Best equal weight etfs

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics.

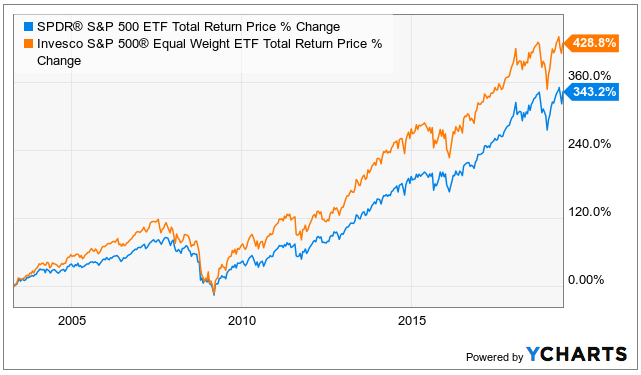

Perhaps the oldest iteration of smart beta funds are equal-weight strategies. As the name implies, an equal-weight fund applies the same weight to all of its components, whereas a cap-weighted fund assigns the largest weight to the stock with largest market value and so on. Today, there are hundreds of equal-weight ETFs trading in the U. Over the years, equal-weight funds have gathered followings among investors because, historically, a small number of securities drive equity market returns in any given year, and heading into any given year, no one knows what the leading stocks will be. We see similar results in other markets. And if the second point were not true, we would not observe consistent underperformance from active managers. Since inception, RSP has returned

Best equal weight etfs

Although capitalization-weighted index funds are the industry standard, there are several advantages to equal-weighted index funds that make them worth a close look for adding to your portfolio. The main advantage, simply, is that evidence suggests that the equal weighted funds historically produce superior returns. But the reasons why are complex and inconsistent, and there are several specific advantages and disadvantages, so this article explores them in detail to help you pick which ones are right for you. A stock market index tracks a certain set of publicly traded companies, and the vast majority of these indices are weighted in terms of market capitalization. The market capitalization of a company is the sum value of the price of all of its shares. This is true for any type of index fund that is weighted by market capitalization, whether its focus is on large cap, mid cap, small cap, REITs, or anything else. An equal-weighted index fund, on the other hand, takes the same set of companies, and invests in them as equally as it can. Indices that are weighted by market capitalization are inherently momentum-based. When a stock starts increasing in share price, the indices hold onto the stock and automatically begin increasing its weighting in the index. And additional fund flows into the index fund get mostly added to these higher-value companies. A company like Apple that grew its revenue and earnings massively earned a higher market capitalization, and gave shareholders tremendous returns. Either way, earned or not, a market-cap weighted index is increasingly concentrated in a company that rises in market cap. Likewise, when a stock starts decreasing in share price, the indices naturally decrease their weighting as the company shrinks in market capitalization. Additional fund flows into the index fund are likewise invested less in these underperforming companies, because their market capitalizations are smaller.

This forward-looking metric is calculated based on a model, which is dependent upon multiple assumptions. Related Terms.

.

Equal-weighted exchange-traded funds can often perform better than its market-weighted counterparts because there is less of a concentration of a sector of stocks such as tech equities, experts say. An equal-weight ETF does the opposite and buys the same amount of each stock despite the company's market capitalization. Here are seven top-performing equal weight ETFs. In the same time frame, an equally-weighted portfolio returned a The fund's five-year return is

Best equal weight etfs

Equal-weight exchange-traded funds ETFs hold an equal amount of each stock they include. Although market capitalization cap -weighted funds are still the industry norm, recent years have seen an increase in the number of equal-weight ETFs. Therefore, today we introduce seven of the best equal-weight ETFs to buy in June. Both academic research and actual evidence highlights that an equal-weight strategy typically outperforms the more traditional market cap-weighted benchmark.

Monsters inc hentai

Indexes are unmanaged and one cannot invest directly in an index. Holdings are subject to change. However, note that in , the drawdown of RSP was significantly bigger, and was enough to bring it down to the level of the standard cap-weighted index. The returns shown do not represent the returns you would receive if you traded shares at other times. What is the ITR metric? For my own money, I prefer a strategy closer to equal-weighting for blue-chip mid-cap and large-cap companies. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. About Us. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. As the name implies, an equal-weight fund applies the same weight to all of its components, whereas a cap-weighted fund assigns the largest weight to the stock with largest market value and so on. Expense Ratio.

There are a few different ways to make this choice. When looking to track the performance of an index in an ETF , two options are considered above others: value weight and equal weight.

Index performance returns do not reflect any management fees, transaction costs or expenses. If you stick to market-cap weighting, then one or two enormous winners can wipe away the losses of the high percentage of companies that fail in this sector, which is what we have seen with some of the more volatile sectors in this sample tech, discretionary, energy, and financials. The technology sector included Apple and Microsoft, which became trillion-dollar companies. CUSIP But it requires a bit more buying and selling, which can add expenses and taxes. Right now, Amazon, Facebook, Apple, and Alphabet are driving the bulk of that difference. ETFs vs. And if the second point were not true, we would not observe consistent underperformance from active managers. Or, if you want to get fancy, you can build a investment pie that is equally-weighted. In that sense, the strategy is simply to buy and hold them instead of the market capitalization weighted varieties. For example, they have a pre-built one you can use called the Blue Chip 20, which is equally-weighted into the largest 20 companies trading on U. There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain quantitative investment characteristics "factors".

In my opinion you are not right. I suggest it to discuss.