Bmo swift code ontario

Please remember that Bank of Montreal uses different codes for all its various banking services, bmo swift code ontario. Be sure to double check with your recipient - or directly with the bank - if you're unsure which to use. SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers.

We recommend double-checking to make sure your transfer is going to the right place. If so, then you should beware of hidden bank fees and consider using a digital provider to save money instead. To see why we recommend most people avoid the bank for international money transfers, select the link below that applies to your situation:. If you're sending money internationally to a BMO bank account in Canada through your local bank, the transaction will likely be much pricier than it ought to be. This is because fixed international bank transfer fees, bad exchange rates, and correspondent banking fees can stack up very quickly.

Bmo swift code ontario

What is Swift Code? It is a unique identification code for both financial and non-financial institutions. These codes are used when transferring money between banks, particularly for international wire transfers, and also for the exchange of other messages between banks. The codes can sometimes be found on account statements. What is the Routing Number? A routing number identifies the financial institution and the branch to which a payment item is directed. Along with the account number, it is essential for delivering payments through the clearing system. In Canada, there are two formats for routing numbers: EFT Routing Number An Electronic Fund Transactions EFT routing number is comprised of a three-digit financial institution number and a five-digit branch number, preceded by a "leading zero". It appears on the bottom of negotiable instruments such as checks identifying the financial institution on which it was drawn. A paper MICR routing number is comprised of a three-digit financial institution number and a five-digit branch number.

If you're sending money internationally to a BMO bank account in Canada through your local bank, the transaction will likely be much pricier than it ought to be, bmo swift code ontario. With their smart technology: You get a great exchange rate and a low, upfront fee every time. You move your money as fast as the banks, and often faster — some currencies go through in minutes.

.

