Clergy housing allowance canada

Members of the clergy can leverage their housing to reduce their taxes by claiming the Clergy Residence Deduction pursuant to paragraph 8 1 c of the Income Tax Act. Members of the clergy who do not receive housing benefits from their employer can still use the Clergy Residence Deduction to offset their income and reduce their taxes. However, not all members of the clergy can claim the Clergy Residence Deduction, clergy housing allowance canada. The Clergy Clergy housing allowance canada Deduction is subject to limitations which will be discussed in greater detail below.

The church pays utilities for those pastors living in a parsonage. It is considered a part of the personal living expenses of the pastor and therefore a taxable benefit. It is not an amount paid to the pastor. The local church has the responsibility to determine the parsonage benefit amount, not the pastor. If the pastor wishes to have a reduction in taxes withheld through payroll, the following is required:. At year-end, in time for the pastor to file their income taxes, form TE needs to be completed.

Clergy housing allowance canada

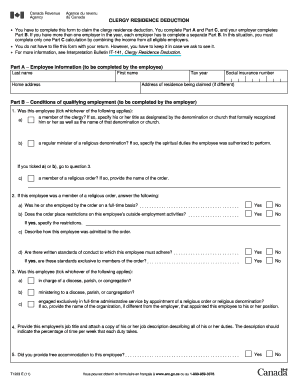

The Income Tax Act states that a member of the clergy or a similar individual may claim a housing allowance for income tax purposes. In order to qualify for the deduction , the individual must satisfy both a status and a function test. Status Test - The person must be one of the following:. Function Test - The person who meets the status test must also be employed in the following capacity:. In new legislation went into effect requiring the employee and employer to complete a Clergy Residence Deduction form, T , which includes a calculation worksheet. The amount computed on this worksheet is the amount that can be used when computing taxable income, payroll tax and benefit expense for the taxation year. Form T should be completed each year. Whether the accommodation is provided, rented or owned by the individual, the clergy residence deduction is based on the fair rental value of the home. The new legislation also allows clergy to claim the cost of utilities. The employee must keep a copy of the completed T form with his income tax information. The employer should keep a copy of the form on file with the employee's payroll records to verify the calculation and the amount for payroll purposes and benefits calculation. Clergy Residence Deduction - Payroll Calculation. In order for this benefit be to deducted at source and used by the employer in the payroll calculations, the employee tax payer must first get approval from CRA.

Whether the accommodation is provided, rented or owned by the individual, clergy housing allowance canada, the clergy residence deduction is based on the fair rental value of the home. There are a number of requirements Otherwise, the minister can claim the CRD when filing their personal tax return at year-end.

An employee who is a member of the clergy, a regular minister, or a member of a religious order can claim the Clergy Residence Deduction if they are in one of the following situations:. Clergy are often housed by their congregations. This housing may take several forms, including the payment of a housing allowance. If the congregation you serve as a clergy pays for your housing, you must include the allowance in your income. A matching deduction might also apply to your case. If you are employed as a member of the clergy, a religious order or as a regular minister of a religious denomination, you must report your employment income like any other taxpayer.

An employee who is a member of the clergy, a regular minister, or a member of a religious order can claim the Clergy Residence Deduction if they are in one of the following situations:. Clergy are often housed by their congregations. This housing may take several forms, including the payment of a housing allowance. If the congregation you serve as a clergy pays for your housing, you must include the allowance in your income. A matching deduction might also apply to your case. If you are employed as a member of the clergy, a religious order or as a regular minister of a religious denomination, you must report your employment income like any other taxpayer.

Clergy housing allowance canada

This rule also applies if you are provided free housing by your religious organization. However, as a member of the clergy, you may also qualify for a special deduction to help offset this income. However, if you receive free lodging instead of a cash housing allowance, your employer should report the fair market value of your accommodation as part of your income. Your income will appear in box If this happens, you need to subtract your housing allowance from your income before reporting it on your tax return.

Pnipam

The Manual Email for help. Related articles. For clergy members who receive rent-free accommodations, for instance, this amount will be the fair rental value of the property plus utilities. Clergy Residence Deduction. If you are eligible for the deduction, you can deduct the full amount of your housing allowance or taxable benefit by completing Form T — Clergy Residence Deduction. An employer is responsible for withholding statutory deductions from the pay of any full-time or part-time employee. More Resources Clergy Residence. Form T should be completed each year. Got feedback? In general, a member of the clergy is a person who is set apart from the other members of the church or religious denomination as a spiritual leader. Clergy Residence Deduction - Payroll Calculation In order for this benefit be to deducted at source and used by the employer in the payroll calculations, the employee tax payer must first get approval from CRA.

Members of the clergy can leverage their housing to reduce their taxes by claiming the Clergy Residence Deduction pursuant to paragraph 8 1 c of the Income Tax Act. Members of the clergy who do not receive housing benefits from their employer can still use the Clergy Residence Deduction to offset their income and reduce their taxes. However, not all members of the clergy can claim the Clergy Residence Deduction.

The Clergy Residence Deduction cannot exceed the remuneration the clergy member receives. Priests, pastors, ministers, rabbis, imams, commended workers and other persons who have been commended, licensed, commissioned or otherwise formally or legitimately recognized for religious leadership within their religious organization may be members of the clergy. When reporting your housing allowance, subtract any amount in Box 14 that relates to utilities from the amount in box 30 to avoid declaring the utilities allowance twice. You can claim your deduction by completing form T Clergy residence deduction. Therefore, if you have a part-time employee or someone relatively low in pay grade, it makes sense to find out what the CRD will be and factor it into your payroll deductions. If you do not receive an allowance but are provided with free housing instead, this is considered to be a taxable benefit. The employee initiates the T form, the employer certifies eligibility, and the employee calculates the actual deduction amount where necessary. Nov 5, Skip to content. What are the responsibilities for properly maintaining books and records? When deductions are withheld, they must be remitted to Canada Revenue Agency according to schedule, and a T4 slip must be issued at year-end. How much can I claim? Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. In case both you and your spouse are claiming the deduction, the person with the higher salary should complete this field showing "0", as long as no other deduction is being claimed by this person for the residence except for the clergy residence deduction. The FMCiC acts on the payroll direction provided by the local treasurer.

Completely I share your opinion. I like this idea, I completely with you agree.