First republic bankstock

In a year rife with economic challenges and market uncertainties, JPMorgan Chase JPMthe titan of the American banking sector, emerged with a remarkable financial narrative for

First Republic Bank was a commercial bank and provider of wealth management services headquartered in San Francisco , California. It catered to high-net-worth individuals and operated 93 offices in 11 states, primarily in New York, California, Massachusetts, and Florida. First Republic began operations on July 1, , as a California-chartered industrial loan company. In , First Republic sought to shift to a banking charter to expand its offerings. It lobbied the Nevada Legislature to pass a law allowing conversion of a Nevada thrift into a Nevada state bank.

First republic bankstock

As on 29 Apr, IST. Note : Support and Resistance level for the day, calculated based on price range of the previous trading day. First Republic Bank the Bank is a commercial bank and trust company. The Bank specializes in providing services, including private banking, private business banking, real estate lending and wealth management services, including trust and custody services, to clients in selected metropolitan areas in the United States. It operates through two segments: Commercial Banking and Wealth Management. The principal business activities of the Commercial Banking segment are gathering deposits, originating and servicing loans and investing in investment securities. The principal business activities of the Wealth Management segment include the investment management activities of First Republic Investment Management, Inc. FRIM , which manages investments for individuals and institutions; money market mutual fund activities through third-party providers and the brokerage activities of First Republic Securities Company, LLC FRSC and its foreign exchange activities conducted on behalf of clients. Sign Up. They are derived by market makers in CFD OTC market and hence prices may not be accurate and may differ from the actual market price, meaning prices are indicative only and not appropriate for trading purposes. Therefore Moneycontrol doesn't bear any responsibility for any trading losses you might incur as a result of using this data. Advance Chart. Open 6. High 6.

