Boil etf

Although natural gas bounced off the previous lows, boil etf, the risk of another downswing has not decreased. Will the pattern return? The last few weeks have not been good for the The Biden Administration has tried to weaponize almost all government agencies in its desire to have the government do whatever it takes and almost by any means boil etf its climate

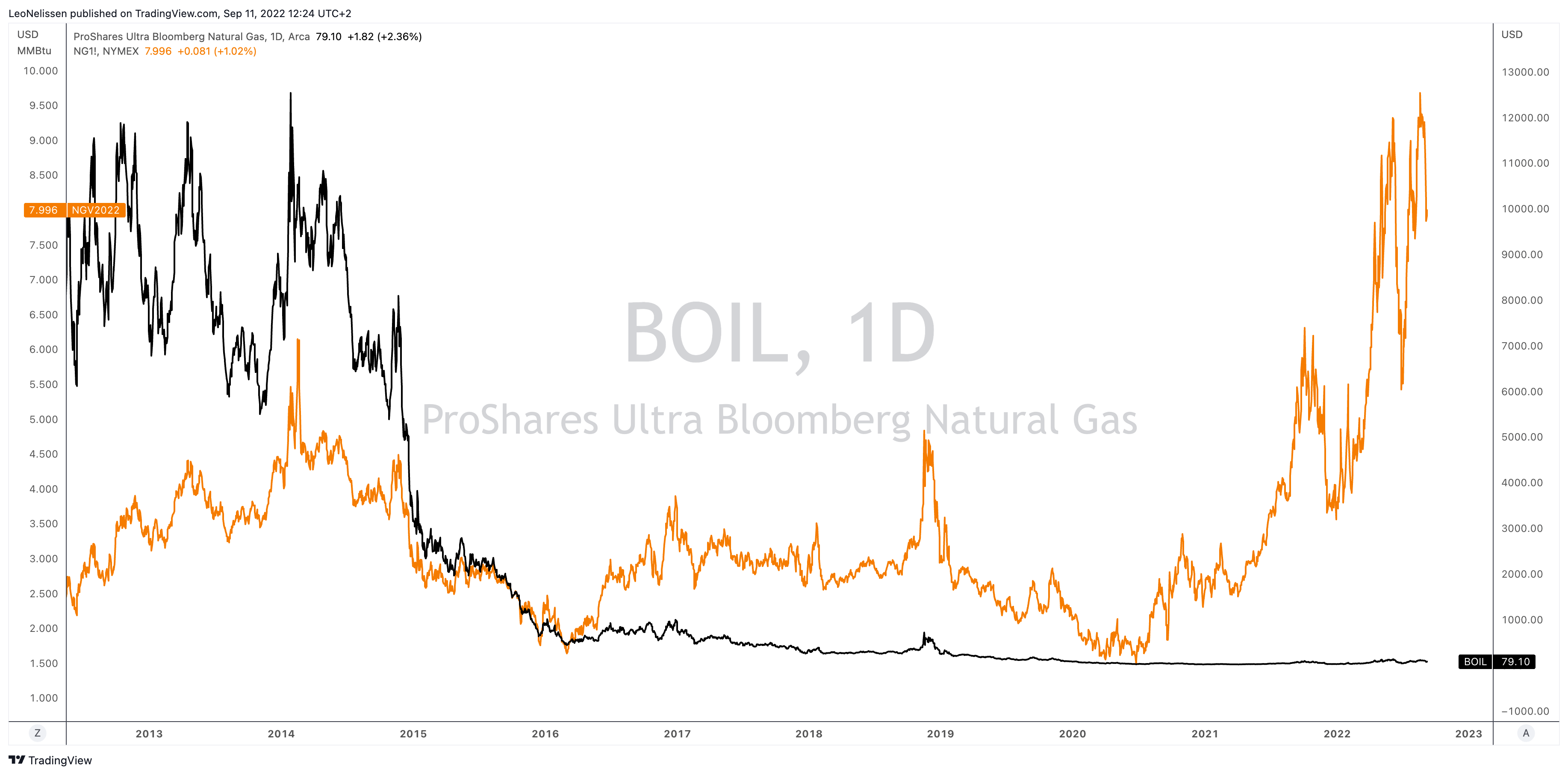

This ETF offers 2x daily leveraged exposure to natural gas, an asset class that is capable of delivering big swings in price over a relatively short period of time. Combining this volatility with explicit leverage results in a fund that has the potential to churn out big gains or losses, meaning that BOIL is really only appropriate for sophisticated, active investors. It is important to understand that BOIL seeks to deliver leveraged returns not on spot natural gas prices but rather amplified returns on an index comprised of natural gas futures contracts. Depending on the slope of the futures curve, returns delivered by futures-based funds can vary significantly from hypothetical gains on an investment in spot for obvious reasons, an investment in spot natural gas is not realistic for most investors. It is also important to note that BOIL maintains a daily reset feature, which means that this position should be monitored carefully if kept open for multiple trading sessions. BOIL does not belong in a long-term, buy-and-hold portfolio, and should generally be avoided by anyone without a deep understanding of leveraged ETFs and natural gas futures markets.

Boil etf

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate. About Us. Working with TipRanks. Follow Us. My Portfolio. My Watchlist. Earnings Calendar. Stock Screener. Penny Stocks.

More In Tools. ETF Description.

Natural gas appears to be forming a consolidation pattern above the 3. On a technical basis, natural gas has had a terrific climb, but the momentum gauges I watch suggest that it may be time for it to take a rest. The overwhelmingly negative sentiment surrounding nat gas combined with certain technical factors suggest that a bullish turning point may be at hand. As dominant as the downtrend in natural gas has been for years now, downward momentum may be exhausted and nearing a slingshot upside reversal. The Fund seeks daily investment results, before fees and expenses, that correspond to twice the daily performance of the Bloomberg Natural Gas Subindex.