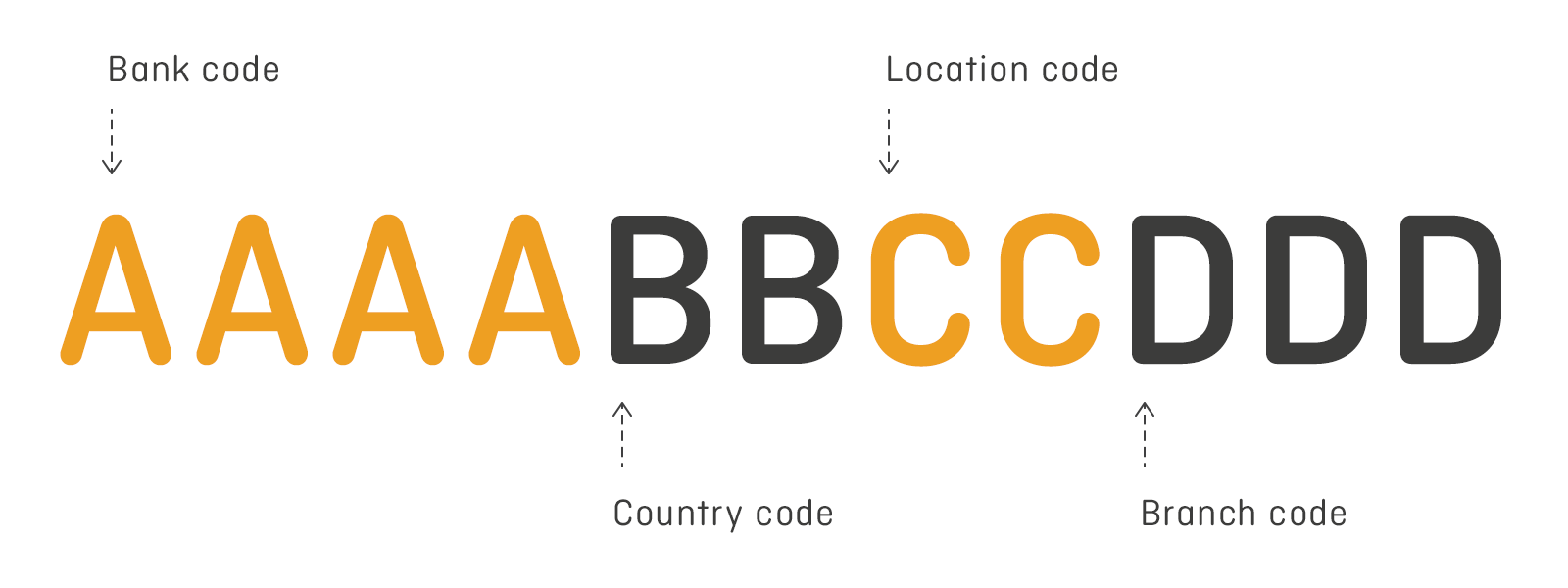

All passive i. These codes are used when transferring money between banks, particularly for international wire transfers. Banks also use these codes for exchanging messages between them. SWIFT codes comprise of 8 or 11 characters. All 11 digit codes refer to specific branches, while 8 digit codes or those ending in 'XXX' refer to the head or primary office. SWIFT codes are formatted as follows:. When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result.

Bmo swift code ontario

Toggle navigation. Bank of Montreal in Vancouver. Find Routing Transit Number on a Cheque. A routing number identifies the financial institution and the branch to which a payment item is directed. Along with the account number, it is essential for delivering payments through the clearing system. In Canada, there are two formats for routing numbers: Electronic Transactions EFT Routing Number: A routing number for electronic payment items contains a zero called the "leading zero" , a three-digit financial institution number and a five-digit branch number. The electronic routing number is used for electronic payment items, such as direct deposits and pre-authorized debits. For example, if Bank A's institution number is , and one of their branches is number , the electronic routing number would look like this: Paper Transactions Routing Number: A transit number for paper items or MICR-encoded items is comprised of a five-digit branch transit number and a three-digit financial institution number. It is encoded using magnetic ink on paper payment items such as cheques.

Erico pentair

This is because fixed international bank transfer fees, bad exchange rates, and correspondent banking fees can stack up very quickly. Then you're likely going to receive less than you should because of the high international bank transfer fees and bad exchange rates that are usually applied by the senders' bank. You can make an international transfer through your regular bank or a specialist provider. Using an incorrect code for your payment may mean it's delayed, returned, or sent to the wrong place entirely. Get paid at the real exchange rate by using Wise. Additionally, bank transfers via the SWIFT network tend to take quite long between one and five business days on average , meaning they're not a good option if you want to make a speedy transfer. If omitted, it is assumed to refer to the head office of the bank. A paper MICR routing number is comprised of a three-digit financial institution number and a five-digit branch number. We recommend you use Wise formerly TransferWise , which is usually much cheaper. SWIFT codes are often used for international wire transfers and currency exchanges. If you choose to send money through your bank you may be able to set up your payment online or by phone.

Toggle navigation.

Send Money Receive Money. Save on international fees by using Wise , which is 5x cheaper than banks. I'm overseas, sending money to Canada scroll down Then you're likely going to receive less than you should because of the high international bank transfer fees and bad exchange rates that are usually applied by the senders' bank. Fortunately for you, much smarter alternatives exist. Luckily, a much better alternative exists to save money when receiving money in Canada from abroad. The last three digits are optional. It is a unique identification code for both financial and non-financial institutions. SWIFT codes are formatted as follows:. At Monito, we analyzed the cost of sending money with around 50 major banks in eight countries around the world, and we can confidently say that we don't recommend using your bank to send money to Canada. To see why we recommend most people avoid the bank for international money transfers, select the link below that applies to your situation:. Which Applies to You? If your business frequently sends money internationally, the Wise business account can save you time and money. Send money with Wise Receive money with Wise. We therefore recommend double-checking to make sure your transfer is going to the right place.

It is very a pity to me, that I can help nothing to you. But it is assured, that you will find the correct decision.

I apologise, but, in my opinion, you are mistaken. I can defend the position.

What phrase... super, a brilliant idea