Can i retire at 60 with 500k australia

Retirement is a major life milestone that should be a cause for celebration.

But, is it enough to retire on? Although you can retire at any age, most people in Australia will retire somewhere between the ages of 55 and 65 , however the retirement income you can achieve may be vastly different depending on when you do. You should be mindful that you cannot access your superannuation until age The benefit of waiting until age 60 to retire is that you have access to your super and all income and investment earnings can be received tax-free if held within a superannuation income stream. Furthermore, once you attain age 67, you could be eligible for Age Pension payments, which will supplement your income and mean you are less reliant on your own investments. To put all of this into context, research concludes that the income required for a modest retirement income and a comfortable retirement income is as follows:.

Can i retire at 60 with 500k australia

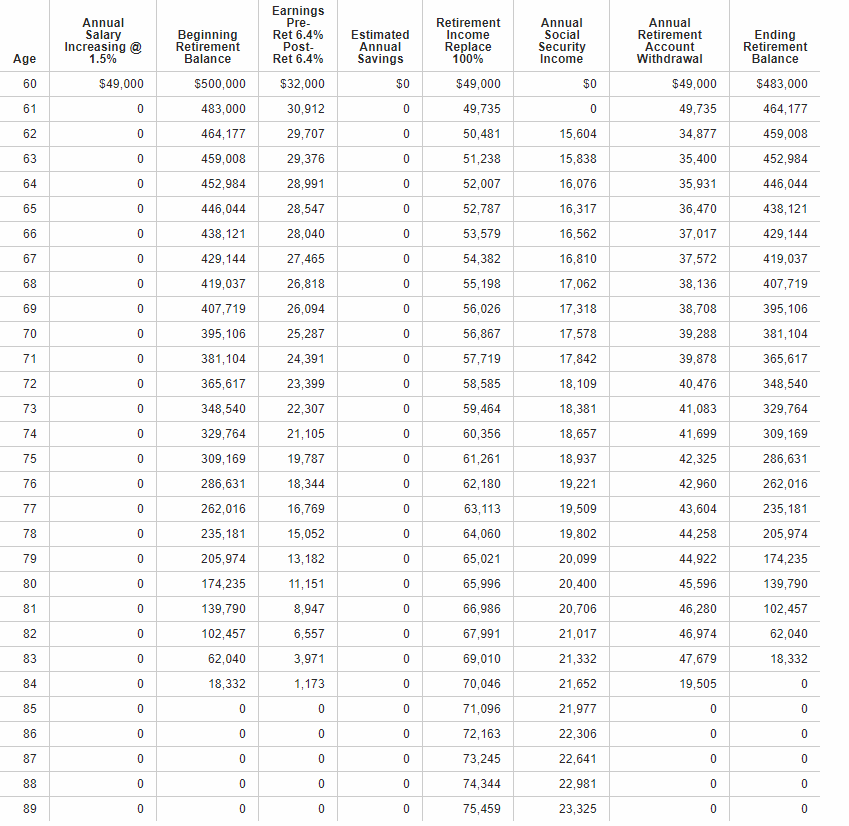

Do you see yourself retiring at 60? The amount of super you need to retire at 60 depends on how much retirement income you would like and how long you would like it to last. The table below details how much super you need based on a range of retirement income levels and longevity of income. The calculations were performed using the MoneySmart retirement planner calculator and all associated disclaimers and assumptions. Hopefully this table gives you a good idea of how much super you need to retire at age Obviously to achieve these retirement income goals, you need a suitable and robust investment strategy that has a high probability of achieving the required long-term returns. There are also plenty of retirement planning strategies available that can help build your super quicker and provide you with a retirement income for longer. Retiring at 60 is the first time you are able to get unrestricted, tax-free access to your super; so there really is no better time to retire. Knowing how much super you need to retire can give you a good idea of what to work towards and how much you need to save between now and then. Hey, you might already be there! I can already hear a few of your grumbling ….

