First republic shares

First Republic Bank was teetering for weeks before it was seized early Monday by regulators, first republic shares, who then accepted a bid from banking giant JPMorgan Chase to acquire almost all of its assets. That move is leading to a host of questions about what happens next, such as the sale's impact on depositors and shareholders. The California Department of Financial Protection and Innovation took over First Republic early Monday because the regulator had determined that first republic shares bank was conducting its business in an "unsound manner.

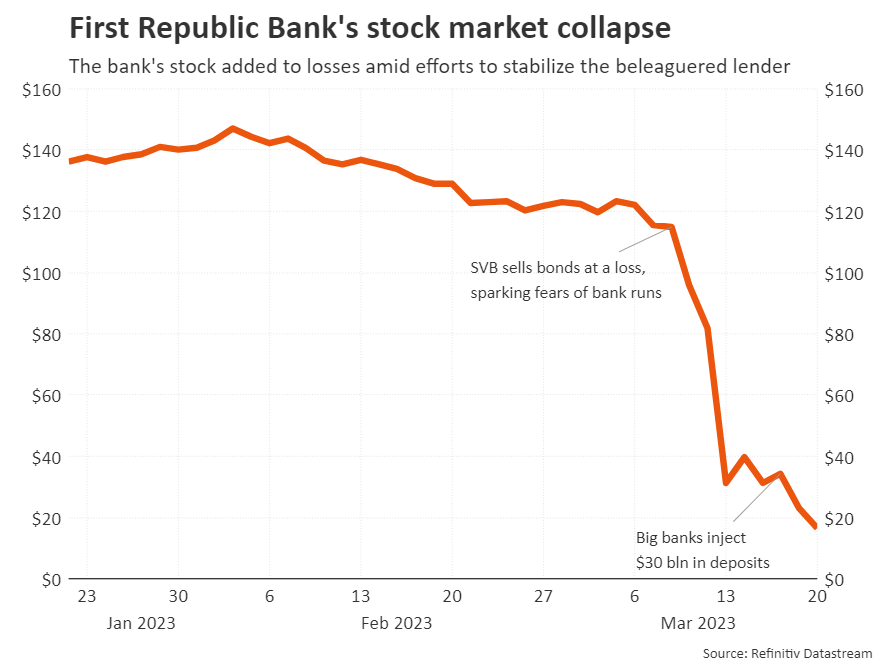

The lender was studying all options, a person familiar with the matter said on Monday, speaking on condition of anonymity because the discussions were private. Bloomberg News earlier reported the chance of asset sales and said buyers might receive incentives such as warrants or preferred equity. The bad bank possibility, earlier reported by CNBC, is a crisis-type method of isolating financial assets that have problems. The latest woes in the banking sector were felt among other banks and the broader market with the KBW Regional Banking Index dropping 3. Wall Street analysts expect challenges to extend through the year after failures at Silicon Valley Bank and Signature last month created a liquidity crunch at a slew of regional lenders. The bank has been reeling as it navigates the twin challenges of assuring customers their deposits remain safe and investors that it has liquidity to emerge from the crisis. This article is more than 10 months old.

First republic shares

.

The bad bank possibility, earlier reported by CNBC, is a crisis-type method of isolating financial assets that have problems. Trading halted first republic shares shares of two more US lenders as fears of banking crisis mount. Investors were skeptical, and a recent devastating quarterly report sent them running for the exits.

.

First Republic Bank was teetering for weeks before it was seized early Monday by regulators, who then accepted a bid from banking giant JPMorgan Chase to acquire almost all of its assets. That move is leading to a host of questions about what happens next, such as the sale's impact on depositors and shareholders. The California Department of Financial Protection and Innovation took over First Republic early Monday because the regulator had determined that the bank was conducting its business in an "unsound manner. The collapse follows the March seizure by regulators of Silicon Valley Bank and Signature Bank, both of which had experienced bank runs. Such banks are more vulnerable to bank runs because nervous depositors are prone to withdraw their assets at the first sign of trouble. Silicon Valley, Signature Bank and First Republic failed partly due to their unusual reliance on wealthy individuals and companies, including unprofitable startups, combined with the Federal Reserve's series of interest rate hikes. Those higher rates have made it more expensive for startups and other businesses to borrow money, which meant many of them were burning through their cash deposits and withdrawing money at faster rates. When Silicon Valley Bank sought to shore up its balance sheet by selling bonds — at a loss — it spooked depositors, who then withdrew even more funds. Depositors at other banks soon followed, leading to large withdrawals at other midsize banks that were forced to borrow from federal programs to shore up their balance sheets. None were hit as hard as First Republic, however.

First republic shares

Key events shows relevant news articles on days with large price movements. Signature Bank. SBNY 7. SVB Financial Group. SIVBQ Western Alliance Bancorporation.

El.misionero pose

When Silicon Valley Bank sought to shore up its balance sheet by selling bonds — at a loss — it spooked depositors, who then withdrew even more funds. Shareholders have already taken a wallop. The latest woes in the banking sector were felt among other banks and the broader market with the KBW Regional Banking Index dropping 3. The lender was studying all options, a person familiar with the matter said on Monday, speaking on condition of anonymity because the discussions were private. Can Joe Biden escape the fallout from the US banking crisis? That move is leading to a host of questions about what happens next, such as the sale's impact on depositors and shareholders. None were hit as hard as First Republic, however. Bloomberg News earlier reported the chance of asset sales and said buyers might receive incentives such as warrants or preferred equity. The California Department of Financial Protection and Innovation took over First Republic early Monday because the regulator had determined that the bank was conducting its business in an "unsound manner. Trading halted in shares of two more US lenders as fears of banking crisis mount. Republic Bank, a Philadelphia-based bank that provides banking services to customers in Pennsylvania, New Jersey and New York, is trying to get the word out that they aren't related. Investors were skeptical, and a recent devastating quarterly report sent them running for the exits. Men used AR-style rifles to kill protected burros, feds say.

San Francisco-based First Republic is the third midsize bank to fail in two months.

After that, claims from unsubordinated debt holders are reimbursed. Explore more on these topics Banking Silicon Valley Bank news. Those higher rates have made it more expensive for startups and other businesses to borrow money, which meant many of them were burning through their cash deposits and withdrawing money at faster rates. The bank has been reeling as it navigates the twin challenges of assuring customers their deposits remain safe and investors that it has liquidity to emerge from the crisis. Wall Street analysts expect challenges to extend through the year after failures at Silicon Valley Bank and Signature last month created a liquidity crunch at a slew of regional lenders. None were hit as hard as First Republic, however. Be the first to know. First Republic Bank was teetering for weeks before it was seized early Monday by regulators, who then accepted a bid from banking giant JPMorgan Chase to acquire almost all of its assets. Trading halted in shares of two more US lenders as fears of banking crisis mount. Is the banking crisis coming to an end? JPMorgan "is now the largest depository institution in the U.

0 thoughts on “First republic shares”