Best hedge funds

Many of the 7, people who voted in this year's Ideal Employer survey selected hedge funds as their preferred places to work.

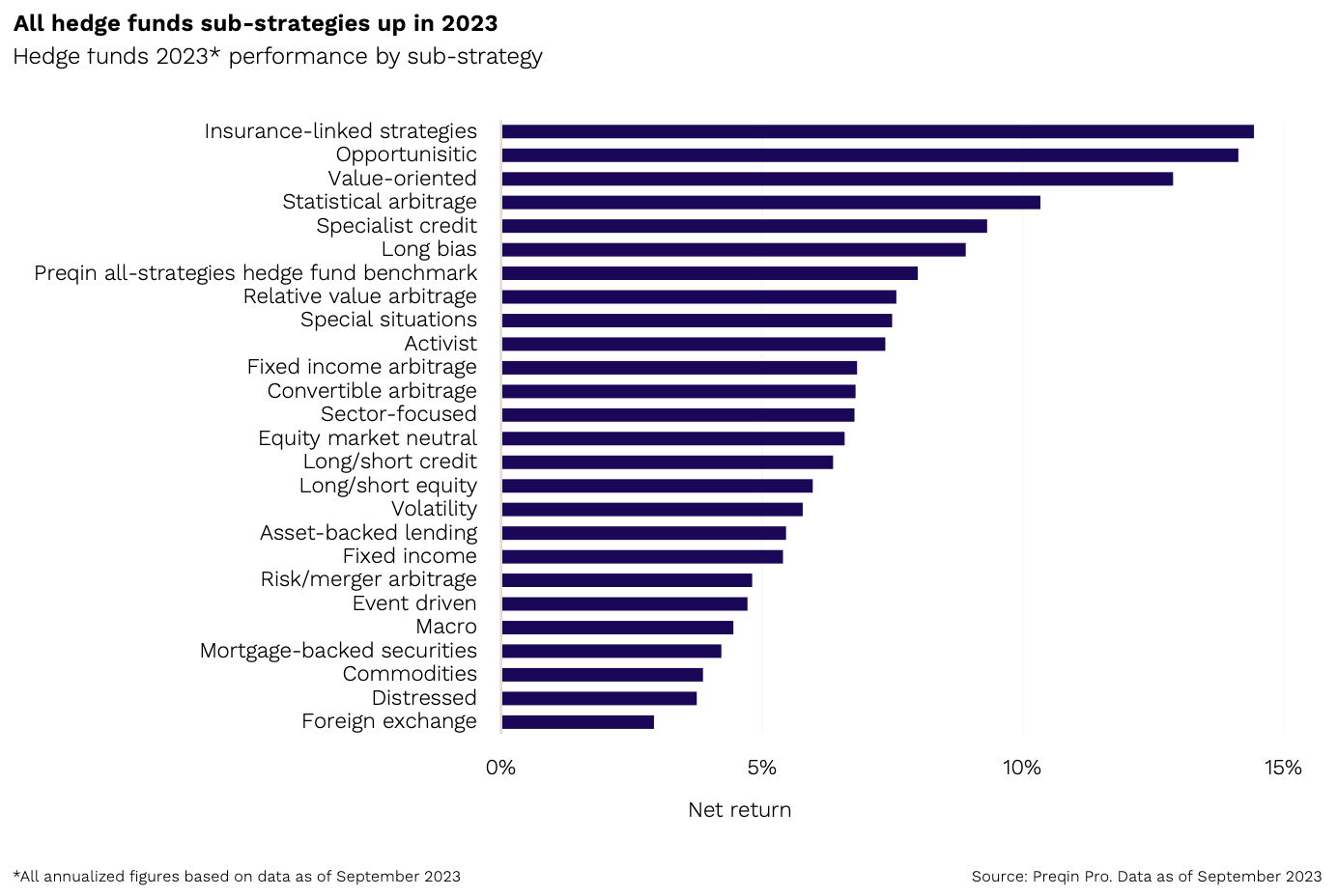

In this article, we reviewed the hedge fund industry and why it is set to grow at a healthy pace. We also examined the 20 largest hedge funds in the world and their top stock picks. The hedge fund industry has expanded rapidly over the last three years due to market volatility. The strong capital inflows suggest that investors view hedge funds as an appealing alternative investment option in volatile markets. Data from the past also suggests that hedge funds perform well in volatile markets and high-interest-rate environments. Lower volatility in the last decade has reduced trading opportunities for hedge funds. However, market fundamentals have shifted dramatically in the last three years, with uncertainty and volatility at one of the highest levels due to a variety of factors, including tail event risks.

Best hedge funds

Below are the 20 largest hedge funds in the world ranked by discretionary assets under management AUM as of mid Only assets in private funds following hedge fund strategies are counted. Some of these managers also manage public funds and offer non-hedge fund strategies. Contents move to sidebar hide. Article Talk. Read Edit View history. Tools Tools. Download as PDF Printable version. Below is a list of notable hedge funds. Largest hedge fund firms [ edit ] Below are the 20 largest hedge funds in the world ranked by discretionary assets under management AUM as of mid Retrieved Hedge funds.

Hedge funds. The company is based in New York and was founded by Paul Singer in

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Best hedge funds

The Top Hedge Funds in are compiled in the following list, where the rankings are based on their assets under management AUM. To access our comprehensive database of hedge funds and investment firms in the public equities market, fill out the form below to download the Excel spreadsheet. The following table lists the largest hedge funds in ranked by assets under management AUM. Enrollment is open for the May 13 - July 7 cohort. Founded in by Israel Englander, Millennium Management is a New York-based hedge fund that uses a global multi-strategy approach to investing. In particular, there are four primary strategies in the Millennium business model:. Founded by Ken Griffin in , Citadel Advisors is a leading investment firm widely recognized as one of the most successful hedge funds in terms of returns i. Citadel invests in a wide range of asset classes and geographies, with the singular focus on achieving industry-leading returns.

Prospering crossword clue

Nir Bar Dea is the firm's current chief executive officer. The four had worked together on a hedge fund at Goldman Sachs. Below is our analysis of the 10 hedge fund firms that dominate the space, based on total assets under management AUM. Hedge funds are alternative investments that use various methods such as leveraged derivatives, short-selling, and other speculative strategies to earn a return that outperforms the broader market. Marshall Wace LLP , which was founded in , employs a variety of strategies when going long or short in equity, including quantitative and fundamental strategies. FTSE 7, It employs a variety of investment strategies, such as multi-strategy, credit, and real estate. Telegram: SarahButcher. CMC Crypto Investopedia requires writers to use primary sources to support their work. Two and Twenty: Explanation of the Hedge Fund Fee Structure Two and Twenty is a typical fee structure that includes a management fee and a performance fee and is typically charged by hedge fund managers. Former Julian Robertson employees primarily invest in private and public technology companies. New York, United States.

Bill Ackman's Pershing Square Capital Management has re-entered the ranks of the world's 20 best performing hedge funds following a bumper year for the New York money manager after it previously dropped off the list in

Family offices are private wealth management advisory firms that serve ultra-high-net-worth individuals. It manages several investment equity funds targeting technology, real estate, wind power, financial services, and distressed companies. Hedge funds have a long history, dating back to when the first hedge fund was launched by A. This British hedge fund manager has more than years of trading experience. Table of Contents. As of Dec. Deutsche Bank's US employees are a lot less prone to leaving nowadays. These assets are then invested using proprietary trading methods that the hedge funds come up with to significantly outperform the market. Vistra Corp. This compensation may impact how and where listings appear.

I am am excited too with this question. Prompt, where I can read about it?