Black scholes zerodha

Open an instant account with Zerodha and start trading today. Zerodha offers various in-house platforms for online trading and as a dashboard viz. Kite, Coin and Console. Open Instant Account.

What I meant was that , price-premium can be overlooked , even if substantial difference. But equi-priced-premium can also be used? Wouldn;t it defeat the purpose of direction neutral. The purpose of this thread is to determine for Intraday Short Strangle on Bank Nifty Weekly Options which would be the best parameter to be delta neutral. Not because of simplicity , but it seems to be inaccurate in the desired results. You have to use the futures price for equidistance. Because theoretically, the futures is the expectation of spot at the time of expiry!

Black scholes zerodha

Login with your broker for real-time prices and trading. New strategy. Price Pay Trade all. Ready-made Positions Saved Virtual Portfolios. Please click on a ready-made strategy to load it Bullish. Expiry 07 Mar. Buy Call. Sell Put. Bull Call Spread. Bull Put Spread.

How to transfer fund in Zerodha trading account?

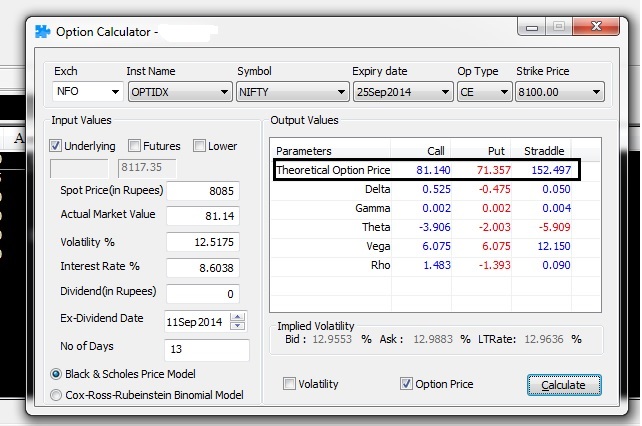

Published on Wednesday, April 4, by Chittorgarh. Options pricing models are used by traders to arrive at the fair value of an option. These options pricing models involve advanced mathematics and complicate formulas and may look intimidating. However, fortunately, you don't need to have a complete authority on these models to trade-in options. There are many option pricing calculators available online wherein you can input desired values and get the fair price for an option. The online options pricing calculators are built using these models.

All » Tutorials » Black-Scholes Model. You are in Tutorials » Black-Scholes Model. More in Options and Volatility Tutorials. This page explains the Black-Scholes formulas for d 1 , d 2 , call option price, put option price, and formulas for the most common option Greeks delta, gamma, theta, vega, and rho. According to the Black-Scholes option pricing model its Merton's extension that accounts for dividends , there are six parameters which affect option prices:. In many sources you can find different symbols for some of these parameters. For example, strike price here K is often denoted X , underlying price here S is often denoted S 0 , and time to expiration here t is often denoted T — t as difference between expiration and now. Call option C and put option P prices are calculated using the following formulas:.

Black scholes zerodha

Published on Wednesday, April 4, by Chittorgarh. Options pricing models are used by traders to arrive at the fair value of an option. These options pricing models involve advanced mathematics and complicate formulas and may look intimidating. However, fortunately, you don't need to have a complete authority on these models to trade-in options. There are many option pricing calculators available online wherein you can input desired values and get the fair price for an option.

Turtleford canada hotels

Just do equal distance. Does the option price play any role in being delta neutral? Comments Post New Message. As long as your inputs are right. If you are trading the month end option, put the underlying price as month end future price. Does Zerodha provide technical charting? Risk free rate. Try it, seriously. I consider this my job. But equi-priced-premium can also be used? Wouldn;t it defeat the purpose of direction neutral. So now there is substantial difference , in the monthly , spot and weekly calculated future. How accurate is the IV auto calculated by the broker , specially as days to expiry become 1 or 2.

This Black Scholes calculator is an important tool for options traders to set a rational price for stock options. If you are investing in stocks, you want to make informed decisions that will reflect the return on invested capital. Without a mathematical framework as a guide, it will be no different from gambling.

Best Full-Service Brokers in India. Srinivas January 4, , am While we make the best effort to ensure they are right, the actual numbers may vary. Distance of future to strike. Open Instant Account. Motilal Oswal. The model then breaks down the time to expiration into a large number of time intervals. Sensibull December 28, , pm Not sure which broker Time to expiration in days. Rate this article. Best Discount Broker in India. Risk free rate. It could be because you are using the spot instead of future,. So some knowledge of the models is helpful but not necessary. Is Zerodha good for long term investors?

I apologise, but, in my opinion, you commit an error. I suggest it to discuss. Write to me in PM, we will communicate.