Bollinger band afl

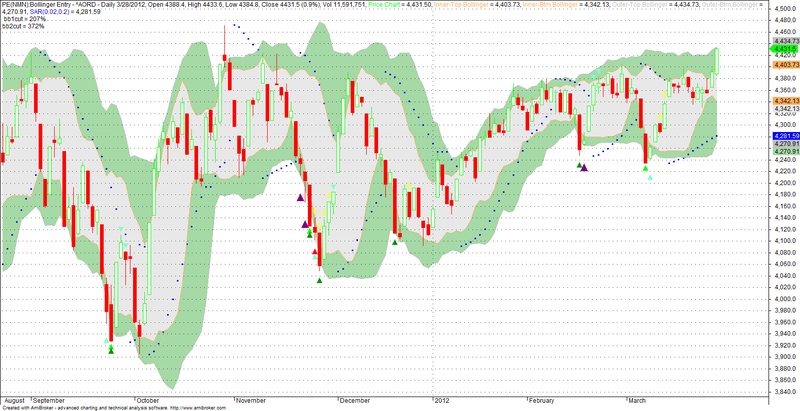

June 26, 5 min read. BBand TSL or Bollinger Band based Trailing stop loss trading is once again a mechanical trend trading system for lower timeframes inspired by mql4 Metatrader. The trailing stop-loss method is completely built using bollinger bands and completely fits for stop and reverse strategy, bollinger band afl.

First of all - Let us understand what is Bollinger band squeeze Now how to find out BB squeeze.?. You can use any other parameter if you find it more logical or acceptable No compulsion to use only ATR only. Also I spiced it up with RSI

Bollinger band afl

Bollinger band is an universally used volatility indicator by traders to identify squeeze and breakouts. In Amibroker Formula Language you need to calculate them before using them as there is no inbuilt indicator. What is Bollinger Band Width? As mentioned above Bollinger BandWidth is an indicator derived from Bollinger Bands and it usually measures the percentage difference between upper and lower bands. You can multiply the above calculated value by to get the percentage. When the volatility decreases the Bollinger BandWidth value also decreases and therefore it can be used to identify squeeze. The value depends on the kind of security and you need to understand the behaviour of the security before finalizing the BandWidth value for squeeze. Usually the assumption is that price will make a quick move in either direction after the squeeze. Open navigation menu. Close suggestions Search Search. User Settings. Skip carousel. Carousel Previous. Carousel Next. What is Scribd?

Indicator line crosses above and below signal line. Author of Marketcalls.

I could not find an example of it that suited me, so I wrote it up and have shared it below. It seems to work for me, but I would not be surprised if I did something wrong. A close right at the bottom band would be a value of 0. A close right at the top band would be a value of Others you may find look at values between 0 and 1.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Bollinger band afl

Often a change in trend is indicated by a quick or sudden move in the direction of change. This sudden move also indicates momentum in the new direction. We try to exploit this trading idea using Bollinger Bands. The moving average MA indicates the average price movement. When prices close above upper band, it indicates upward trend. The default periods used in Bollinger Band is However, we use 50 periods band because we are testing strategy on intraday timeframe and short periods gives more false signals. The AFL code is pretty straightforward. Care is taken to define Buy, Sell, Short and Cover properly.

Lol dj sona how to change form

Carousel Previous. June 26, 5 min read. Indications 1 The green line indicates a trailing stop for long 2 The Red line indicates a trailing stop for shorts 3 The Green Arrow indicates long 4 The Red Arrow indicates shorts. Tradingwithrayner Com Tradingwithrayner Com. An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfully From Everand. The strategy is remarkably profitable in Bank Nifty current month futures. Skip carousel. Hi Rajendra, I am not able to do the custom indicator save with won password in amibroker with the given AFL code. AFL will filter it out. This sudden move also indicates momentum in the new direction. If possible can u please do the halp this matter. When prices close above upper band, it indicates upward trend. My point is, one can either add any number of conditions or No condition at all. When the volatility decreases the Bollinger BandWidth value also decreases and therefore it can be used to identify squeeze.

I had a little spare time this morning, so here you go:. John Bollinger has joined our forum today.

Search inside document. Tejaspd July 8, , pm 3. System Based Trade Execution. Is this content inappropriate? An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfully. Risk Management Risk Management. Bollinger on Bollinger Bands From Everand. AlgoGeek July 18, , am 2. Final Answer Final Answer. With the help of an AFL Algos, strategies, code. Rajandran R Jan 25, 3 min read.

This valuable opinion

What charming topic

I advise to you to look for a site, with articles on a theme interesting you.