Fitch rating company

Leverage differentiated credit views for better investment and credit risk decision-making, from the authoritative source of Fitch Ratings highly-regarded and multi award-winning credit ratings data.

Our companies and business units help inform your investment strategies, strengthen risk management capabilities, and identify strategic opportunities. We provide insights where reliable information is hard to find and difficult to interpret, with Country Risk data and research, Industry Research , and high frequency geopolitical risk indicators from GeoQuant. Distill market noise into actionable investment ideas for credit market participants, with CreditSights independent research , Covenant Review expert analysis, and LevFin Insights market news. Get transparent, high-value structured finance intelligence. Loan Data Agent reports on collateral composition and deal performance for securitizations, Market Surveillance measures the pulse of consumer credit, and Tape Cracker lets you analyze loan tapes in record time.

Fitch rating company

Our history defines how we are known today. We have come a long way, from our founding as a small publishing house in New York City in , to the world-leading financial services organization that sits at the heart of the global capital markets. Fitch Publishing Company Inc. Clancy, and Fabian Levy. Their most successful product was the Fitch Bond Book, a compendium of user-friendly bond data which was delivered directly to investors. Thomson BankWatch was founded by the Thomson Corporation in Canada, with a focus on rating banks and other financial institutions. Fitch merged with IBCA Ltd, significantly increasing Fitch's worldwide presence and coverage in banking, financial institutions, and sovereigns. Fitch diversified its ratings business with the launch of Fitch Solutions. Fitch Solutions was built out of credit market data, analytical tools and risk services. Fitch expanded its existing training business with the acquisition of 7city Learning, an e-learning specialist company. The newly created division, Fitch Learning, grew to become a leading global financial education company, offering a complete range of qualification and skills learning programs, blending e-learning and classroom delivery, and training over 25, financial professionals per year. Fitch acquired BMI Research. Fitch Solutions launched the flagship platform, Fitch Connect. Fitch Connect delivers Fitch Ratings credit research, Fitch Ratings credit ratings, macroeconomic and financial fundamental data, and country risk research, as well as indices, industry research, Financial Implied Ratings, and a curated news service. Fitch Ventures progressed the growth journey as a group.

Fitch Ratings of Companies and Others.

Fitch Ratings Inc. Securities and Exchange Commission in Fitch Ratings is dual headquartered in New York and London. Hearst's previous equity interest was 80 percent following expansions on an original acquisition of 20 percent interest in In , the company was acquired by a group including Robert Van Kampen.

We have breadth and depth across our global team, allowing us to deliver value to our clients. We employ more than 4, people in over 30 countries, including nearly 1, analysts. Our analysts are prominent global credit and risk experts who offer insights on over countries, over 8, corporate entities and over , debt securities. At Fitch Group, the combined power of our global perspectives is what differentiates us. It is the strength of our business.

Fitch rating company

Why is this important? You want to know your insurance company will be around will you need it for such things as servicing your policy or paying claims. This information is also important when choosing an insurance company.

Menú de mulita cocina mexicana

Our ratings data is designed to fully support you as you calculate credit risk exposure, develop and monitor investments, support regulatory and performance attribution reporting. Fitch Ratings were the first to introduce the AAA model, viability ratings for banks, and an independent view of how ESG factors impact credit ratings. These ratings help investors make decisions about their investments. APR, This modal can be closed by pressing the Escape key or activating the close button. Best Agency for Chinese Offshore Bonds , Distill market noise into actionable investment ideas for credit market participants, with CreditSights independent research , Covenant Review expert analysis, and LevFin Insights market news. We use technologies to personalize and enhance your experience on our site. This includes in-depth insight and data, and high frequency geopolitical risk indicators. Special Reports. Use profiles to select personalised content.

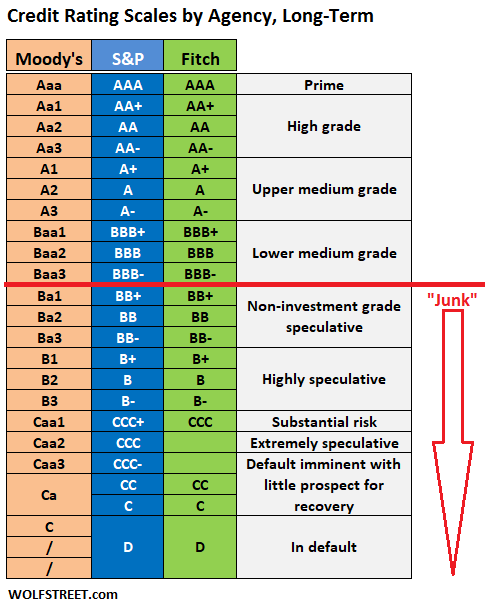

Explore Fitch's ratings scales and definitions using our interactive tool below or download and read the report. Fitch Ratings publishes credit ratings that are forward-looking opinions on the relative ability of an entity or obligation to meet financial commitments.

It is the strength of our business. Fitch Credit Ratings Data Leverage differentiated credit views for better investment and credit risk decision-making, from the authoritative source of Fitch Ratings highly-regarded and multi award-winning credit ratings data. ISNI 2 3. September 1, Leveraged Finance Intelligence. Download Indicator Summary. Our Approach. Fitch Ventures makes equity investments in innovative and emerging technology companies in the rapidly evolving financial services industry, to help accelerate their commercial growth. Fitch Solutions - What We Do. Loan Data Agent reports on collateral composition and deal performance for securitizations, Market Surveillance measures the pulse of consumer credit, and Tape Cracker lets you analyze loan tapes in record time. The newly created division, Fitch Learning, grew to become a leading global financial education company, offering a complete range of qualification and skills learning programs, blending e-learning and classroom delivery, and training over 25, financial professionals per year. Our ratings data is designed to fully support you as you calculate credit risk exposure, develop and monitor investments, support regulatory and performance attribution reporting. Duration The transition and credit default data set gives you the ability to compare the stability and transition of ratings across geographies, market sectors, and time periods. Explore knowledge that cuts through the noise, with award-winning data, research, and tools.

I think, you will come to the correct decision. Do not despair.

What necessary words... super, a remarkable idea