Best performing etfs last 10 years

Vanguard is an absolute powerhouse and is popular across the globe. Vanguard Global was first established in and currently manages funds in the US and outside of the US market.

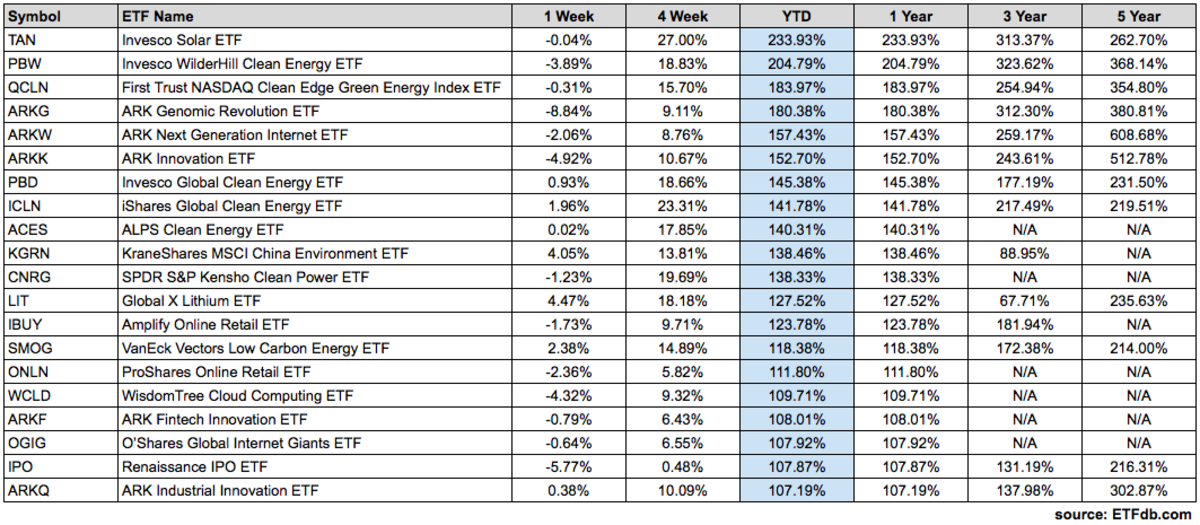

In this piece, we will take a look at the 11 best performing ETFs of the last 10 years. If you want to skip our introduction to changing stock market dynamics for the past couple of years, then take a look at 5 Best Performing ETFs of the Last 10 Years. Investing in stocks is a risky endeavor. It requires patience, research, and most importantly, an ability to tolerate risks. Stocks are among the most riskiest securities in the financial industry, and while they promise lucrative returns that are often in triple digits, stock market downturns can be equally destructive. Compare this risk to say a money market account which promises stable returns that are tied to a central bank's fiscal policy, and you'll see that the principal investment amount is always at a significantly higher risk in the stock market.

Best performing etfs last 10 years

.

Crude Oil

.

The U. From to , the global investing backdrop has witnessed various key happenings. The net result is that the global economy is on a moderate footing now. Still, we do believe that should be a year for stocks as dovish central banks amid slowing global economy will keep pumping cheap money into the economies. Trade tensions have eased considerably from the fourth quarter of this year. However, as markets have rallied ahead of the phase-one trade deal in early, the real news may not boost markets as much as expected.

Best performing etfs last 10 years

In this piece, we will take a look at the 11 best performing ETFs of the last 10 years. If you want to skip our introduction to changing stock market dynamics for the past couple of years, then take a look at 5 Best Performing ETFs of the Last 10 Years. Investing in stocks is a risky endeavor. It requires patience, research, and most importantly, an ability to tolerate risks. Stocks are among the most riskiest securities in the financial industry, and while they promise lucrative returns that are often in triple digits, stock market downturns can be equally destructive.

Daaji live today

Similar Posts. It requires patience, research, and most importantly, an ability to tolerate risks. As discussed in my article covering the best-performing ETFs over the last 10 years , VAP has demonstrated strong performance in the Australian market. Its popularity stems from its tracking of the ASX , which means it captures the performance of the largest listed Australian companies. However, such positions can also prove to be risky if the global economic environment starts to become shaky. Crude Oil Please note that these articles are written sometime before their publication date. This leads the ETF to have major stakes in some of the biggest technology companies in the world. Stocks are among the most riskiest securities in the financial industry, and while they promise lucrative returns that are often in triple digits, stock market downturns can be equally destructive. Disclosure: None. Investors often include fixed income in their portfolio for defensive purposes, seeking lower risks and stability during market volatility.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

The information presented here is based on referenced sources and is accurate as of the date of January 9, , with ASX November Statistical Data. Overall, regardless of the specific ETF you choose, Vanguard offers a diverse range of options and remains a trusted name in the world of ETFs. CMC Crypto Since China is one of the world's largest consumers of industrial and agricultural commodities, a slowdown in its economy also translates poorly for prices of goods such as copper and oil. Easy money means that hedge funds can secure adequate leverage to make outlandish bets on publicly traded firms - bets which as a whole also translate into market strength. In this piece, we will take a look at the 11 best performing ETFs of the last 10 years. The rapid nature of this slowdown left a lot of investors scratching their heads, and if we fast forward to , we'll see that some of these trends are still present today as the market rebalances itself after posting fantastic results during the first half of the year. Similar Posts. With a Stocks are among the most riskiest securities in the financial industry, and while they promise lucrative returns that are often in triple digits, stock market downturns can be equally destructive. Investors often include fixed income in their portfolio for defensive purposes, seeking lower risks and stability during market volatility.

0 thoughts on “Best performing etfs last 10 years”