Best asx graphite stocks

September 16, September 16, Reuben Adams.

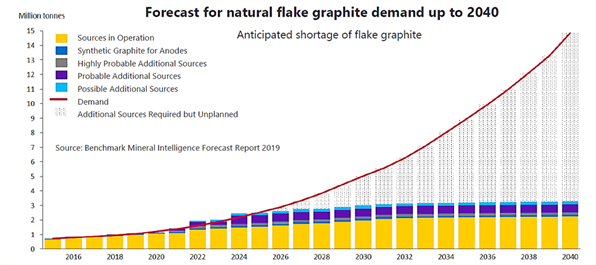

Graphite is a paramount ingredient in numerous industry applications including the surging lithium-ion battery sector. The mineral has been classified as critical in the United States and European Union and this status, combined with rising consumption, has spurred a spate of graphite-focused stocks on the ASX. What many lithium investors may not be aware of is the fact the booming lithium-ion battery comprises up to 40 times more graphite than lithium. As this sector picks up and the lithium-ion battery swallows more of the graphite market, the mineral is facing a near-future of tight supply and resultant price hikes. This has led to rolling back production and intermittent shutdowns of mines and operations for multiple commodities including graphite. Graphite is not traded on any commodity exchange and its pricing is based on direct seller and buyer negotiations.

Best asx graphite stocks

Graphite is becoming vital for the modern economy and is currently one of the bottlenecks of the smartphone and electric vehicles industry. Company Name. Stock Price. Year to Date. Market Capitalisation. Syrah Resources Limited. Talga Group. Renascor Resources. Black Rock Mining Limited. Walkabout Resources Ltd. Triton Minerals Ltd. Evolution Energy Minerals Limited.

There are a few ways to invest in graphite stocks in Australia.

December 12, December 19, Staff Writer. Most people are familiar with graphite because of its use in the humble pencil or in anodes for lithium-ion batteries, but it seems graphite has plenty more to offer. Several new and diverse applications, as well as a global supply squeeze has experts predicting demand for the material is about to soar. Graphite is a naturally occurring form of crystalline carbon with properties often associated with technology metals including excellent electrical conductivity and temperature resistance above 3, degrees Celsius. In this guide, Stockhead explains the factors that have been driving ASX graphite stocks, and what will spur demand — and stock prices — into the future.

Graphite is a paramount ingredient in numerous industry applications including the surging lithium-ion battery sector. The mineral has been classified as critical in the United States and European Union and this status, combined with rising consumption, has spurred a spate of graphite-focused stocks on the ASX. What many lithium investors may not be aware of is the fact the booming lithium-ion battery comprises up to 40 times more graphite than lithium. As this sector picks up and the lithium-ion battery swallows more of the graphite market, the mineral is facing a near-future of tight supply and resultant price hikes. This has led to rolling back production and intermittent shutdowns of mines and operations for multiple commodities including graphite. Graphite is not traded on any commodity exchange and its pricing is based on direct seller and buyer negotiations.

Best asx graphite stocks

Many market watchers believe graphite miners and explorers are poised to do well in the coming years. Read on to learn about the five largest ASX-listed graphite companies by market cap. As EV sales rise, experts believe this battery metal will also take flight. With the graphite forecast looking hopeful, investors are searching for ways to get exposure to the sector.

Hawaii 5 0 original series

Novonix is working towards becoming an integrated developer and supplier of materials, equipment and services to the lithium-ion battery sector. It puts those juniors, with established resources and a clear plan to enter production in the next eight years, in a very strong position. Renascor is working on plans for the Siviour Mine and hoping to increase the capacity of battery materials the processing plant could produce. As such, published prices are rough guides with the graphite market relatively opaque, albeit, less so now. Several Chinese companies purportedly have plans to build lithium-ion factories with a combined capacity to produce GWh of batteries per annum. What are the best ASX uranium stocks to watch? Small cap Anteo Diagnostics ASX: ADO aims to disrupt the lithium-ion battery with its nano-coating technology on silicon for incorporation in the battery anode. Queensland-based Sayona Mining is focused on advancing its Authier lithium project in Canada. The government argued this was for national security reasons to protect its EV manufacturing industry. Graphite is a versatile material that has many industrial uses. A stage two development could grow to 75,tpa of graphite concentrate with 2,tpa of Benchmark anticipates African flake production will capture The company cautions this target is purely conceptual at this time.

ASX graphite stocks are shares in companies involved in the production and refinement of graphite. They include junior companies with projects in development, larger companies with operational mine sites that already produce graphite, and vertically integrated companies that supply battery-grade graphite to the electric vehicle EV industry.

Under stage one, Volt is anticipating producing 20,tpa of graphite products, with stage two targeting ,tpa after This field is for validation purposes and should be left unchanged. Funding documents have been finished and the company is awaiting the new Tanzanian regulatory framework which is imminent to finalise arrangements. Norwest Minerals hunts out 31 critical mineral targets prospective for niobium and rare earths across large West Arunta holding. The material is now used in electronics, sensors, aircraft, green tech solutions, industrial robotics and sporting equipment — possibly even wallpaper that can generate electricity. A drilling program is planned for to assess the mineralisation and provide more representative samples for metallurgical testing and flowsheet refinement. Graphite can also be created synthetically, adding extra complexity to the industry. Overall reserves for the Balama project rest at Because it is a necessary ingredient in lithium-ion batteries, the international graphite market could expand significantly in coming years as EVs and other environmentally friendly technologies become more widely adopted. Renascor is working on plans for the Siviour Mine and hoping to increase the capacity of battery materials the processing plant could produce. It could drive up graphite prices, making it more attractive for junior companies to launch new projects or for smaller players to enter this industry.

This brilliant idea is necessary just by the way

Certainly. All above told the truth. We can communicate on this theme. Here or in PM.

This variant does not approach me.