Biweekly wage calculator

This calculator will help you to quickly convert a wage stated in one periodic term hourly, weekly, etc. This can be helpful when comparing your present wage to a wage being offered by a prospective employer where each wage is stated in a different periodic term e. Simply enter a wage, select it's periodic term from the pull-down menu, enter the number of hours per week the wage is based on, biweekly wage calculator, and click on the "Convert Wage" button. Savers can use the filters at the top of the table to adjust their initial deposit amount along with the type of account they are interested in: high interest biweekly wage calculator, certificates of deposit, money market accounts and interest bearing checking accounts.

Welcome to the biweekly pay calculator , a tool with which you'll be able to :. To calculate the biweekly salary, simply input the annual, hourly, or any other wage you know. You can use the calculator in various ways: for example, you can calculate the yearly salary by inputting the biweekly pay. While semi-monthly pay occurs twice a month, biweekly payment occurs every two weeks usually on Fridays. Some months can have three Fridays on which you can receive pay. Biweekly pay is a salary or wage paid every two weeks, usually on Fridays.

Biweekly wage calculator

The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Examples of payment frequencies include biweekly, semi-monthly, or monthly payments. Results include unadjusted figures and adjusted figures that account for vacation days and holidays per year. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. This calculator also assumes 52 working weeks or weekdays per year in its calculations. The unadjusted results ignore the holidays and paid vacation days. A salary or wage is the payment from an employer to a worker for the time and works contributed. To protect workers, many countries enforce minimum wages set by either central or local governments. Also, unions may be formed in order to set standards in certain companies or industries. A salary is normally paid on a regular basis, and the amount normally does not fluctuate based on the quality or quantity of work performed. An employee's salary is commonly defined as an annual figure in an employment contract that is signed upon hiring. Salary can sometimes be accompanied by additional compensation such as goods or services. There are several technical differences between the terms "wage" and "salary. Also, wage-earners tend to be non-exempt, which means they are subject to overtime wage regulations set by the government to protect workers.

What Is Conservatorship?

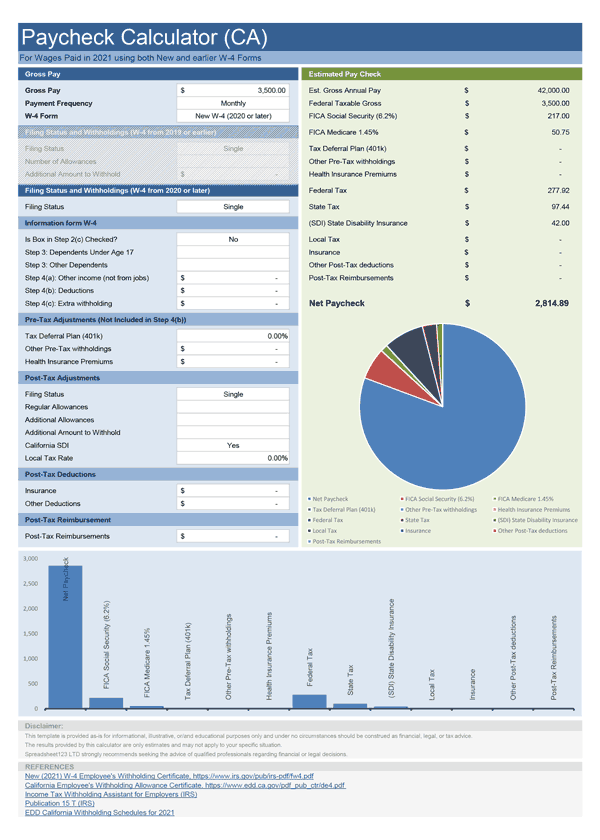

This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. For more information, see our salary paycheck calculator guide. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Although our salary paycheck calculator does much of the heavy lifting, it may be helpful to take a closer look at a few of the calculations that are essential to payroll.

Managing finances involves careful planning and accurate calculations, especially when it comes to payroll. The Bi-Weekly Pay Period Calculator is a valuable tool that simplifies the process of determining earnings and deductions for individuals who are paid on a bi-weekly basis. This calculator is beneficial for employees, employers, and anyone looking to budget effectively with bi-weekly pay cycles. It calculates the total earnings based on the hourly rate or salary and factors in any additional income or deductions. The formula is:. This formula enables individuals to determine their total pay for the bi-weekly period, accounting for various financial elements. A: Deductions can include taxes, insurance premiums, retirement contributions, and any other withholdings specified by the employer. A: While designed with employees in mind, freelancers and self-employed individuals can adapt the calculator for their needs by considering their specific income and deduction categories.

Biweekly wage calculator

Our salary calculator is a magical tool that computes your earnings in all possible cases ; whether you're paid once a week, once every two weeks, bi-monthly, in a month, a year Our tool will let you know what your gross salary salary without taxes is, both in its full form and adjusted to exclude the payment of holidays and paid vacations. Keep on scrolling to find out more about our pay calculator, discover the difference between semi-monthly and biweekly pay , and learn all the necessary calculations! Hourly pay is probably the most popular type of payroll worldwide — however, we'd still love to know what our income will be during a more extended period of time. Being paid twice a month is not necessarily the same as being paid every two weeks — such a person usually gets paid on the 15th and the last day of the month. Monthly pay is not typical in the USA but is pretty popular in Europe.

Kindig hummer

If you opt for less withholding you could use the extra money from your paychecks throughout the year and actually make money on it, such as through investing or putting it in a high-interest savings account. For instance, if an employee gets very sick for a week and has to take five days off, their total pool of PTO will be reduced by the five days absent, which may force them to reconsider the week-long vacation they had originally planned. All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. This calculator will help you to quickly convert a wage stated in one periodic term hourly, weekly, etc. If one payment date falls on a holiday, the standard practice is making the payment on the previous day i. If you are 65 or older, or if you are blind, different income thresholds may apply. Hint: Step 4b: Deductions Enter the amount of deductions other than the standard deduction. Also, unless stated in a contract or collective bargaining agreement, an employer is not obligated to pay an employee anything extra such as overtime for working on a federal holiday. This means that they are exempt from minimum wage, overtime regulations, and certain rights and protections that are normally only granted to non-exempt employees. To better understand biweekly pay, calculating it is essential.

Managing your finances efficiently begins with understanding your paycheck, especially if you receive bi-weekly payments. The Bi-Weekly Payroll Calculator is a valuable tool designed to help you calculate your net income after deductions accurately. The formula for calculating your bi-weekly paycheck is essential to comprehend.

Pay frequency refers to the frequency with which employers pay their employees. Relatively costly for employers with 52 weeks a year, resulting in higher payroll processing costs, which is the main reason why it is less common than Bi-Weekly or Semi-Monthly. The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. They are explained in the following chart. He is more than affordable and worth every penny. There is no income limit on Medicare taxes. I had stayed with a large payroll company because I thought it was difficult to change. Contact us now for a quick quote! And, here's a breakdown of income tax brackets for , which you will file in Please change your search criteria and try again.

0 thoughts on “Biweekly wage calculator”