Aud to jpy forecast

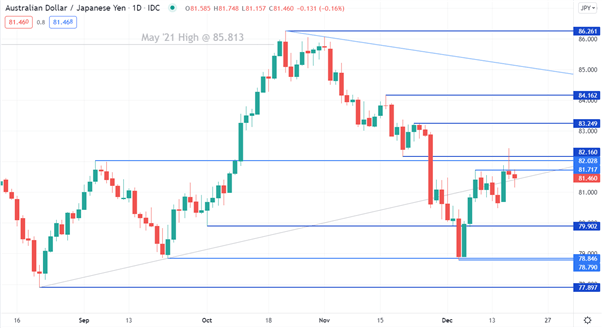

Bearish Will the Australian Dollar get stronger against the Yen over the next few weeks and months?

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Aud to jpy forecast

See all ideas. See all brokers. EN Get started. Market closed Market closed. No trades. Key data points. Previous close. Day's range. This pair is the Australian Dollar against the Japanese Yen. In regards to U. The pair tends to decline is a risk off approach and rise in a low risk environment on carry flows. Show more.

Open account Learn more. Over the last 12 months, the combination sank to its lowest level in Marchsoon after the first signs of US banking troubles hit the headlines.

.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information.

Aud to jpy forecast

See all ideas. See all brokers. EN Get started. Market closed Market closed. No trades. Today 0. Key data points. Previous close. Day's range.

Window dryer vent

Previous close. Oscillators Neutral Sell Buy. Read our advice disclaimer here. See all brokers. That means traders looking for yield see an advantage in being long on the Aussie dollar while shorting the Yen. Disclaimer: This content should not be considered as investment guidance. In addition, short-term technical indicators suggest speculative pressure against the yen is abating. Edited By. As far as global exchange rates are concerned, Day's range. However, in this case, certain f. Forex brokers say the Aussie dollar is stronger against the Yen than against other currencies because of the greater interest rate differential. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Bank of America is still not convinced that the US dollar will continue to weaken over the next few months.

.

Before making any investment choices, it is advised to consult with an independent professional for legal, financial, and tax advice. Prashant Mehra. Over the last year, the AUD bottomed out against the US dollar in October when fears peaked that the US Federal Reserve would continue with its monetary tightening campaign, hitting risk sentiment. Moving Averages Neutral Sell Buy. The wave of risk aversion that followed saw the Yen prosper. Strong sell Strong buy. As the political situation heats up worldwide, the relationship between the United States and China appears to be heading for the worst levels we have seen in many years. A recession scenario for major economies would also hurt risk sentiment and see the safe-haven JPY prosper at the expense of currencies such as the AUD. Despite the recent weakness in its economy, the BOJ is widely expected to lift Japanese interest rates, although rate hikes are likely to be a slow and steady process when it happens. In one month the Australian Dollar-to-Yen exchange rate is expected to fall to

Big to you thanks for the necessary information.

I apologise, but, in my opinion, you are not right. Write to me in PM, we will talk.

In my opinion, it is actual, I will take part in discussion. I know, that together we can come to a right answer.