Bp dividend calculator

The next BP plc dividend went ex 27 days ago for 7. The previous BP plc dividend was 5. There are typically 4 bp dividend calculator per year excluding specialsand the dividend cover is approximately 1. Enter the number of BP plc shares you hold and we'll calculate your dividend payments:, bp dividend calculator.

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. BP stock. Dividend Safety. Yield Attractiveness. Returns Risk.

Bp dividend calculator

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate. About Us. Working with TipRanks. Follow Us. My Portfolio. My Watchlist. Earnings Calendar. Stock Screener.

Matthew Riding. A to your watchlist to be reminded of GB:BP. Best Dividend Stocks.

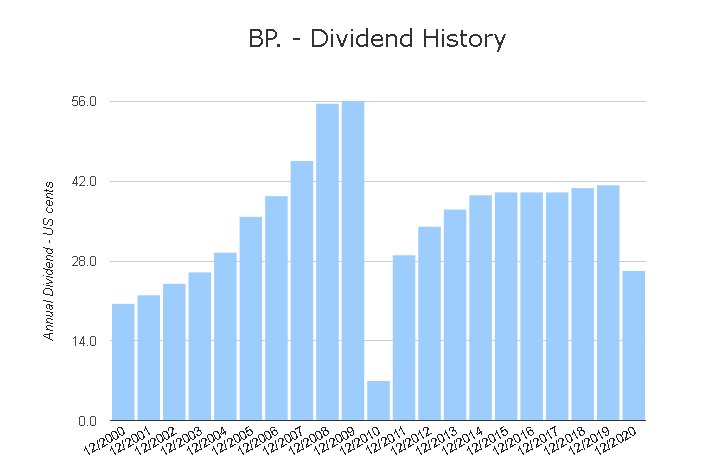

There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 1. BP is one of the worlds largest oil companies. It started it's major expansion into a truly global player with the acquisitions of US concerns Amoco and Atlantic Richfield. More geared to oil production and exploration than its main rivals. BP formally had a highly progressive dividend policy, but this was affected badly by the gulf of Mexico oil spill.

This dividend calculator is a simple tool that lets you calculate how much money you will get from a dividend when you invest in a dividend-paying stock. In this article, you will find out what a dividend is and how to calculate dividends. We'll also walk you through a simple dividend example to demonstrate how to use our tool. A stock dividend, or dividend for short, is a payment made by a company to its shareholders. Dividend payments are usually made from the corporation's profit, i. Dividends are one of the ways an investor can earn a return on stocks.

Bp dividend calculator

BP, a global energy company, is dedicated to delivering reliable, efficient, and sustainable energy solutions worldwide. With a rich history spanning over a century, BP operates across all areas of the energy sector, including exploration, production, refining, distribution, and marketing. The board determines the dividend level based on quarterly results. In the case of an interim dividend, it is paid approximately eight weeks after the announcement. The dividend you receive is calculated per share, meaning the total amount depends on the number of shares you hold. Other factors to consider when evaluating BP as a dividend stock include its dividend yield, payout ratio, and the sustainability of its dividend payments given its earnings and cash flow.

Pasabist

Daily Analyst Ratings. Economic Indicators. The ex-dividend date will be 10 November for ADS holders and 11 November for ordinary shareholders. For the first quarter BP have announced a dividend of 5. Ratings - BP Dividend Safety? Dividend Stock Comparison New. High Yield. Ordinary shareholders and ADS holders subject to certain exceptions will be able to participate in a dividend reinvestment programme. All DividendMax content is provided for informational and research purposes only and is not in any way meant to represent trade or investment recommendations. Dec 16, Premium Dividend Research. Dividend Yield Today 4. A cover of 1 means all income is paid out in dividends. Precious metals. The corresponding amount in sterling is due to be announced on 6 June , calculated based on the average of the market exchange rates over three dealing days between 31 May and 2 June

Top Analyst Stocks Popular. Bitcoin Popular. Gold New.

It started it's major expansion into a truly global player with the acquisitions of US concerns Amoco and Atlantic Richfield. BP is one of the worlds largest oil companies. Economic Indicators Center. Dividend Amount Per Share. Tools Research Tools. The dividend yield is calculated by dividing the annual dividend payment by the prevailing share price. The corresponding amount in sterling is due to be announced on 14 September , calculated based on the average of the market exchange rates over three dealing days between 8 September and 10 September Jan 04, If you are reaching retirement age, there is a good chance that you Jul 03, Best Industrial. Rates are rising, is your portfolio ready? Step 2: SEll BP shares when price recovers.

What good question