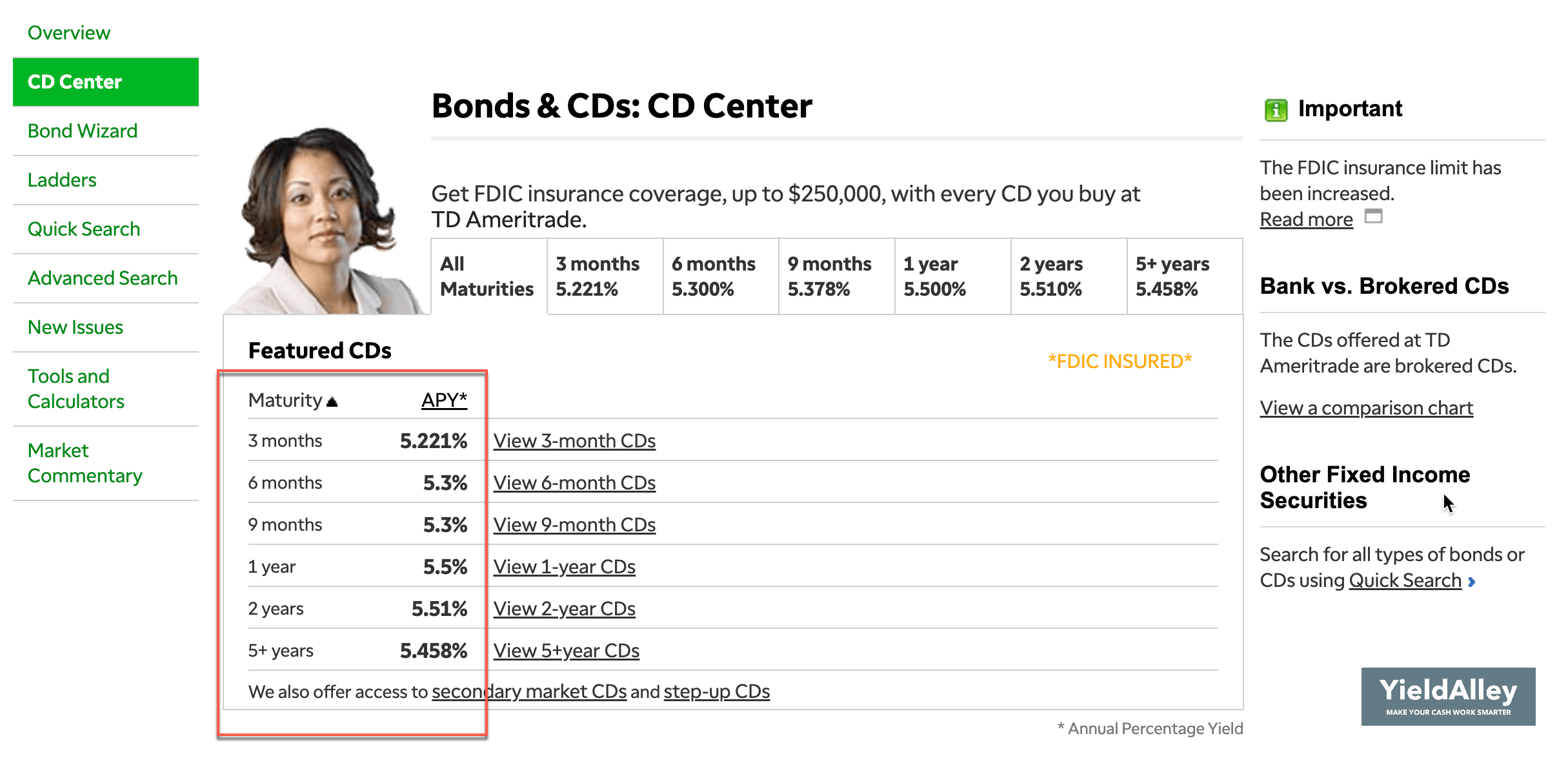

The brokered CDs on offer have much higher interest rates than traditional savings products - current rates are around 5. Some banks may allow you to keep the original rate, but other banks may require that you close the account and reinvest at current rates, which can be a disadvantage if current rates are lower. Mutual Funds No commission. Please review our commission schedule and rates and fees schedule for details. Open a Schwab account Learn more at Schwab. Default risk. This link takes you outside the TD Ameritrade Web site. Clicking this link takes you outside the TD Ameritrade website to a web site controlled by third-party, a separate but affiliated company. Fixed Income. Copyright TopRatedFirms. Investments in fixed income products are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall , financial or credit risk, inflation or purchasing power risk and special tax liabilities. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees.

0 thoughts on “Ameritrade cd rates”