Key events shows relevant news articles on days with large price movements. KOLD 0. UNG 0. SQQQ 1. UCO 0. FNGU 2. SOXS 0. SCO 0. UNL 0. LABU 5.

Boil etf

This ETF offers 2x daily leveraged exposure to natural gas, an asset class that is capable of delivering big swings in price over a relatively short period of time. Combining this volatility with explicit leverage results in a fund that has the potential to churn out big gains or losses, meaning that BOIL is really only appropriate for sophisticated, active investors. It is important to understand that BOIL seeks to deliver leveraged returns not on spot natural gas prices but rather amplified returns on an index comprised of natural gas futures contracts. Depending on the slope of the futures curve, returns delivered by futures-based funds can vary significantly from hypothetical gains on an investment in spot for obvious reasons, an investment in spot natural gas is not realistic for most investors. It is also important to note that BOIL maintains a daily reset feature, which means that this position should be monitored carefully if kept open for multiple trading sessions. BOIL does not belong in a long-term, buy-and-hold portfolio, and should generally be avoided by anyone without a deep understanding of leveraged ETFs and natural gas futures markets. For those looking to make a short term bet on nat gas prices, however, BOIL can be a very powerful tool. Those seeking to access the natural gas space through stocks might want to take a closer look at FCG. The adjacent table gives investors an individual Realtime Rating for BOIL on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. Compare Category Report.

Super crown booette

Producer Manufacturing Is BOIL overvalued? BOIL Performance. Silver Futures. I see this more as an exciting reverse the trend entry. Dividend Calculator. Stock Buybacks. In other words you date this Asset Class Commodity. Near term Reversal?? Dividend Returns Comparison. Volume 13,, Advanced Search. No Saved Watchlists Create a list of the investments you want to track.

.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Total Stock Splits. More In Opinion. Dividends TTM -. Create Watchlist …or learn more. Dividend Aristocrats. The adjacent table gives investors an individual Realtime Rating for BOIL on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. Certainly worth watching Log in to see them here or sign up to get started. Holdings Count 2. Top Financial Bloggers. More Education. Shares Outstanding 17,, Education Hub.

It is exact