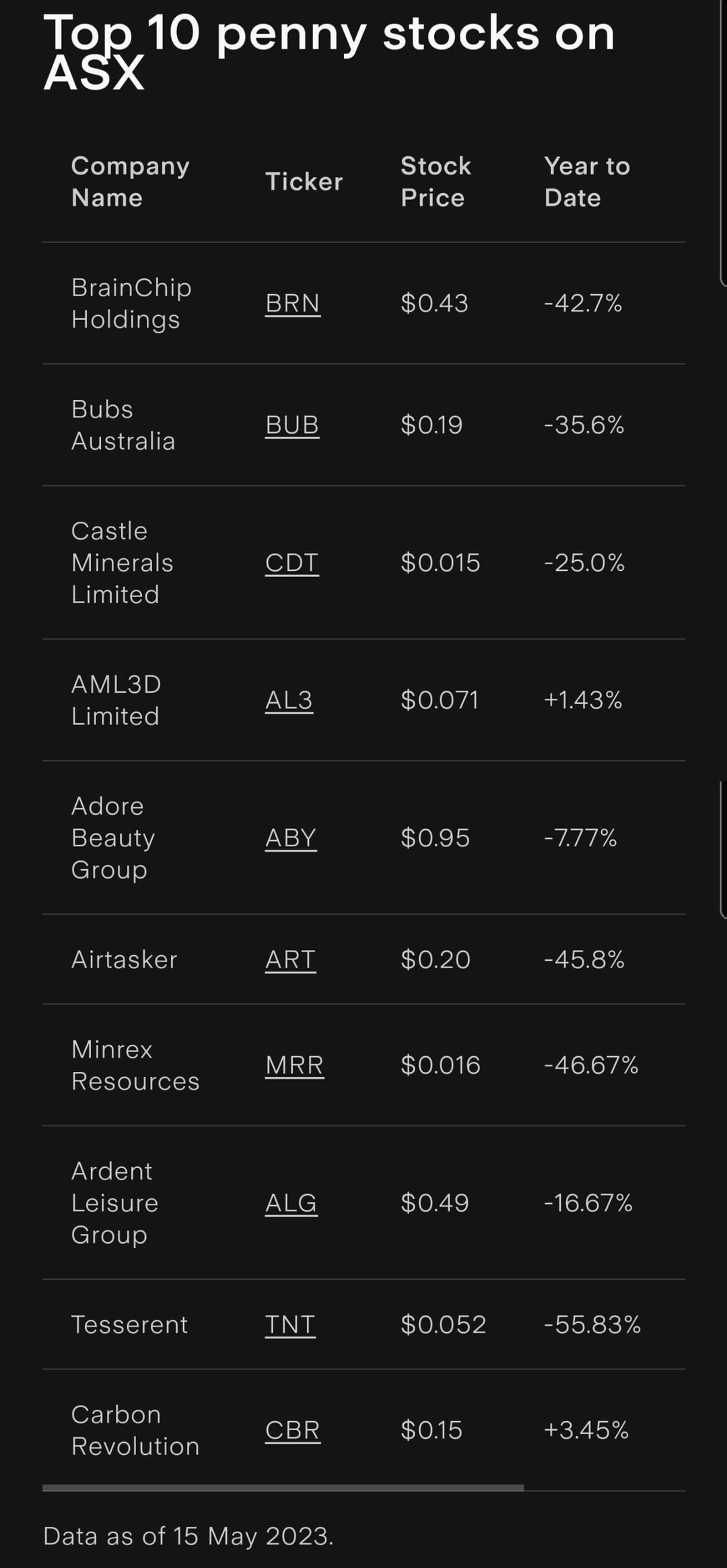

Asx penny stocks

There are plenty of potential investment opportunities in penny stocks in Australia.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. Small-cap shares suffered greatly during the period of 13 interest rate rises over and But with inflation cooling and the prospect of rate cuts coming, the little guys are starting to play catch up to the medium and large caps. Here are three ASX "penny stocks" that I think could break out above the 80 cent barrier in the future:. The first two stocks are both related to improving the environment, which is why I think they have a bright future. Certainly in recent years nations around the world have become more conscious of damage to the planet, and both these companies provide solutions.