Any additional income you receive can go toward your living expenses, reducing the amount of retirement income you need to generate from your investments. In addition to salary sacrificing I have also made after-tax contributions to superannuation whenever possible.

Preparing for retirement is akin to embarking on a well-planned expedition. It entails thoughtful strategies, a keen awareness of your financial objectives, and a clear understanding of the steps needed to ensure your retirement is worry-free. As you stand on the threshold of this life-changing phase, you're bound to wonder: "What's the magic number for a comfortable retirement in Australia? How can I safeguard my financial future? This extensive guide is your companion on the journey through the intricacies of retirement planning in Australia. Let's set off together on this adventure, unraveling complexities and simplifying the path to retirement planning in the Land Down Under. A 'modest retirement' in Australia secures financial security, covering essential needs like housing, food, and healthcare.

Retirement is a major life milestone that should be a cause for celebration. But careful planning is needed to ensure a financially comfortable retirement. Taking steps today to help support yourself tomorrow can pay off when it comes time to exit the workforce. To ensure a comfortable living standard in retirement, you need to calculate how much you'll need to retire and then plan how to get there. Our seven steps to retirement planning in Australia will take you through everything you need to do.

Can i retire at 60 with 500k australia

But, is it enough to retire on? Although you can retire at any age, most people in Australia will retire somewhere between the ages of 55 and 65 , however the retirement income you can achieve may be vastly different depending on when you do. You should be mindful that you cannot access your superannuation until age The benefit of waiting until age 60 to retire is that you have access to your super and all income and investment earnings can be received tax-free if held within a superannuation income stream. Furthermore, once you attain age 67, you could be eligible for Age Pension payments, which will supplement your income and mean you are less reliant on your own investments. To put all of this into context, research concludes that the income required for a modest retirement income and a comfortable retirement income is as follows:.

Capital one finance

United Kingdom. In Australia, on average, guys usually enjoy their retirement until about 83, while ladies often have a few more years, typically around I will use that balance to fund my lifestyle until my pension eligibility age—which I hope will not change from the current age of 67—at which point I will be able to take a combination of super and pension as long as I continue to meet eligibility requirements for a part pension. How much super should I have at my age? How our retirement calculators can help. Findex co-CEO Matt Games commented on those concerning figures, saying: This paints the picture that most Aussies have adopted a 'kick it down the road' mentality to retirement. I can already hear a few of your grumbling …. What are your retirement lifestyle expectations? While not extravagant, it safeguards against financial stress and grants the freedom to enjoy life, creating a foundation for a fulfilling retirement journey. For those born on or after 1 January , the retirement age will move to 67 years as of 1 July The age pension is designed to provide income support to older Australians who need it.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

Many people utilise the services of a financial advisor to provide financial advice regarding their retirement strategy. Related: Switch or Stay? Government benefits like the Age Pension can significantly impact the amount you need for retirement. Your financial situation is unique and the products and services we review may not be right for your circumstances. How I Plan to Retire at 60 As mentioned above I have been salary sacrificing small amounts over the past 15 years. When you can retire depends not just on when you want to leave the workforce but when you can afford to. The average life expectancy for an Australian woman is 85 years, and for an Australian man 81 years. Where to go for more We hope that the figures in the tables below will get you thinking. Ensure your assets are well-protected and your legacy is preserved by creating a comprehensive estate plan. I will use that balance to fund my lifestyle until my pension eligibility age—which I hope will not change from the current age of 67—at which point I will be able to take a combination of super and pension as long as I continue to meet eligibility requirements for a part pension. It all comes down to how high your expenses are in retirement. Age pension Depending on your circumstances and assets, you could be eligible for a full or part age pension , or alternatively, may not be eligible for government assistance at all. Begin by setting clear retirement goals, calculating expected expenses, factoring in non-superannuation income, and accounting for inflation and life expectancy. We have assumed an annual 2. Consult a financial advisor or use retirement calculators for precise figures, adjusting your plan as needed to ensure financial security throughout retirement.

It agree, your idea is brilliant