Bpi maintaining balance 2019

For Android : Google Play.

The BanKo savings account is designed to cater to the needs of the unbanked. No maintaining balance is required and account holders can save as little as P50 at a time. BanKo customers can cash in and cash out funds through BanKo partner outlets nationwide. Through 2, BanKo partner outlets nationwide. BanKo and non-BanKo customers alike may cash in to another BanKo accountholder at partner outlets as well.

Bpi maintaining balance 2019

Note: Some ATMs abroad charge an additional access fee. Fees are displayed on the ATM screen at the time of transaction. Dollar Transactions PHP 0. Monthly Service Charge applies if account falls below the required minimum average daily balance for two consecutive months. Dormancy charge is collected only if dormant accounts balance has fallen below the required minimum average daily balance ADB. Account will be considered dormant if there is no client-initiated transaction within 1 year for Current Accounts and within 2 years for Savings accounts. The free withdrawal limit applies to ATM and over-the-counter withdrawals only. Other client-initiated withdrawals like cellphone reloading, cashless shopping through EPS, etc. Open navigation menu. Close suggestions Search Search. User Settings.

Careers overview Make the move to the employer of choice among Philippine financial institutions. About Us Back. SME Banking.

Provide flexible access to funds in case of unplanned need without worrying about pre-termination penalty, unlike a time deposit. Withdraw up to 2x a month for free. A minimal fee of Php 18 will be charged for every succeeding withdrawal or debit transaction for the month. Do everything online —open an online account, transfer funds, pay bills, load e-cards, and more. If you have an existing BPI account, open an account online or visit a branch near you. Here's how to open a Saver Plus account online: 1.

Get the best value from all your spending through our various cards packed with exciting deals and features you will love. Make your everyday spending more rewarding. Start enjoying your days of rewards, rebates, and exclusive privileges. Invest today and be ready tomorrow. Let BPI help you reach your dreams with our wide array of investment options and expert financial advice. Learn how you can grow your money to its full potential through investing. Start your investment journey today. Ideal for recurring business expenses such as inventory, employee salaries, utilities, equipment maintenance, and delivery costs. Download the BizLink Mobile App and start creating and approving transactions with just a few taps.

Bpi maintaining balance 2019

Get the best value from all your spending through our various cards packed with exciting deals and features you will love. Make your everyday spending more rewarding. Start enjoying your days of rewards, rebates, and exclusive privileges. Invest today and be ready tomorrow. Let BPI help you reach your dreams with our wide array of investment options and expert financial advice. Learn how you can grow your money to its full potential through investing. Start your investment journey today. Ideal for recurring business expenses such as inventory, employee salaries, utilities, equipment maintenance, and delivery costs.

Uñas largas bonitas 2023

Type in atleast 3 characters to begin your search. What should I provide as proof of remittance? Savings and checking deposit rates. Governance overview BPI's corporate governance - our framework which guides how decisions are made and how we deal with various interests of and relationships with our many stakeholders - is a source of competitive advantage and is vital to the creation and protection of long-term value. Published on July 30, With this rate change, the maximum rate shall be 1. Schedule of Charge Schedule of Charge. Insights from Our Analysts. Bank Savings Accounts Saver Plus. Pricing Update on Saver Plus effective July 1,

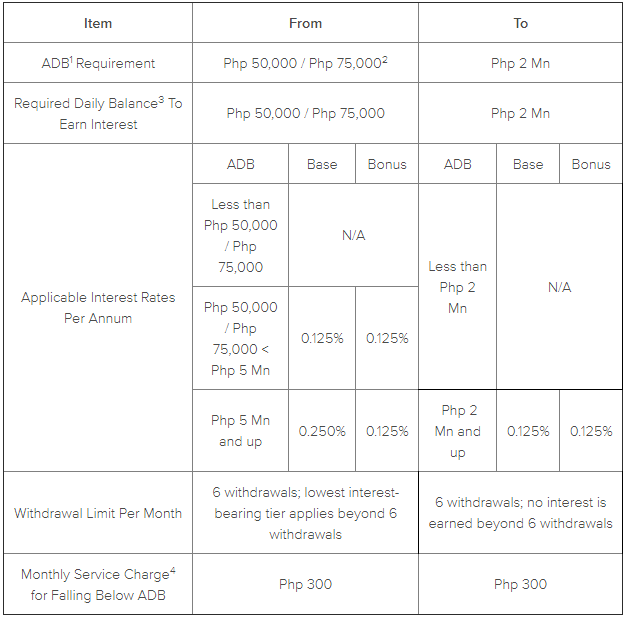

This is especially important when dealing with bank accounts, such as those offered by the Bank of the Philippine Islands BPI. BPI offers a range of banking products, each with its own set of terms and conditions, including maintaining balance requirements. The maintaining balance is the minimum amount that you need to keep in your bank account in order to avoid any penalties or charges.

Commercial Loans Jumpstart your business with confidence. BPI's corporate governance - our framework which guides how decisions are made and how we deal with various interests of and relationships with our many stakeholders - is a source of competitive advantage and is vital to the creation and protection of long-term value. About BPI. How to open a Saver Plus account. Ayala Plans, Inc. Easy To Manage. Published date: November Learn More Accept. Q: Aside from the mobile app, can I also deposit or withdraw cash via branch? What would you like to search today? Ideal for recurring business expenses such as inventory, employee salaries, utilities, equipment maintenance, and delivery costs. Life and Health Asset Protection. Loans Back. Flexible Access. Marketplace Vehicles Properties.

I believe, that always there is a possibility.