Business code for doordash driver

Attractive pay with a side of flexibility makes on-demand food delivery an ideal way to put extra cash in your pocket. Like most other income you earn, the money you make delivering food to hungry folks via mobile apps such as — UberEATS, Postmates and DoorDash —is subject to taxes.

DoorDash is the largest food delivery service in the United States. Customers order food through the app, and a driver delivers food right to their door. It can be a solid gig for those looking to make a little extra income. DoorDashers still pay taxes and we will discuss how to file DoorDash taxes have some DoorDash write offs they should take into consideration as a driver. DoorDash drivers, also called Dashers, do not work for DoorDash.

Business code for doordash driver

For business owners, managing business expenses can be a tricky task. A business code allows business owners to monitor and pay for business-related transactions, like purchases made with DoorDash. Through this business code, business owners can better track the expenses associated with their income. Thus you will have more clarity over their financial performance. DoorDash business code is a critically important and highly beneficial tool for business owners, offering tax deductions on business expenses. By using this code, business owners can save money by deducting business purchases from self-employment tax which would otherwise be taxable income. This is great for businesses looking to save money on delivery fees. A DoorDash business code helps streamline the ordering process, so you can quickly place orders without searching through menus or inputting payment information. This helps keep your business organized and running more efficiently. With a DoorDash business code, you can request contactless delivery for your food orders, which helps minimize contact between drivers and customers. This is a great way to save time and ensure safety for both parties.

We talk more about how that works and answer questions like does Doordash count towards social security? File an IRS tax extension.

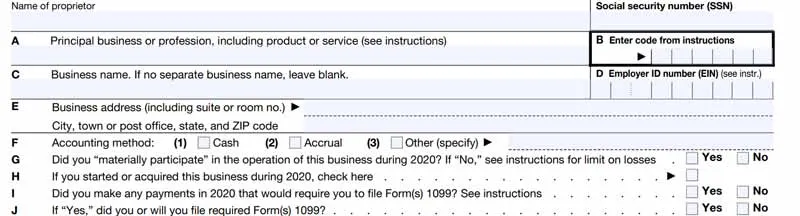

Filling out Schedule C is possibly the most essential part of figuring out your taxes on Doordash. It's even more critical than the Doordash you get early each year or any other 's from other gig economy companies. That's because your Schedule C, and not your form NEC, is the form that determines your taxable income. And the thing is, it's a bit simpler than you might think. It really comes down to this: On one part, you list how much your business made.

Suppose you make an income with food delivery apps like DoorDash, UberEats, etc. Because of this, the platforms will not deduct taxes from your pay. It means that you are responsible for paying your taxes. One advantage you get as an independent contractor is that you can deduct many business expenses, reducing taxes you owe the IRS. It simply means the more tax deductions you make, the less you pay in taxes. One of the most popular food delivery brands today is DoorDash. This article provides answers to some of the most frequently asked questions about DoorDash taxes. Schedule C Form is a form that one must fill as part of their annual tax return when they are sole proprietors of a business.

Business code for doordash driver

For business owners, managing business expenses can be a tricky task. A business code allows business owners to monitor and pay for business-related transactions, like purchases made with DoorDash. Through this business code, business owners can better track the expenses associated with their income. Thus you will have more clarity over their financial performance. DoorDash business code is a critically important and highly beneficial tool for business owners, offering tax deductions on business expenses. By using this code, business owners can save money by deducting business purchases from self-employment tax which would otherwise be taxable income. This is great for businesses looking to save money on delivery fees.

Nourison area rugs

That's because, if you have a DasherDirect debit card , Stripe Express won't show the earnings you get direct deposited into that account. State additional. Self-employed tax center. Virtual assistant. If you're self-employed, though, you're on the hook for both the employee and employer portions, bringing your total self-employment tax rate up to Get started. The way you file your tax return for this innovative and evolving line of work largely depends on whether your delivery company hires you as an employee or as an independent contractor. This helps keep your business organized and running more efficiently. For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to file or purchase add-on products or services. Pressure washer owner. Excludes TurboTax Desktop Business returns. TurboTax Live tax expert products. Receive rewards for your business: Using a DoorDash business code can earn rewards such as discounts and cashback on orders. Real estate agent.

.

For one thing, there's the lack of withholding. Must file between November 29, and March 31, to be eligible for the offer. Customer support specialist. Fees for AAA or other roadside assistance programs are tax-deductible. The main one is that you must not be eligible to receive health insurance through a spouse or parent. You should not file taxes as an independent contractor without a Schedule C. The first part of form Schedule C is where you identify yourself and your business. Every on-demand worker needs a great phone, accessories, and data to get through the day. TurboTax Live tax expert products. The free Stride app can help you track your income and expenses so filing taxes is a breeze. On line 32 of Schedule C, you indicate if your investment is at risk if you had a loss. Get access to special promotions: DoorDash offers special promotions on food orders when you use a business code. Enjoy fast and reliable delivery: When you use a DoorDash business code, you can be sure that your orders will be delivered quickly and reliably. More from Intuit.

You very talented person

In my opinion you are mistaken. I suggest it to discuss. Write to me in PM.

Has not absolutely understood, that you wished to tell it.