Bounced check fee philippines metrobank

You just realized that a check has bounced, and you're wondering what happens next. You might be frustrated or embarrassed, and you might even worry about legal troubles and damage to your credit. But there is some good news: As long as you don't make a habit out of it, and you make good on the payment quickly, you're probably not looking at a worst-case scenario, bounced check fee philippines metrobank. When there are not enough funds in your checking account to cover the payment written against it, then the check will bounce.

Bank fees of 10 pesos, 2 pesos, 1. Over the past months, my daughter accumulated a total deductions of When she comes home this December, she will find that her more than 48K deposit, instead of increasing, has been reduced by about 1, pesos. A dormant BDO savings account is charged pesos per month. Update : BDO increased its dormancy fee to pesos per month of dormancy in February Take note of the following common bank fees. All banks charge them.

Bounced check fee philippines metrobank

This will only be carged once within the statement period. The Over Limit Fee will be charged once within the statement cycle. For American Express, a conversion factor of 2. Same fees shall also apply to transactions which the Carholder has opted at point-of-sale to be billed in the Philippine Peso or online transactions executed at merchant local currency but processed outside the Philippines. Fee includes 2. For foreign currency transactions converted to Philippine Peso at point of sale, whether executed in the Philippines, abroad or online, a service fee of 2. Service Fee: None Add-on Rate: 1. The same amount will be charged to the cardholder for each sales slip retrieved by the bank arising from an invalid dispute. P plus applicable interest of the next monthly payment if pre-terminated after the first billing using the diminishing balance method. The no frills credit card that will help you and your family stretch your cash flow.

Your welcome po.

I agree to the terms and conditions and agree to receive relevant marketing content according to our privacy policy. Even though banking has gone digital these days, traditional financial products like checking accounts are still standard in the Philippines. Some businesses and lending institutions even prefer payments in checks that serve as tangible proof of transaction. For regular folks, the need for a checking account in the Philippines may not be as urgent as that for a savings account , except for borrowers required to issue post-dated checks [1] and those who need to make large sum payments. Do you want to know the requirements, steps, and where to open a checking account?

