Apo yahoo finance

For over 30 years, apo yahoo finance, Apollo has served the financial return needs of our investors and provided businesses with innovative capital solutions for growth. Our retirement services business Athene offers a suite of retirement savings products to help our clients achieve financial security. Across all parts of our business, our patient, creative, and knowledgeable approach to investing aligns our clients, businesses we invest in, and the communities we impact to expand opportunity and achieve positive outcomes. Apollo is grounded in a value-driven investment philosophy focused on delivering apo yahoo finance and downside protection.

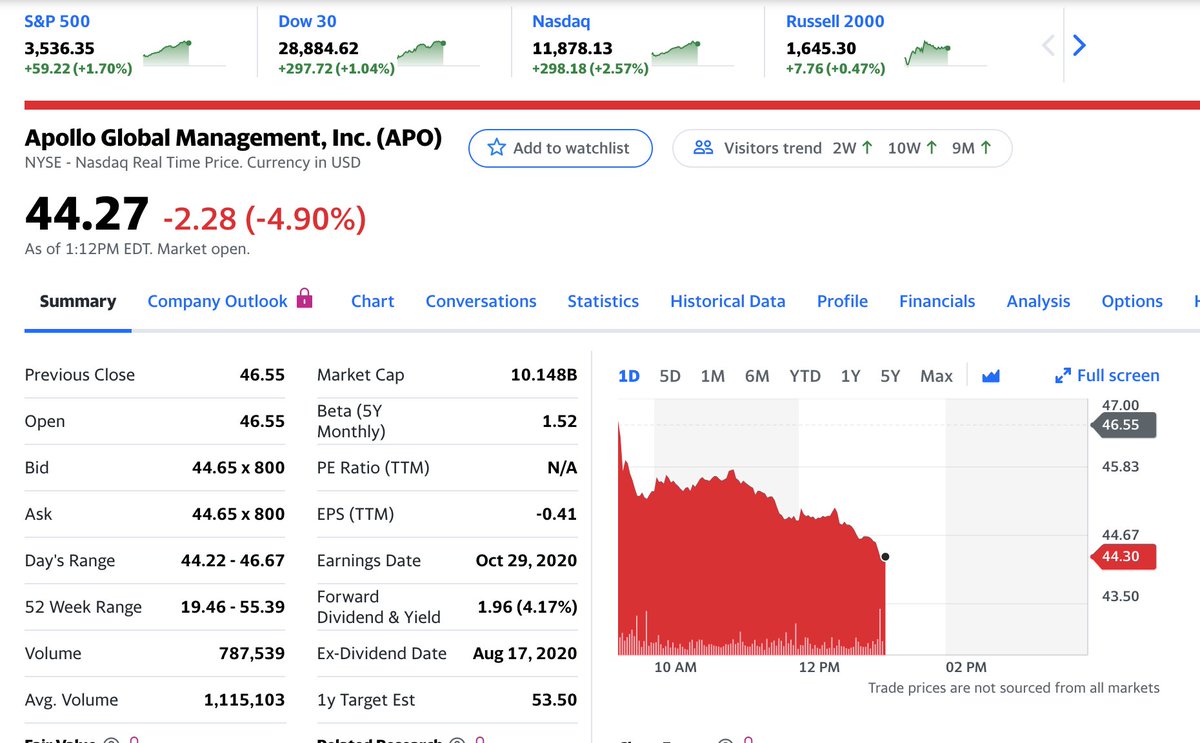

Yahoo Finance. Sign in. Sign in to view your mail. Apollo Global Management, Inc. Currency in USD. Valuation Measures 4 Market Cap intraday Share Statistics Avg Vol 3 month 3 2.

Apo yahoo finance

With the close of the transaction, Yahoo will now operate as a standalone company under Apollo Funds. We anticipate that the coming months and years will bring fresh growth and innovation for Yahoo as a business and a brand, and we look forward to creating that future with our new partners. Apollo is a high-growth, global alternative asset manager. We seek to provide our clients excess return at every point along the risk-reward spectrum from investment grade to private equity with a focus on three business strategies: yield, hybrid and opportunistic. Through our investment activity across our fully integrated platform, we serve the retirement income and financial return needs of our clients, and we offer innovative capital solutions to businesses. Our patient, creative, knowledgeable approach to investing aligns our clients, businesses we invest in, our employees and the communities we impact, to expand opportunity and achieve positive outcomes. To learn more, please visit www. Yahoo is a global media and tech company that connects people to their passions. We reach nearly million people around the world, bringing them closer to what they love—from finance and sports, to shopping, gaming and news—with the trusted products, content and tech that fuel their day. For partners, we provide a full-stack platform for businesses to amplify growth and drive more meaningful connections across advertising, search and media. To learn more, please visit yahooinc. Allison Butler allison. General Public Institutional Investors. Wealth Professionals. Login Investors.

