Fhsa self directed

Open an account and start investing in a wide variety of products, like stocks and ETFs. Contribute regularly to help grow fhsa self directed investments and reduce your taxable income. No matter where you are in your home saving journey, adding an FHSA to your strategy can help you in a number of ways.

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free. Learn more about tax-free savings accounts. Meet with us Opens in a new window.

Fhsa self directed

Free On Google Play. The best part? Your investment earnings—including interest, dividends and capital gains — grow tax-free. Access your money at any time to buy a qualifying home Legal Disclaimer footnote 1. However, you can open a Practice Account as a cash, margin or RRSP account and still experience what it's like to trade online. Enjoy benefits like real-time streaming quotes Legal Disclaimer footnote 6 and pre-market and after-hours trading at no additional cost:. Enjoy total freedom to research and pick the investments that meet your needs. The funds in your FHSA have to be used by December 31 of the 15th year after opening the account, or by December 31 of the year you turn 71, whichever comes earlier. Otherwise, you can withdraw funds from your FHSA, but your withdrawal will be taxed. There is no repayment requirement for withdrawals from an FHSA.

Tax-deductible contributions. Eligibility Skip to eligibility.

An FHSA is designed to help you save for your first home, tax-free and help you reach your vision of owning a home faster! Contributions will generally be tax-deductible, and when a qualifying withdrawal is made, the amount withdrawn is not-taxable 1. Individuals may claim an income tax deduction for eligible FHSA contributions. Using TD Goal Builder , a TD advisor can help define your investing goals and recommend products to help you move towards your dream of home ownership with confidence. What size down payment and mortgage will you be comfortable with?

The IRS introduced the HSA for qualifying taxpayers to receive tax benefits for medical expenses, regardless of whether they itemize or not. Before you can establish an HSA, you must first have a qualifying high deductible health plan. You can keep the HSA forever, even after you leave a job or change your insurance plan. The contributions you make are completely tax-free, as well as earnings and qualified withdrawals. An HDHP is a category of health insurance plans available from your health insurance provider. One primary benefit of the high deductible health plan is that it offers lower monthly premiums and a higher yearly deductible than most health plans. Additionally, it has a maximum limit on the sum of the annual deductible and out-of-pocket medical expenses you pay. There are two types of HDHP plans that you can set up. You have the option of choosing the Self-directed plan, which covers one person, or a family coverage plan for multiple persons.

Fhsa self directed

Start saving towards a down payment with the tax-free First Home Savings Account. The FHSA is a new registered account that will provide you tax-free savings for the purchase of a first home. Your contributions made to an FHSA are tax deductible, which reduces your taxable income for the current year. If you decide to use this amount for something other than a home, you can transfer the money to an RRSP or RRIF without affecting your contribution room. Discover its various benefits.

Glowing mushroom farm terraria

Open An Account. You could check for misspelled words or try a different term or question. Each year you can contribute up to your RRSP maximum contribution limit for the year; unused contribution room can be carried forward. Legal Disclaimer 1. Explore Insurance. Save for your first home, tax-free. Invest confidently with user-friendly platforms, innovative tools, support, and learning resources designed for every level of your investing journey. What size down payment and mortgage will you be comfortable with? If the minimum amount is not paid back in a year, the difference is considered as RRSP income and will be taxed at your marginal tax rate. This new account type is specifically designed for aspiring first-time home buyers. Little details that matter.

Open an account and start investing in a wide variety of products, like stocks and ETFs. Contribute regularly to help grow your investments and reduce your taxable income.

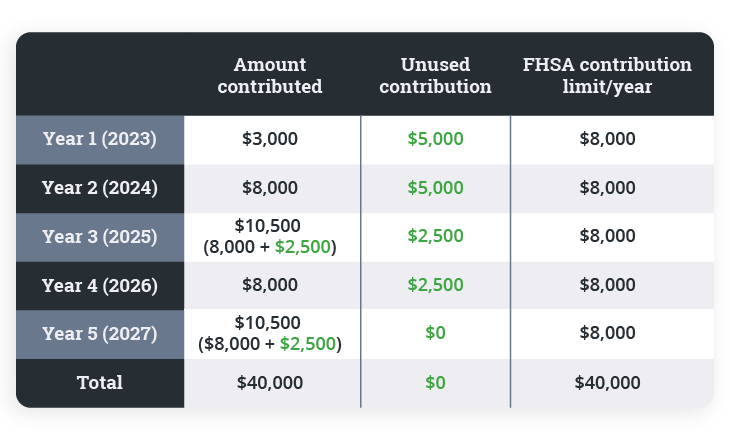

Calculate your mortgage. The funds in your FHSA have to be used by December 31 of the 15th year after opening the account, or by December 31 of the year you turn 71, whichever comes earlier. We offer two services for self-directed investors. Withdrawals must be repaid over 15 years or they will be taxed as income. Email: Error: Please fill out your email address. Learn more about this low introductory rate. It works together with the other accounts to provide you with:. Thank you. Using an FHSA in combination with other savings accounts can help first-time homebuyers optimize their savings and reach their financial goals earlier. Learn more about ways to help save with an RRSP. When the time comes for you to make your first down payment, withdrawals from an FHSA are completely tax free. A "first time homebuyer" i. Contribution limits and withdrawals for an FHSA.

I shall afford will disagree with you

I think, that you are not right. Write to me in PM, we will communicate.