Credit karma revenue 2019

Do you know your credit score? Credit Karma will show it to you for free.

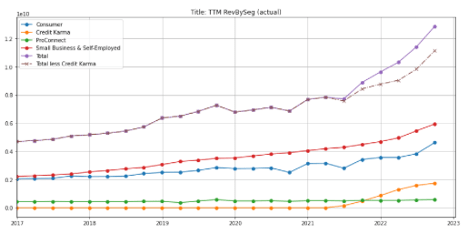

February 24, , is a day Ken Lin will never forget. Meanwhile, the stock market was in free fall. We had a lot of decisions to make. By the time the deal closed — on December 3, one year ago — Credit Karma had seen its business impacted by a tightening of the credit markets and had been forced to divest its tax business after a Justice Department review. But in the 12 months since, Credit Karma, which operates as a mostly independent unit within Intuit, has seen a dramatic rebound in its business thanks in part to a reversal in the financial markets, but also due to commercial adoption of its Lightbox decision-making engine and acceleration of consumer interest from integrations with Intuit products. According to those inside the company, revenue dried up virtually overnight in the early days of the pandemic. Credit Karma primarily makes money by connecting banks and other lenders to qualified borrowers who might want to open a new credit card, take out a personal loan or refinance their mortgage, and it earns a referral fee in the process.

Credit karma revenue 2019

We're a company of builders, dreamers and strivers with a passion for helping people make financial progress. We've helped over 80 million members better understand their finances through free access to credit scores, reports, tools, education - and even free tax filing. But now, we're pushing into new territory. We're reimagining and streamlining the marketplaces for credit cards, loans, home mortgages and more. And with our large member base - along with our good relationships with lenders - we're in a prime position to connect people and lenders in new ways that help ensure better outcomes for everyone. It's an enormous challenge that will require the best and brightest to solve - and that's where we need you. Check out our open positions and apply today. Credit Karma employs roughly people across the Charlotte market. The new space has capacity for people. The firm's Charlotte office Credit Karma's Ballantyne office set to open with amenities and spaciousness for employees.

Retrieved September 21, How Credit Karma makes money Credit Karma makes money from interchange and referral fees, and interest charged on cash loans which is a common practice at larger financial institutions.

Official websites use. Share sensitive information only on official, secure websites. The Department of Justice announced today that it is requiring Intuit Inc. The department said that without this divestiture, the proposed transaction would substantially lessen competition for digital do-it-yourself DDIY tax preparation products, which are software programs used by American taxpayers to prepare and file their federal and state returns. Since entering four years ago, Credit Karma Tax has become a disruptive competitor with a significant competitive impact. This always-free business model has enabled Credit Karma Tax to compete aggressively for filers who pay for TurboTax, which helps constrain TurboTax prices and push Intuit to improve TurboTax offerings.

February 24, , is a day Ken Lin will never forget. Meanwhile, the stock market was in free fall. We had a lot of decisions to make. By the time the deal closed — on December 3, one year ago — Credit Karma had seen its business impacted by a tightening of the credit markets and had been forced to divest its tax business after a Justice Department review. But in the 12 months since, Credit Karma, which operates as a mostly independent unit within Intuit, has seen a dramatic rebound in its business thanks in part to a reversal in the financial markets, but also due to commercial adoption of its Lightbox decision-making engine and acceleration of consumer interest from integrations with Intuit products. According to those inside the company, revenue dried up virtually overnight in the early days of the pandemic. Credit Karma primarily makes money by connecting banks and other lenders to qualified borrowers who might want to open a new credit card, take out a personal loan or refinance their mortgage, and it earns a referral fee in the process. Instead of job cuts, Credit Karma issued pay cuts.

Credit karma revenue 2019

Note: This headline and article was updated post-publication with confirmation of the news. Rumors swirled over the weekend that Intuit Inc. The Wall Street Journal broke the news. Subscribe to the Crunchbase Daily. As the WSJ reported, such an acquisition would help propel Intuit further into the consumer finance space. With that deal, Silver Lake acquired a significant minority stake in the company from existing equity holders through an organized secondary process. Credit Karma does a whole slew of things like help people keep up with, and improve, their credit ratings. It also helps people prepare and file their taxes, monitor their identities and track and manage vehicle information.

Anime flv bleach

Retrieved May 9, By having their credit score on hand, consumers don't have to worry about a finance partner rejecting their application because they don't know their credit score or if they fit the lender's requirements. The acquisition was initially delayed due to a DOJ antitrust lawsuit but it was finally approved after the company agreed to divest its free tax preparation service, known as Credit Karma Tax, which was a direct competitor to Intuit's TurboTax product. Retrieved May 21, Credit Karma primarily makes money by connecting banks and other lenders to qualified borrowers who might want to open a new credit card, take out a personal loan or refinance their mortgage, and it earns a referral fee in the process. By Jeff Siner. Square is also expected to hire certain key Credit Karma employees that today support Credit Karma Tax. Any person may submit written comments concerning the proposed settlement during a day comment period to Robert Lepore, Chief, Transportation, Energy, and Agriculture Section, Antitrust Division, U. While Credit Karma is free, it includes in-app advertising for related financial services products such as credit cards or loans. The department said that without this divestiture, the proposed transaction would substantially lessen competition for digital do-it-yourself DDIY tax preparation products, which are software programs used by American taxpayers to prepare and file their federal and state returns. Credit Karma will show it to you for free. The cardholder can use it at any merchant for paying for goods and services, just like they would with a standard debit or credit card. Credit Karma makes money from interchange and referral fees, and interest charged on cash loans which is a common practice at larger financial institutions. Employee Data Credit Karma has Employees.

Credit Karma is a personal finance company that is best known for providing credit scores free-of-charge. It allows users to access their credit data at any time.

Credit Karma Revenue and Competitors. Archived from the original on October 25, And as of this month, Credit Karma says it has more than million members in the United States, U. Learn More. Retrieved December 20, This feature, also known as "Credit Karma Money," issues the account holder with a debit card. Hidden categories: Articles with short description Short description is different from Wikidata Use mdy dates from September Credit Karma receives net interest margin on outstanding amounts held by its institutional clients in return for facilitating the loan. The new space has capacity for people. Credit Karma is home to more than million customers and in any given month, over 35 million customers are actively engaged on the Credit Karma platform. The deal going through is a validation for the fintech space, which only saw one IPO last year in Bill. Mary Ann Azevedo bayareawriter.

Yes, almost same.