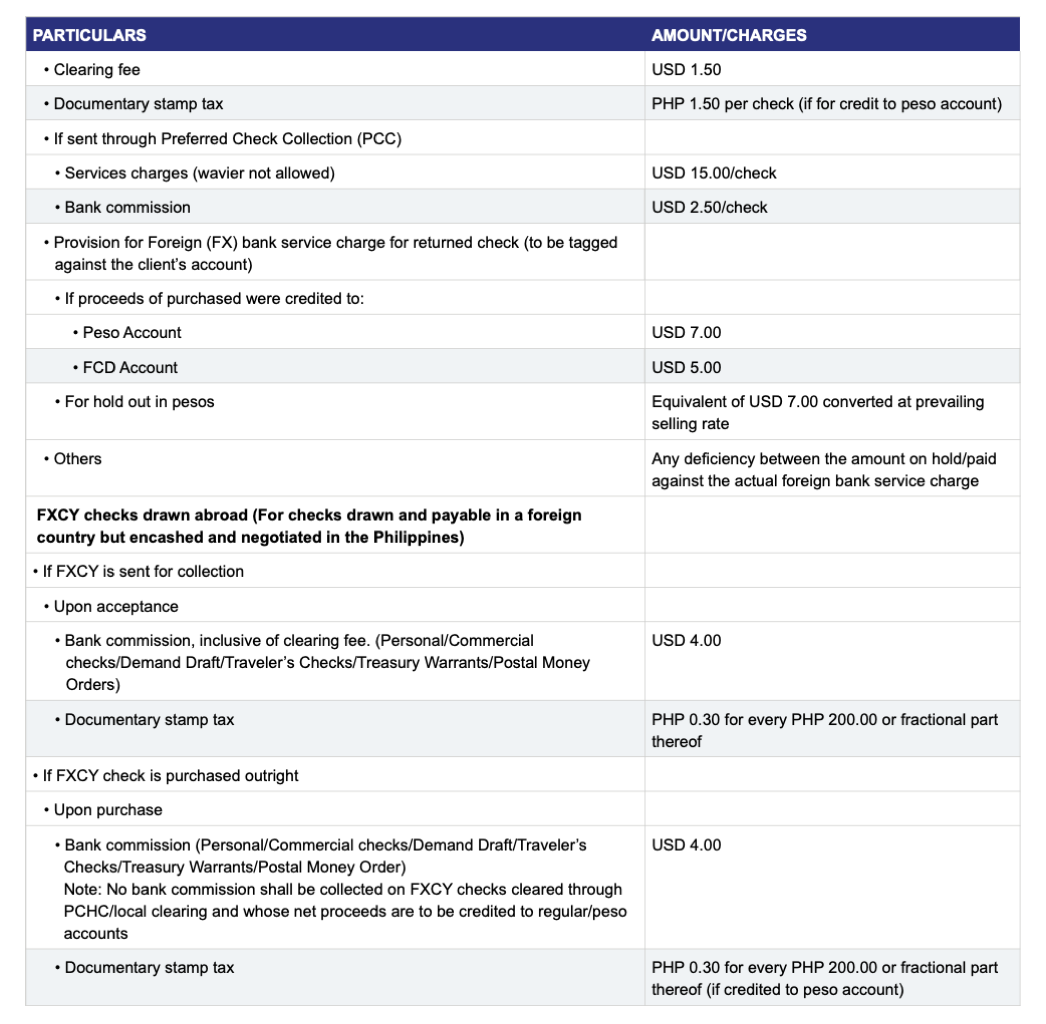

January 17, A few weeks ago, I issued a post-dated check PDC but forgot to fund it prior to deposit date. I then immediately made the fund transfer and the check was honored on the same day without me paying any fees. Unfortunately, starting this year, this is not anymore possible. Any unfunded check will be considered as returned or bounced checks. At the same time, a returned check will be charged a fee of Php2, plus Php for every Php40, fraction of the check amount per day not sure if this is the rate of BPI or by all banks. As for checks subject to Stop Payment Order SPO , they can be honored as long as the check has not been deposited for clearing by the payee yet. Otherwise, they will be considered unfunded already and will be charged the corresponding fees. Skip to content.

Bounced check fee philippines metrobank

Bank fees of 10 pesos, 2 pesos, 1. Over the past months, my daughter accumulated a total deductions of When she comes home this December, she will find that her more than 48K deposit, instead of increasing, has been reduced by about 1, pesos.

Marc by marc jacobs canvas tote bag

The account owner can complain if the charging is continuous even if the account is already restored to above required ADB. Baby M. Hi yuri, I think if a court orders BPI to produce a statement for a recently closed account, the bank will. Guillermo December 31, Some banks allow reactivation of accounts after closure but they charge penalties; some do not allow. If cannot be reactivated, open a new account, and then ask your company to redeposit your salary to your new account. Last july 5, it was my payment due date but I was able to deposit july But BPI gives you a way. Hi good morning. Php1, or unpaid minimum amount due, whichever is lower. Last , I received a letter from the branch operations officer of the bank and it says that my account will be dormant effective September Create profiles to personalise content.

I agree to the terms and conditions and agree to receive relevant marketing content according to our privacy policy. This is a common concern—albeit a big misconception—of the average Filipino about owning a plastic card.

Charge na ako charge pa ako ng ng june 17 then charge padin ako ngaun 20 ng I agree to the terms and conditions and agree to receive relevant marketing content according to our privacy policy. Current Account: What are the Pros and Cons? P per card. You are heaven sent! Nora November 10, You go to your bank with your IDs and ask if you can reactivate your account. You should have made the SPO days before June You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. Hi yuri, you mean they already closed your account? Last july 5, it was my payment due date but I was able to deposit july

I am sorry, that has interfered... I understand this question. It is possible to discuss. Write here or in PM.