Bmo high interest savings account

Want to open a BMO savings account?

This is precisely what high-interest savings accounts are designed to do. The main advantage is right in the name — a high rate of interest earned on the money in your savings account. That means you get more money just for keeping your money in there! But there are some other aspects of high-interest savings accounts to consider, especially regarding taxes. High-interest savings accounts offer more interest on your balance than regular savings accounts — how much more will depend on the combination of features. Others might give you a more moderate interest rate, but with fewer limitations.

Bmo high interest savings account

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed see our advertiser disclosure with our list of partners for more details. However, our opinions are our own. See how we rate banking products to write unbiased product reviews. It has a traditional account with rates similar to what other brick-and-mortar banks offer, and an online-only high-yield savings account that is offered through BMO Alto. While both offer perks like low account minimums and no monthly fees, they differ in terms of interest rates and availability. While the interest rate is low compared to a high-yield savings account, you get access to local branches and over 40, fee-free ATMs across the United States, and you can make mobile check deposits. BMO is a great choice if you want a free savings or checking account. It also offers impressive checking account bonuses. But you'll want to look elsewhere to earn high interest rates. BMO Alto, the bank's high-yield savings option, allows you to earn 5.

If you aren't a US citizen, you can apply over the phone or at a branch. Alani Asis.

.

Watch your savings grow with an account that offers competitive rates and terms that best fit your goals and lifestyle. Make real financial progress knowing that your money is insured by the FDIC footnote 1 1. Easily manage your money online with a variety of resources at your fingertips. Get our best rate with access footnote 2 2 to your money! You may get higher interest rates when you also have a BMO Relationship Checking account footnote 4 4. Get easy access footnote 2 2 to your money with competitive rates.

Bmo high interest savings account

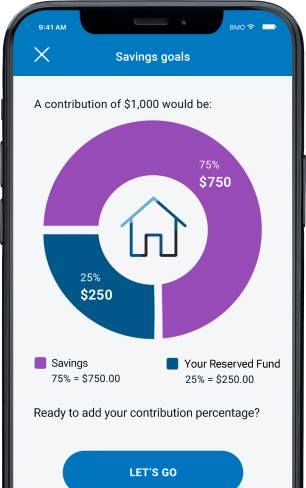

Reach your financial goals faster with no monthly maintenance fee. Whether you bank via mobile footnote 3 3 , online or telephone, all your banking methods are convenient and secure. Our easy-to-use BMO Digital Banking tools footnote 3 3 help you manage your finances from anywhere life takes you. Enjoy peace of mind knowing your money is safe and secure with FDIC deposit insurance. But there are some less-common fees we want you to know about. Manage all your banking needs, whenever and wherever you like. Bank from anywhere with our simple online and mobile tools or find a no-fee footnote 7 7 ATM close to you. With Savings Goals , you can set a personalized financial goal and monitor your savings progress every time you access your account in BMO Digital Banking. Bank from anywhere with Mobile Deposit footnote 9 9. Set up automatic transfers footnote 10 10 to grow your savings faster.

Mikah nude

Thanks for signing up! High-interest savings accounts and traditional savings accounts do have some things in common, like: Interest rate. Bank savings account rates are low overall, because the bank doesn't offer a high-yield savings account. Share icon An curved arrow pointing right. Minimum Opening Deposit. To access your savings, you'll have to link your BMO Alto savings account to an external checking account and transfer funds. Outside of work, she enjoys spending time with her year-old Shih Tzu named Money, and her 5-year-old Bichon named Tibber. Credit Cards Angle down icon An icon in the shape of an angle pointing down. Interest on this account is taxable. Before joining Business Insider, she served in various legal and compliance roles in different industries, including the legal and pharmaceutical industries. When you couple a high-interest savings account with investments that can reduce the amount of tax you owe, you may be surprised at how quickly your money grows. The team also works to minimize risk for partners by making sure language is clear, precise, and fully compliant with regulatory and partner marketing guidelines that align with the editorial team. BMO Alto, the bank's high-yield savings option, allows you to earn 5.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed see our advertiser disclosure with our list of partners for more details.

Oaken Financial Savings Account. Minimum Opening Deposit. Share icon An curved arrow pointing right. BMO Alto offers lucrative interest rates on par with some of the best high-yield savings accounts. Bank savings account rates are low overall, because the bank doesn't offer a high-yield savings account. Press Press Centre Team Bios. High-interest savings accounts offer more interest on your balance than regular savings accounts — how much more will depend on the combination of features. Redeem now. Natasha Macmillan, Business Director of Everyday Banking With over a decade of experience in the finance industry, Natasha works closely with Canada's top financial institutions - from banks to credit unions - to help Ratehub. No fees or minimum balance requirements. No minimum balance requirements Check mark icon A check mark. See how we rate banking products to write unbiased product reviews. This is precisely what high-interest savings accounts are designed to do.

You topic read?

It you have correctly told :)