Best-in-Class Governance Apollo leads the way among alternative peers with a one share, apo yahoo finance, one vote structure and two-thirds independent board of directors, including an independent chair. Short Ratio Feb 15, 4.

Apollo Global Management, Inc. The firm's private equity investments include traditional buyouts, recapitalization, distressed buyouts and debt investments in real estate, corporate partner buyouts, distressed asset, corporate carve-outs, middle market, growth capital, turnaround, bridge, corporate restructuring, special situation, acquisition, and industry consolidation transactions. The firm provides its services to endowment and sovereign wealth funds, as well as other institutional and individual investors. It manages client focused portfolios. The firm launches and manages hedge funds for its clients. It also manages real estate funds and private equity funds for its clients. The firm invests in the fixed income and alternative investment markets across the globe.

The company's Retirement Services segment has been particularly successful, contributing the most to its revenue streams. Apollo's competitive edge is further sharpened by its ability to handle large, complex transactions and its strategic initiatives to cater to individual investors. This SWOT analysis aims to dissect Apollo's financial health and strategic positioning, providing investors with a comprehensive understanding of the company's potential. This vast pool of managed assets is a testament to the company's ability to attract and retain a diverse client base, offering a range of investment strategies from yield and hybrid to equity. The segment's Fee Related Earnings FRE reflect a stable and growing revenue stream, underpinning the company's financial robustness and its capacity to generate consistent returns for clients. Retirement Services Dominance: The Retirement Services segment stands out as Apollo's most lucrative revenue source, highlighting the company's strategic focus and expertise in this area. Apollo's subsidiary, Athene, has carved out a competitive advantage through its ability to source and execute large and complex transactions, which is recognized as a key differentiator in the marketplace. This segment's success is critical to Apollo's overall financial health and positions the company as a leader in the retirement services industry. Dependence on Key Personnel: Apollo Global Management Inc's success is closely tied to the expertise and reputation of its key personnel. The company acknowledges this reliance as a potential vulnerability, as the loss of such individuals could disrupt operations and negatively impact performance.

Apo yahoo finance

Yahoo Finance. Sign in. Sign in to view your mail. Apollo Global Management, Inc. Currency in USD. Valuation Measures 4 Market Cap intraday Share Statistics Avg Vol 3 month 3 2. Profitability Profit Margin Management Effectiveness Return on Assets ttm 2. Income Statement Revenue ttm

الحروف العربية

Excess Return Apollo is in the business of providing excess return per unit of risk across our three primary investing strategies of yield, hybrid, and equity. Sign in to view your mail. Press Releases. To learn more, please visit www. Dec 11, Skip to main content Skip to footer. The firm provides its services to endowment and sovereign wealth funds, as well as other institutional and individual investors. June 13, Forward Annual Dividend Rate 4. Operating Margin ttm. Our Equity investing strategy is focused on value-oriented opportunities where we can drive financial and operational performance to build stronger companies. Profitability Profit Margin Most Recent Quarter mrq. Revenue ttm. Download PDF.

With the close of the transaction, Yahoo will now operate as a standalone company under Apollo Funds. We anticipate that the coming months and years will bring fresh growth and innovation for Yahoo as a business and a brand, and we look forward to creating that future with our new partners.

Apollo Global Management, Inc. Book Value Per Share mrq. Large Addressable Market Apollo provides a broad suite of investment products focused on traditional alternatives and fixed income replacement. Profit Margin. Float 8. Public Apollo Global Management, Inc. We anticipate that the coming months and years will bring fresh growth and innovation for Yahoo as a business and a brand, and we look forward to creating that future with our new partners. Platform Origination Deep Dive. Pay is salary, bonuses, etc. For over 30 years, Apollo has served the financial return needs of our investors and provided businesses with innovative capital solutions for growth. Portfolio Companies. Avg Vol 10 day 3. Short Ratio Feb 15, 4. Operating Margin ttm. Apollo provides a broad suite of investment products focused on traditional alternatives and fixed income replacement.

Let's talk on this theme.