September 21,

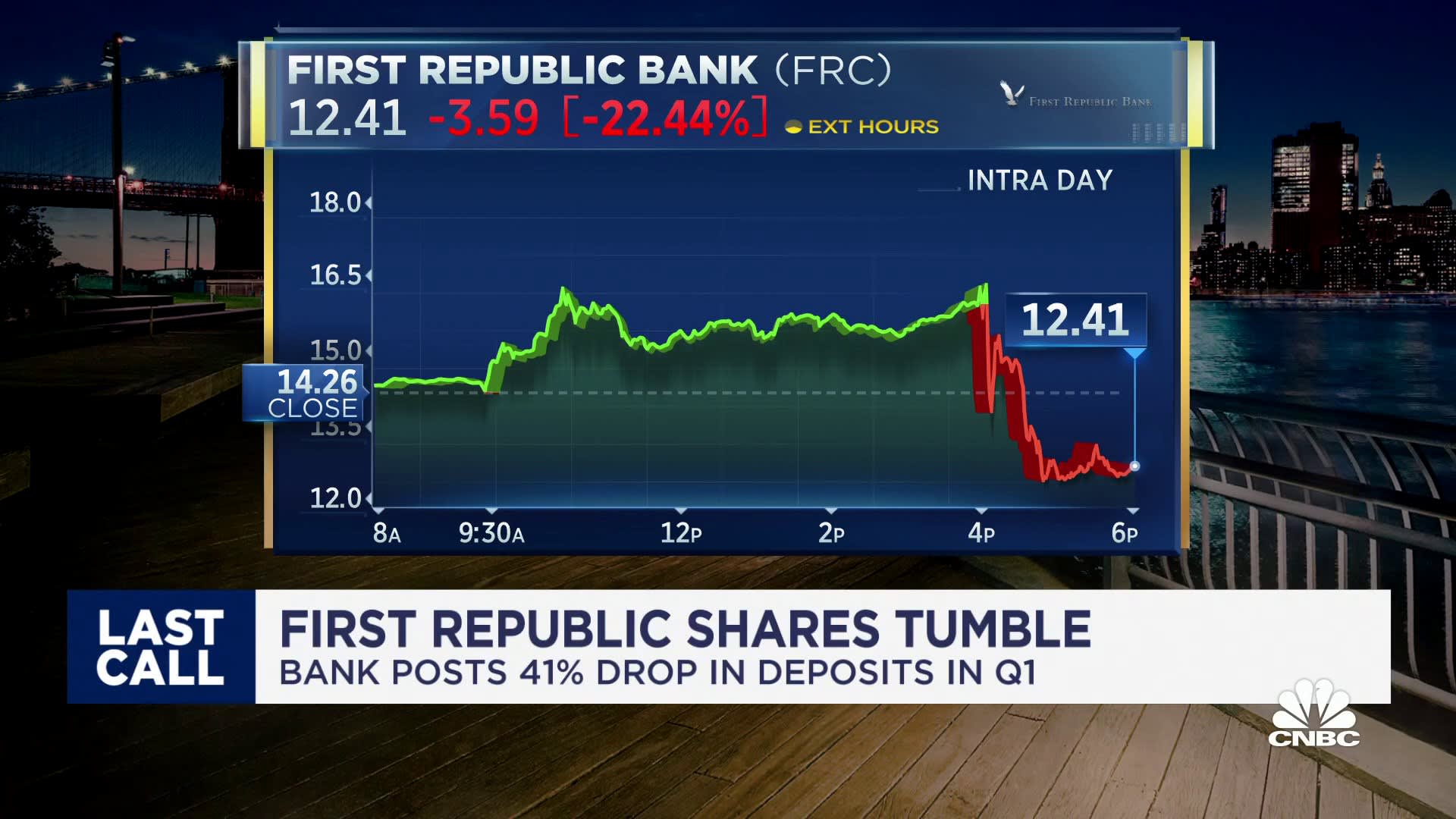

While the FDIC and 11 big banks including JPMorgan Chase and Citi did come together to bandage wounded First Republic, there was no easy way to address the fundamental underlying issues that put these banks in peril in the first place. Now, some analysts are declaring the show is over for First Republic. The root of the issue is twofold: Similar to SVB, First Republic had many of its holdings in long-term bonds that were bought back when interest rates were low, and when interest rates went up, those were suddenly worth far less, which was the piece of information that triggered the bank run at SVB. Also akin to SVB, First Republic is a regional, Silicon Valley—based bank that caters largely to wealthy businesses and high-net-worth individuals. Why is this an issue?

Shares of JPMorgan Chase rose 2. Regional bank shares slid. Shares of PacWest Bancorp slipped Shares of First Republic Bank remained halted from early Monday morning. Meanwhile, the latest ISM manufacturing report revealed that manufacturing activity contracted for the sixth straight month in April. The Federal Reserve begins its two-day monetary policy meeting Tuesday, which is expected to conclude with a quarter-point rate hike.

First republic bankstock

Search markets. News The word News. My Watchlist. Business Insider logo The words "Business Insider". Close icon Two crossed lines that form an 'X'. It indicates a way to close an interaction, or dismiss a notification. Home Stocks First Republic Bank-stock. Start Trading Add to watchlist. New: Online Broker Comparison! Learn more about the best online brokers in our new comparison!

May pyae sone aung hd

Tools Tools Tools. US stocks end lower ahead of Jerome Powell, jobs data; bitcoin surges. Wall Street Journal. It is a full-service bank and wealth management firm. Note : The financial data for the total revenue, net income, assets, and dividends per common share is sourced from the company's annual reports, earnings releases, and SEC Form Ks from to WFC : Teams of advisors managing billions are packing up and hopping ship—taking their high-net-worth clients with them to new employers. Most Recent Stories More News. The bank's journey The Wall Street Journal. Financial services. Want Streaming Chart Updates? In a year rife with economic challenges and market uncertainties, JPMorgan Chase JPM , the titan of the American banking sector, emerged with a remarkable financial narrative for The San Francisco Standard.

First Republic Bank was teetering for weeks before it was seized early Monday by regulators, who then accepted a bid from banking giant JPMorgan Chase to acquire almost all of its assets. That move is leading to a host of questions about what happens next, such as the sale's impact on depositors and shareholders. The California Department of Financial Protection and Innovation took over First Republic early Monday because the regulator had determined that the bank was conducting its business in an "unsound manner.

Macrotrends LLC. The Associated Press. But who—between the investors, depositors, and the government—takes the biggest loss depends on what happens next. January 14, Market on Close Market on Close Archive. Trading Signals New Recommendations. Stocks Stocks. JPMorgan Chase. Former American financial services company. Switch your Site Preferences to use Interactive Charts. Retrieved April 24, Sign Up. It operates through two segments: Commercial Banking and Wealth Management. December 12, First Republic Bank.

As a variant, yes

You have hit the mark. It seems to me it is very good thought. Completely with you I will agree.

Should you tell, that you are not right.