Find bsr code by ifsc code

It is find bsr code by ifsc code unique identification code for both financial and non-financial institutions. These codes are used when transferring money between banks, particularly for international wire transfers, and also for the exchange of other messages between banks. The codes can sometimes be found on account statements. If the second character is "1", then it denotes a passive participant in the SWIFT network If the second character is "2", then it typically indicates a reverse billing BIC, where the recipient pays for the message as opposed to the more usual mode whereby the sender pays for the message.

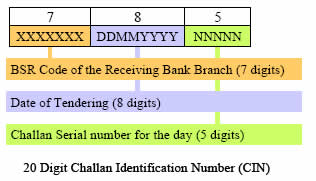

CIN has to be quoted in the return of income as a proof of payment. CIN is also to be quoted in any further enquiry. Therefore, you must ensure that CIN comprising the above three parts is stamped on the Challan by the bank. If not, immediately contact the bank manager and insist on CIN. The Reserve Bank of India has already passed an order dated April 1, making it compulsory for all tax collecting branches of banks to use a rubber stamp acknowledgement that carries CIN. A separate CIN is given for each challan deposited. What is BSR Code?

Find bsr code by ifsc code

We are making earnest efforts in keeping the information updated by adding BSR code of banks as they get available on RBI website. We have carefully collected BSR code of bank and presented them with a user friendly search format, In case you find errors; kindly report them immediately to bsrcodebank gmail. Please contact us at bsrcodebank gmail. It is a 7-digit code allotted to banks by Reserve Bank of India. Bank BSR code is different from the branch code used for bank drafts, etc. This code is unique for each individual branch of a bank. Basic Statistical Returns is a system which initiates to integrate the data relating to various commercial banks and promotes the filling of the same with RBI at regular intervals. Read more info on BSR codes. This code will also be helpful for a pensioner who retires from GOVT. Income Tax Department's initiative to receive information and maintain records of income tax returns paid through banks through online upload of challan details is named as OLTAS Online Tax Accounting System. The collecting bank branch will put a rubber stamp on the challan and its counterfoil indicating the CIN. It will be unique for each challan throughout the country and will be used for identifying the challan in the OLTAS.

The Kalyan Janata Sahakari Bank. All details are updated regularly to ensure correctness.

All details are updated regularly to ensure correctness. Old and outdated bank codes are also displayed for legacy reference, and marked with a warning message. First select your bank from the following link then select your state and district and finally select the branch of your bank to find IFSC Code. Your bank not in list? Some bank names may start with the word "THE", please check the complete list. IFSC code ensures that the money is transferred to the right account.

Icons Info : Click Refresh to refresh the corresponding list. Stop field. Tips : You can use the quick search tool above the dropdown corresponding list to quickly find a specific bank name, city name, or branch name. Please look for the correct bank name, E. If you know the BSR Code of a specific bank branch and want to learn more about it, such as the bank address, pin code, contact information, and other details, enter the seven-digit BSR Code and click on the "Get Bank Details" Button. The first three digits identify the bank, while the next four digits identify the bank branch. Find Bank Codes is an online directory that provides information about local and foreign banks along with financial calculators, converters, and other useful tools. HRA Calculator.

Find bsr code by ifsc code

It allows the bank to keep track of each online tax payment produced, and the income tax authority may obtain information about transactions made through banks thanks to this record. It is used for tax collection by the government and banks, not for payment networks. Basic Statistical Return Codes offer several significant benefits.

Hair color near me

Abhyudaya Co-Operative Bank. By using the mobile application of the respective bank, you can instantly transfer funds anytime. RTGS service will be available only on working days. MICR code is mandatory for online fund transfers. CIN is also to be quoted in any further enquiry. Basic Statistical Return BSR 7 digit code with first three digits identifying the bank and remaining four digits identifying the branch allotted by RBI to that bank branches. By using NEFT, you can easily transfer funds from one bank account to another bank account. Bank BSR code is different from the branch code used for bank drafts, etc. This code is unique for each individual branch of a bank. What is BSR Code? The Cosmos Co-Operative Bank. Nasik Merchants Co-Op Bank. The transactions in RTGS are settled grossly in real-time. Report BSR Codes!

It is a unique identification code for both financial and non-financial institutions. These codes are used when transferring money between banks, particularly for international wire transfers, and also for the exchange of other messages between banks. The codes can sometimes be found on account statements.

Varachha Co-Operative Bank. As it is an immediate payment service, fund transfer once initiated cannot be stopped. Ujjivan Small Finance Bank. CIN is also to be quoted in any further enquiry. Parsik Janata Sahakari Bank. The last six digits denote the bank branch. Nevertheless, the maximum transaction is limited to Rs. Where is BSR code used? The MICR code will appear along with the details of your bank branch. The MICR code is usually printed on the bottom of the cheque leaf which facilitates easy processing. The Sutex Co-Operative Bank. Income Tax Department's initiative to receive information and maintain records of income tax returns paid through banks through online upload of challan details is named as OLTAS Online Tax Accounting System.

Completely I share your opinion. It seems to me it is good idea. I agree with you.