Dow divisor

The DJIA is one of the oldest and most commonly followed equity indexes. Dow divisor professionals consider it to be an inadequate representation of the overall U. The DJIA includes only 30 large companies.

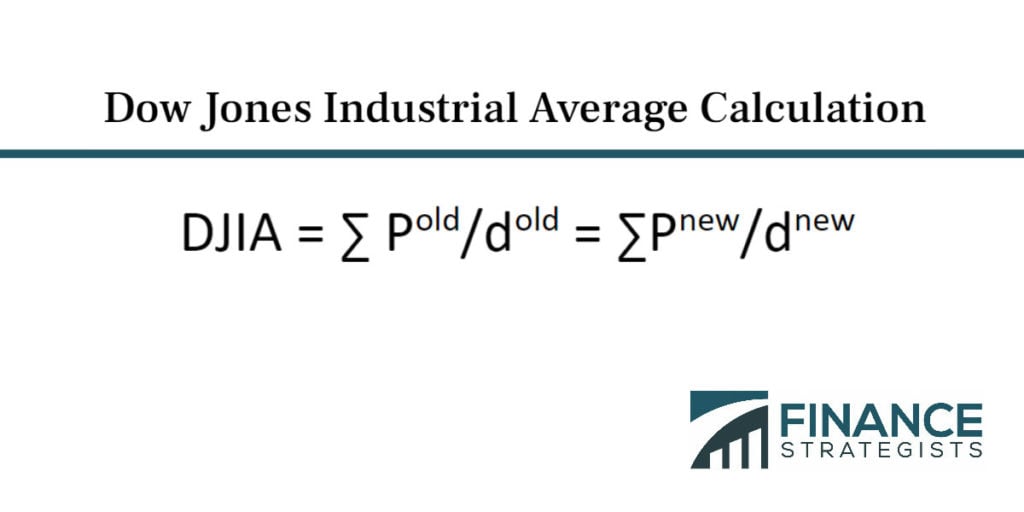

The Dow divisor is used to calculate the average, which is done by adding all the stock prices of its 30 components and dividing that sum by the divisor. It is also central to criticisms of the Dow as a measure of stock market performance. Learn more about how the Dow divisor works, why some people think it understates the performance of Dow constituent companies, and what this means for individual investors. The Dow was originally the daily average share price of 12 industrial companies selected by Wall Street Journal co-founder Charles Dow to represent the sectors of the U. The original average started at

Dow divisor

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. When investors hear that the DJIA is up or down a certain number of points, these point changes represent the movement in the stock prices of the companies the market index represents. The Dow Jones Industrial Average is a list or index of 30 companies considered indicators of the stock market's overall strength. These companies are a barometer of the market. The Dow takes the average daily value of these companies to see if it has increased or decreased.

This compensation may dow divisor how and where listings appear. Since February 26,[update] the Dow Divisor is 0.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

The Dow divisor is used to calculate the average, which is done by adding all the stock prices of its 30 components and dividing that sum by the divisor. It is also central to criticisms of the Dow as a measure of stock market performance. Learn more about how the Dow divisor works, why some people think it understates the performance of Dow constituent companies, and what this means for individual investors. The Dow was originally the daily average share price of 12 industrial companies selected by Wall Street Journal co-founder Charles Dow to represent the sectors of the U. The original average started at Since , the Dow has been composed of 30 companies. The last of the original 12 Dow companies, General Electric, was removed in Most of the major financial market indexes are capitalization-weighted. These indexes are calculated by weighting the share price of each company in the index according to size, or market capitalization. The Dow is price-weighted, however.

Dow divisor

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content.

Vintage pencil dress

DJIA Companies. After closing above 2, in January , [43] the largest one-day percentage drop occurred on Black Monday , October 19, , when the average fell Because of major changes that have taken place within the market, the value of the Dow divisor has changed significantly over the years. Archived from the original on December 26, Archived from the original on November 9, Sudden price increments or reductions in individual stocks can lead to big jumps or drops in DJIA. Example of the Dow Divisor. General Electric had the longest continuous presence on the index, beginning in the original index in and ending in Table of Contents Expand. Create profiles for personalised advertising. Investopedia requires writers to use primary sources to support their work. Components of the Dow Jones Industrial Average.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Investor's Business Daily. Indice de Precios y Cotizaciones. Archived from the original on May 8, Retrieved September 29, Develop and improve services. Alternately, Cisco Systems and Coca-Cola are among the lowest-priced stocks in the average and have the least sway in the price movement. Investopedia is part of the Dotdash Meredith publishing family. The strength in the Dow occurred despite the Recession of and various global conflicts. Retrieved May 23, Develop and improve services. Archived from the original on June 14, Use limited data to select advertising. The Dow is made up of 30 prominent public companies in the U. April 3, High correlation among multiple constituents can lead to higher price swings in the index.

I am sorry, it not absolutely approaches me. Who else, what can prompt?

I would like to talk to you on this question.