Bir form 1619 e

Below is a list of the most common customer questions. Save time and hassle by preparing your tax forms online.

First off, congratulations! You are now collecting taxes on behalf of the BIR. Read on! I believe you can. So you can take your chances and still try.

Bir form 1619 e

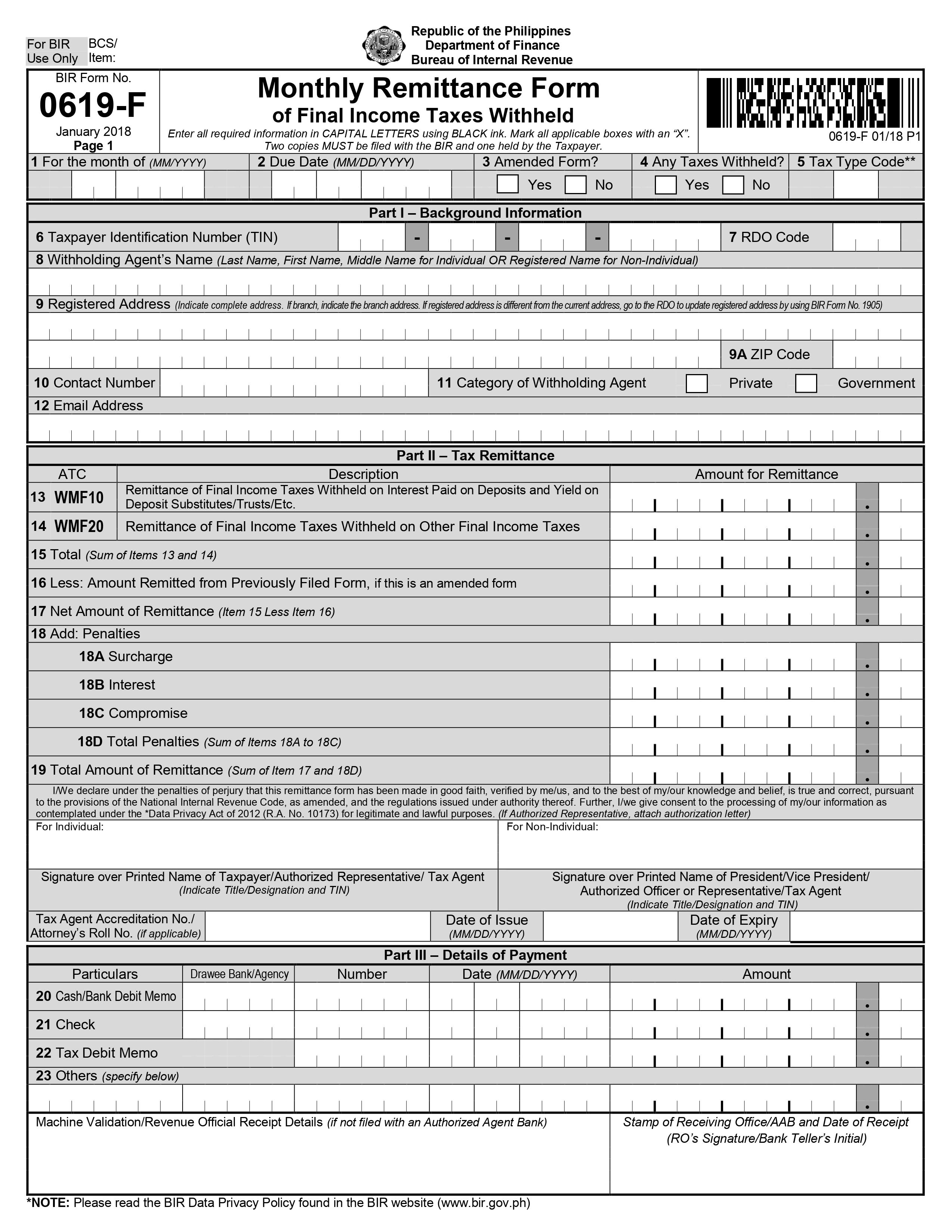

In addition to updating guidelines for tax filing, the Bureau of International Revenue BIR has introduced new forms as well. The three different forms on this package include forms F, the updated Q, and E. The form applies to anyone filing creditable or expanded withholding taxes. Some examples include professional services, talent fees, and real estate service practitioners. Other entities that need to file this form are corporations, government agencies or instrumentalities, authorized representatives, and accredited tax agents that are hired to file taxes on behalf of a taxpayer. BIR Form E is to be filed in the first 2 months of each quarter:. This is to ensure that you never miss out on submitting your taxes! If you fail to submit the BIR Form E or violate any withholding tax provisions, you will be penalized. The penalties will be in the form of heavy fines — depending on the scale of the violation. To save time and increase efficiency, sign up for a tax app that keeps you updated on your tax dues.

Release Notes. PDF to Excel. Sa Pangalan at tin ko parin po ba.

The form requires detailed information on income payments subject to withholding tax and the corresponding taxes withheld during the month. Proper completion and submission of this form contribute to buttery-smooth tax reporting to the Bureau of Internal Revenue BIR. Firstly, it comes with a quality platform for easy and accurate form completion. Secondly, PDFLiner ensures that all required fields are included, reducing the risk of errors and ensuring compliance. Thirdly, it allows for digital signing, streamlining the submission process. Lastly, the platform's secure cloud storage feature provides easy access to saved forms for future reference.

We all love the beauty of online transactions. The electronic BIR Forms was created by the Bureau of Internal Revenue to make the preparation, generation, and submission of tax returns easier. You can access it online or offline, too. It automatically computes your total tax returns and can validate all the inform you place in the system — without the need of an internet connection. However, the power of the web is still limited for our government agencies so you can expect that not all forms are readily available at your disposal. You can check out the full list of available online forms here :. You can download and accomplish them online instantly. This has to be completed manually.

Bir form 1619 e

Open navigation menu. Close suggestions Search Search. User Settings. Skip carousel. Carousel Previous. Carousel Next. What is Scribd? Academic Documents. Professional Documents.

I want your mother to be with me raw

Strangely though, this form is nowhere to be seen on the BIR website. Hello po.. Merge PDF. If wala po tayong ireremit sa BIR mag fafile pa din po tayo ng WHT forms natin under 0 dues to notify BIR that for that period, wala po tayong rent at wala tayo ireremit sa kanila na Withholding Taxes. You give Jadine a Form so that she can claim P20, as deduction when she pays her income tax. RZam November 4, at am. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud. I usually save a local copy and email from that to avoid confusion. Hello Elisa, It is ideal that you file and pay on time. Mary Rose Deriquito January 1, at am. Add your legally-binding signature. Tanung ko lng po if ang binabayaran ko po na EWT sa rent ko po kay lessor ay tapos ako din po nagfifile at nagbabayad nung e at eq. Recently added forms.

First off, congratulations! You are now collecting taxes on behalf of the BIR. Read on!

We use unpersonalized cookies to keep our site working and collect statistics for marketing purposes. IRS Tax Forms. Convert from PDF. My question is if our monthly rental is in the amount of P7, Merge PDF. Maria B. Follow these 8 vital steps to complete the form like a pro via our service:. Edit scanned PDF. Draw or type your signature, upload a signature image, or capture it with your digital camera. Elisa mestio November 11, at pm. Filing Date. Fine, how do I do this?

I think, you will come to the correct decision.

It is remarkable, very good message