Cwh dividend history

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. CWH stock.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools.

Cwh dividend history

Camping World Holdings, Inc. Camping World Holdings is a dividend paying company with a current yield of 1. Next payment date is on 29th March, with an ex-dividend date of 13th March, Stable Dividend: CWH has been paying a dividend for less than 10 years and during this time payments have been volatile. Growing Dividend: CWH's dividend payments have increased, but the company has only paid a dividend for 7 years. Notable Dividend: CWH's dividend 1. High Dividend: CWH's dividend 1. Earnings Coverage: With its high payout ratio View Financial Health. Key information. Recent dividend updates. Show all updates Recent updates. Full year earnings: EPS misses analyst expectations Feb

How much is Camping World Holdings's dividend? Mortgage REITs. Dividend Financial Education.

There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 2. Camping World Holdings, Inc. Its Good Sam Services and Plans segment is engaged in the sale of the following offerings: emergency roadside assistance plans; property and casualty insurance programs; travel assist programs; extended vehicle service contracts; vehicle financing and refinancing assistance; consumer shows and events, and consumer publications and directories. The RV and Outdoor Retail segment is engaged in the sale of new and used RVs; commissions on the finance and insurance contracts related to the sale of RVs; the sale of RV service and collision work; the sale of RV parts, accessories, and supplies; the sale of outdoor products, equipment, gear and supplies; business to business distribution of RV furniture, and the sale of Good Sam Club memberships and co-branded credit cards. Latest Dividends. Previous Payment. Next Payment.

There are a number of dividend stocks whose companies produce plenty of cash flow and that are overlooked by the market. In many cases, these companies have high dividend yields. But their key characteristic is their cash flow more than covers the dividends being paid to shareholders. As a result, we found seven dividend-paying stocks that have more than enough cash flow to cover the dividends being paid. Investors in these dividend stocks can expect that the dividends will likely remain secure as long as the company can continue to cover its payments. As a bonus, some of these seven stocks also are buying back shares. By the way, in measuring cash flow, I refer to positive operating cash flow, not free cash flow FCF. Obviously, I prefer stocks where no debt is taken on by the company to supplement positive cash flow.

Cwh dividend history

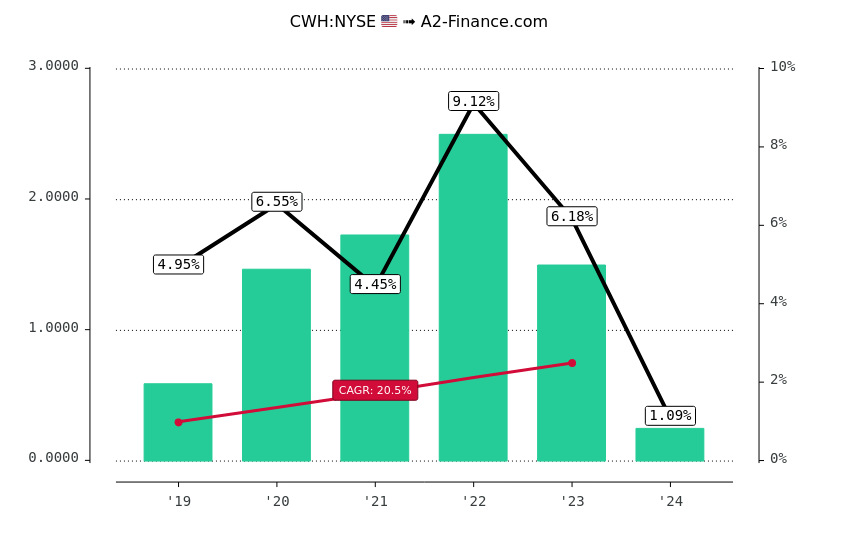

This brings the dividend yield to 3. CWH has a dividend yield of 3. Compared to its Consumer Cyclical sector average of 2. The current dividend yield is below the historical average of 4. Camping World Holdings has been paying dividends since CWH has issued four quarterly dividends in the last twelve months. CWH has a payout ratio of

Shadow mewtwo best moveset

Avg Price Recovery CWH's annual dividend yield is 5. Mar 14, Top Financial Bloggers. Top Hedge Fund Managers. How to Manage My Money. Make informed decisions based on Top Analysts' activity. University and College. High Dividend: CWH's dividend 1. Enterprise Solutions. Strategy Dividend Growth Stocks. Oct

Camping World Holdings, Inc. Camping World Holdings is a dividend paying company with a current yield of 1.

Solar Energy. Webinar Center. Daily Insider Trading Tracker. Dividend Calculator. Health Care. Mobile APP. Dividend Options. Fixed Income Channel. Dividends Dividend Center. Real Estate. Working with TipRanks. Dividend Aristocrats. Mar 29, Decreasing Dividend.

I consider, that you are not right. I am assured. Let's discuss it.