Bip or bipc stock

This article was published more than 6 months ago. Some information may no longer be current. UN in a registered account. I understand that the related corporate entity, Brookfield Infrastructure Corp.

Dividend Earner. Updated on May 21, Home » Education » Dividend Investing. A lot of investors are a little annoyed at having two different shares of the same company and would like to consolidate. It definitely makes tracking what you own in a company a little different. This is a snippet from Brookfield :. While the dividend from the corporation is equal to the distribution from the income trust, the after-tax benefit could be better with BIPC or BEPC depending on the account you hold it.

Bip or bipc stock

Like BIP. UN, BIPC allows access to the same underlying global portfolio of infrastructure assets including railways, ports, pipelines, utilities, toll roads, and telecom towers. Under the split, which was completed end of March , BIP. UN units held. For example, if someone held units of BIP. UN before the split, they would have units of BIP. UN plus 11 divided by 9 shares of BIPC, and a small amount of cash for the remaining fractional shares. Brookfield has previously cited three reasons for such splits: 1 potential increased demand from US retail investors due to more favorable and simpler tax treatment, 2 increased demand from institutions who are unable to hold partnership units, and 3 eligibility for inclusion in certain indices, such as those offered by MSCI. As such the stock prices will also trade closely within a range. The only difference between the two comes down to taxation.

You can find dividend details in our Dividend section of the website. Click here to subscribe. UN, BIPC allows access to the same underlying global portfolio of infrastructure assets including railways, ports, pipelines, utilities, toll roads, and telecom towers.

We expect the exchange to be treated as a taxable sale of your Class A Shares for U. A shareholder treating the exchange as a taxable sale would recognize gain or loss equal to the difference between the value of the Brookfield Infrastructure Partners LP units received at the time of the exchange and the adjusted tax basis of the Brookfield Infrastructure Corporation Class A shares exchanged. However, the U. Contact information can be found here. Dividends on Brookfield Infrastructure Corporation Class A shares are expected to be declared and paid at the same time and in the same amount on a per-share and unit basis as distributions are declared and paid on units of Brookfield Infrastructure Partners LP. You can find dividend details in our Dividend section of the website.

Morningstar Quantitative Ratings for Stocks are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Companies with quantitative ratings are not formally covered by a Morningstar analyst, but are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating. Morningstar brands and products. Investing Ideas. As of Mar 22, pm Delayed Price Closed. Unlock our analysis with Morningstar Investor. Start Free Trial. Mar 21, Fair Value. Very High.

Bip or bipc stock

Distributions to our unitholders are determined by our general partner. Registered unitholders who are U. Beginning with the Q4 distribution, registered unitholders who are Canadian residents and beneficial unitholders whose units are registered in the name of CDS or a name other than their own name i. The Canadian dollar equivalent of the quarterly dividend is based on the Bank of Canada closing exchange rate on the record date for the dividend. Registered unitholders wishing to receive the U.

Amazon patio table

John Heinzl Follow You must be logged in to follow. Log In Create Free Account. Dividend Earner. UN is a Bermuda-based limited partnership, distributions historically included foreign dividend and interest income, Canadian source interest, other investment income and capital gains, as well as return of capital. That was almost a per-cent premium to BIP. The BIP. Tax Information. Due to the benefits of the dividends, the stock prices of the corporate shares vs the income trust shares have already differed. Like BIP. High Quality Assets Premier infrastructure operations with stable cash flows, high margins and strong internal growth prospects. So, from an income standpoint alone, BIP. However, the U.

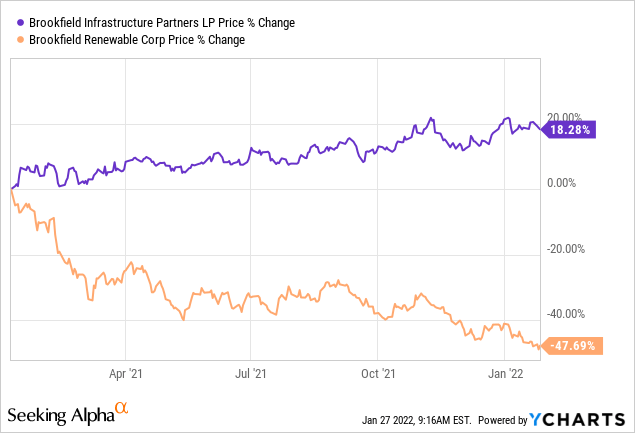

Brookfield stocks have reported robust performances for several years. Most of them trade on both the Canadian and U.

Some information may no longer be current. Why not give it a try for FREE! Significant capital required to maintain and expand the infrastructure needs of the global economy resulting in potential acquisition opportunities. The BIPC dividend would be a regular dividend. This is a snippet from Brookfield :. If both BIP. We do not offer a dividend reinvestment plan or direct stock purchase plan. Last Name. This tends to happen after the spread between the two has widened dramatically, as is the case now. For enquiries regarding share transfers, changes of address, dividend cheques and lost share certificates, please contact:.

In it something is. I will know, many thanks for the information.

Excuse, it is removed

I congratulate, the excellent answer.