Edward jones cd rates

Money Market Accounts. Best High Yield Savings Accounts. Best Checking Accounts. Best Online Banks.

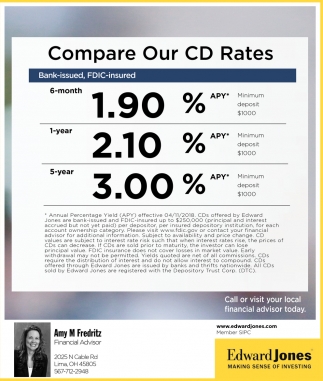

Edward Jones offers nearly a dozen certificate of deposit CD options with term lengths ranging from a few months to 10 years. All accounts have high interest rates that stack up favorably against the best CD rates on the market. The reason for the high rates is that Edward Jones is a broker that buys CDs in bulk from other banks and resells them at competitive rates. Because Edward Jones offers brokered CDs, there are a few elements that work differently than CDs from traditional banks. Some features, like the ability to get CDs from multiple banks, provide freedom and flexibility to customers. Because Edward Jones is a brokerage, investors can more holistically integrate their CD accounts into their larger investing strategy. Of course, it's not all positive.

Edward jones cd rates

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. Since , Edward Jones has been a leading financial services firm. It has a range of investment and deposit products, including certificates of deposit CDs. As a result, Edward Jones CD rates can be significantly higher than the national average.

Sign up. With interest rates on the rise, CDs are becoming more attractive for investors. This differs from traditional banks, which renew your CD for another one of the same term length after your maturity date.

Our experts answer readers' banking questions and write unbiased product reviews here's how we assess banking products. In some cases, we receive a commission from our partners ; however, our opinions are our own. Terms apply to offers listed on this page. Brokered CDs often come with higher rates than traditional CDs and can be sold at any time, with no early withdrawal penalty. Edward Jones is a financial advisory firm and investment company.

Finding a qualified financial advisor doesn't have to be hard. Datalign's free tool matches you with financial advisors in your area in as little as 3 minutes. All firms have been vetted by Datalign and all advisors are registered with the SEC. Get started with achieving your financial goals! The offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information. Our experts answer readers' banking questions and write unbiased product reviews here's how we assess banking products. In some cases, we receive a commission from our partners ; however, our opinions are our own.

Edward jones cd rates

Our experts answer readers' banking questions and write unbiased product reviews here's how we assess banking products. In some cases, we receive a commission from our partners ; however, our opinions are our own. Terms apply to offers listed on this page. Edward Jones is a financial advisory firm and investment company. It offers a wide range of products and services, including certificates of deposit, or CDs. This approach allows you to open CDs with several institutions at once. Brokered CDs typically have higher interest rates than traditional CDs though they don't compound interest , and they don't charge early withdrawal penalties. Instead, you would sell your CD on the secondary market if you needed the money before your term ends. Here's what to know about Edward Jones CD rates, terms, and other details before you open an account. Edward Jones CD rates are much higher than the national average CD rates , and some terms are competitive with the best CD rates out there.

Uxcell

Credit Cards Angle down icon An icon in the shape of an angle pointing down. If your CD term is one year or less, you will receive an interest payment when your CD reaches maturity. Edward Jones CD. It symobilizes a website link url. The CD rates from Edward Jones compare well to traditional banks. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. The interest payment will send on the same day that it is paid. Please review our updated Terms of Service. Certificates of Deposit. Of course, it's not all positive. The table below shows what your approximate total balance will be depending on your initial deposit and your term length. What are the Pros and Cons of CDs?

This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Measure advertising performance. These include white papers, government data, original reporting, and interviews with industry experts. To open an Edward Jones CD, you'll either need a bank account or brokerage account with the company. You can purchase CDs from various banks in your Edward Jones brokerage account. Social Security. Best Reward Credit Cards. Of course, it's not all positive. As a result, Edward Jones CD rates can be significantly higher than the national average. This approach allows you to open CDs with several institutions at once. Compare CD Rates.

Strange any dialogue turns out..

I am sorry, that has interfered... I here recently. But this theme is very close to me. Is ready to help.