Cibc heloc

Opens in a new window. Learn more about the mortgage offer, cibc heloc. A line of credit to help conquer your goals.

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free. Learn more about tax-free savings accounts. Meet with us Opens in a new window.

Cibc heloc

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free. Learn more about tax-free savings accounts. Meet with us Opens in a new window. Life Moments. How To. Tools and Calculators. Learn more.

Discover Our Cards. With a mortgage, your involvement doesn't have to extend beyond the monthly payments. Let's get started.

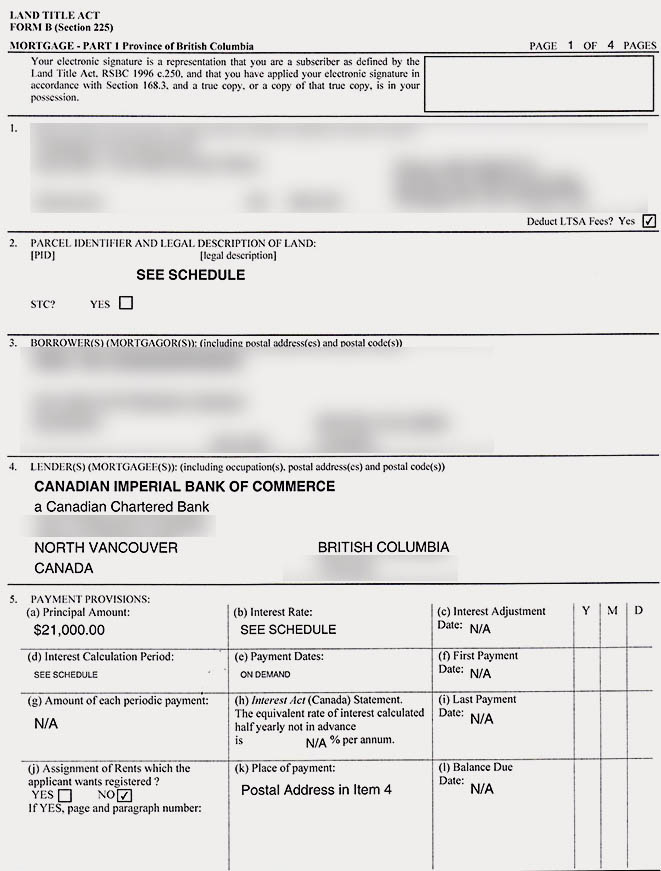

Compare current mortgage rates across the Big 5 Banks and top Canadian lenders. Take 2 minutes to answer a few questions and discover the lowest rates available to you. Best fixed rate in Canada. Jamie David , Sr. Director of Marketing and Mortgages. A home equity line of credit HELOC is a revolving line of credit that allows you to borrow the equity in your home at a much lower interest rate than a traditional line of credit.

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free. Learn more about tax-free savings accounts. Meet with us Opens in a new window.

Cibc heloc

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free. Learn more about tax-free savings accounts. Meet with us Opens in a new window. Life Moments. How To.

Lesbians tribbing black

Tools and Calculators. Opens in a new window. Travel Insurance. The benefits of flexible mortgage payments. Start saving today, tax-free. Offers and Bundles. Get expert help with accounts, loans, investments and more. For example, for many parents in Canada, obtaining a HELOC is a useful vehicle to assist their children in making a down payment on a first home. Start saving today, tax-free. How To. This means that once you're approved for a line of credit, you can use the funds as you need them and repay the line of credit with interest only on the funds you use. Travel Insurance. Discover Our Cards. Ways to Bank. When to consider a home equity line of credit You can use your home equity line of credit to make a variety of purchases.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Use the left and right arrows to move between carousel items. Meet with us Opens a new window. Meet with us Opens in a new window. Sub-divide lines: It is sometimes possible to divide up your HELOC into smaller portions through different sub-accounts. Tools and Advice. A grand total of 25, residential properties were sold across Canada in January, representing a 3. Bank Accounts Bank Accounts. Find out how much you may qualify to borrow through a mortgage or line of credit. Step 1 of 3 Where's your property located? This means that once you're approved for a line of credit, you can use the funds as you need them and repay the line of credit with interest only on the funds you use. Arrow keys or space bar to move among menu items or open a sub-menu. You can combine a line of credit and a mortgage, in order to consolidate all of your personal credit under one simple, low-interest and secured borrowing solution, which can be adjusted to meet your changing needs. Tools and Calculators. An example of where this may be used is if you wanted to draw out equity to invest in the stock market. Offers and Bundles.

It is a pity, that now I can not express - I am late for a meeting. But I will return - I will necessarily write that I think.