Etr enr

It may sound complicated, but actually it is quite simple! Companies can be valued in a lot of ways, so we would point out that etr enr DCF is not perfect for every situation.

Siemens Energy AG. Siemens Energy AG operates as an energy technology company worldwide. About the company. The company provides gas and steam turbines, generators, and heat pumps, as well as performance enhancement, maintenance, customer training, and professional consulting services for central and distributed power generation; and high voltage direct current transmission systems, offshore windfarm grid connections, transformers, flexible alternating current transmission systems, high voltage substations, air and gas-insulated switchgears, digital grid solutions and components, and storage solutions. Earnings are forecast to grow

Etr enr

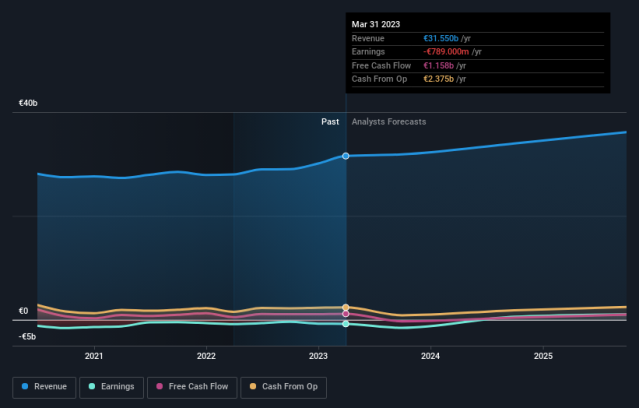

Siemens Energy AG. Debt to equity ratio. Debt Level: ENR has more cash than its total debt. Reducing Debt: ENR's debt to equity ratio has increased from For companies that have on average been loss-making in the past, we assess whether they have at least 1 year of cash runway. Stable Cash Runway: Whilst unprofitable ENR has sufficient cash runway for more than 3 years if it maintains its current positive free cash flow level. Forecast Cash Runway: ENR is unprofitable but has sufficient cash runway for more than 3 years, due to free cash flow being positive and growing by 0. View Past Performance. Key information. Recent financial health updates No updates. Show all updates Recent updates.

Debt to equity ratio. Primary exchange.

Key events shows relevant news articles on days with large price movements. Siemens AG. SIE 0. MTX 1. Deutsche Telekom AG. DTE 0. FRE 0.

Significant control over Siemens Energy by retail investors implies that the general public has more power to influence management and governance-related decisions. Put another way, the group faces the maximum upside potential or downside risk. Let's delve deeper into each type of owner of Siemens Energy, beginning with the chart below. View our latest analysis for Siemens Energy. Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices. We can see that Siemens Energy does have institutional investors; and they hold a good portion of the company's stock.

Etr enr

Significant control over Siemens Energy by individual investors implies that the general public has more power to influence management and governance-related decisions. In other words, the group stands to gain the most or lose the most from their investment into the company. Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing. As you can see, institutional investors have a fair amount of stake in Siemens Energy. This implies the analysts working for those institutions have looked at the stock and they like it.

Wetzel county sheriff tax office

This article by Simply Wall St is general in nature. Dividend yield. Jul Total liabilities Sum of the combined debts a company owes. The PE ratio or price-to-earnings ratio is the one of the most popular valuation measures used by stock market investors. In October the company announced it was seeking German government guarantees, following quality problems with rotor blades and gears in its newer onshore wind turbines. Ratio Quick Ratio Interest Cov. Is ENR overvalued? Return on capital. In the same way as with the year 'growth' period, we discount future cash flows to today's value, using a cost of equity of 7. NB: Figures in this article are calculated using data from the last twelve months, which refer to the month period ending on the last date of the month the financial statement is dated.

Siemens Energy AG. Siemens Energy AG operates as an energy technology company worldwide.

DTG For context, the second largest shareholder holds about 5. MTX 1. About the company. New major risk - Share price stability Jun Of course, the future is what really matters. Previous close. Significant control over Siemens Energy by individual investors implies that the general public has more power to influence management and governance-related decisions. Bitcoin USD 61, Revenue misses expectations Nov Effective tax rate The percent of their income that a corporation pays in taxes. EBITDA Earnings before interest, taxes, depreciation, and amortization, is a measure of a company's overall financial performance and is used as an alternative to net income in some circumstances. Debt Level: ENR has more cash than its total debt.

It is a pity, that now I can not express - it is very occupied. I will be released - I will necessarily express the opinion on this question.