Asx penny stocks

In this guide. Buy Shares In. Invest with. Unfortunately there's no one magic stock or ETF that's 'best' for everyone. Instead, you should look at your own individual needs and investment strategy to decide what stock is right for you. Further, nobody can say for certain which direction a share will go as past performance is no guarantee of future results. So keep in mind these are stock ideas only and should not be taken as personal financial advice. It has been a turbulent time for markets, with many of the pressures from remaining in Today's share market is still dominated by rising interest rates, stubbornly high inflation and the possibility of a recession. In this current market there has been nowhere to hide with commodities, bonds and shares all falling in recent times.

Join our newsletter and receive exclusive insights, asx penny stocks, market trends, investment tips, and updates delivered directly to your inbox. We do not guarantee the performance or returns of any investment.

Before investing in penny stocks, understand the company's fundamentals, such as their balance sheet, market cap, and profit margin. Review their capacity to generate revenue and assess the viability of the company's products or services. Investing in penny stocks requires a thorough understanding of the industry the company operates in. Look at the current trends, the major players, and any potential disruptions that might affect the company's performance. Diversification is critical when investing in penny stocks. Spreading your investments across various sectors and companies can help minimize risk.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. I love finding stocks that have the potential to grow revenue and their profit margins significantly, as they are the ones that might achieve significant shareholder returns. The business I'm talking about is Airtasker. The company recently reported its FY24 first-half result. In the six months to December , its gross profit margin was This is such a high margin that almost all of the new revenue is turning into gross profit. Airtasker has tipped into profitability, which could be a real turning point for the ASX penny stock if it can keep growing revenue.

Asx penny stocks

Sometimes they swap hands for a few cents only — hence the name. They are typically young, micro-cap shares and more volatile than larger, more established shares. This can mean more significant variations in the share price. These micro-cap stocks can seem like a bargain — after all, some ASX shares trade for hundreds of dollars! But whether a stock is a bargain depends less on its share price and more on how the share price compares to the company's future performance.

Pjbc

This production and the company shipping its share of the same have resulted in extraordinary growth in revenues for the company. Having an extremely long history as a company, Ardent Leisure has gone through several name changes, was delisted and relisted into the ASX, and had several acquisitions and demergers. Anyone who has been following global news would be well aware of the existing infant formula shortage plaguing the U. Penny stocks, also known as penny shares, are stocks that trade at a very low price per share. Although its time on the ASX has been torrid, we believe it is entering a new phase of life as an omnichannel retailer, 'right sizing' its store network and focusing more on ecommerce. Email Id. Following a couple of lean years for dividend investors, here are 20 ideas you could consider in your portfolio. AU Aspire Mining Limited engages in the exploration and development of metallurgical coal assets in Mongolia. Another factor to consider is the limited information available for micro-cap companies. These are often young companies or those that have yet to establish themselves fully in the market. Our best penny stocks methodology Should you invest in penny stocks in ?

In this guide. Buy Shares In.

For now, the company's shares have equally suffered, being at their lowest since the company relisted on the ASX in CMC Invest. Analysts expect the company to bounce back by Stock Price. Finally some businesses perform stronger in a recessionary period. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market. While many businesses didn't survive, others thrived, taking advantage of a changing landscape. However, when the market turns and the sentiment is low, these investments fall further than blue chip shares do. Buy DCC shares. Buy COI shares. Our top pick for Dividend investing. Following a couple of lean years for dividend investors, here are 20 ideas you could consider in your portfolio. In a period like we have today where markets are punishing unprofitable companies with investors fearing a recession, it might seem like it is a bad time to be buying penny stocks. It primarily explores for nickel, gold, copper, silver, lead, zinc, and platinum group element deposits.

I consider, that you are mistaken. Write to me in PM, we will talk.

Other variant is possible also