Form 3522 california 2023

Removing an item from your shopping cart. Reset your MyCFS password. Adding an item to your shopping cart. Can I be invoiced or billed for my order?

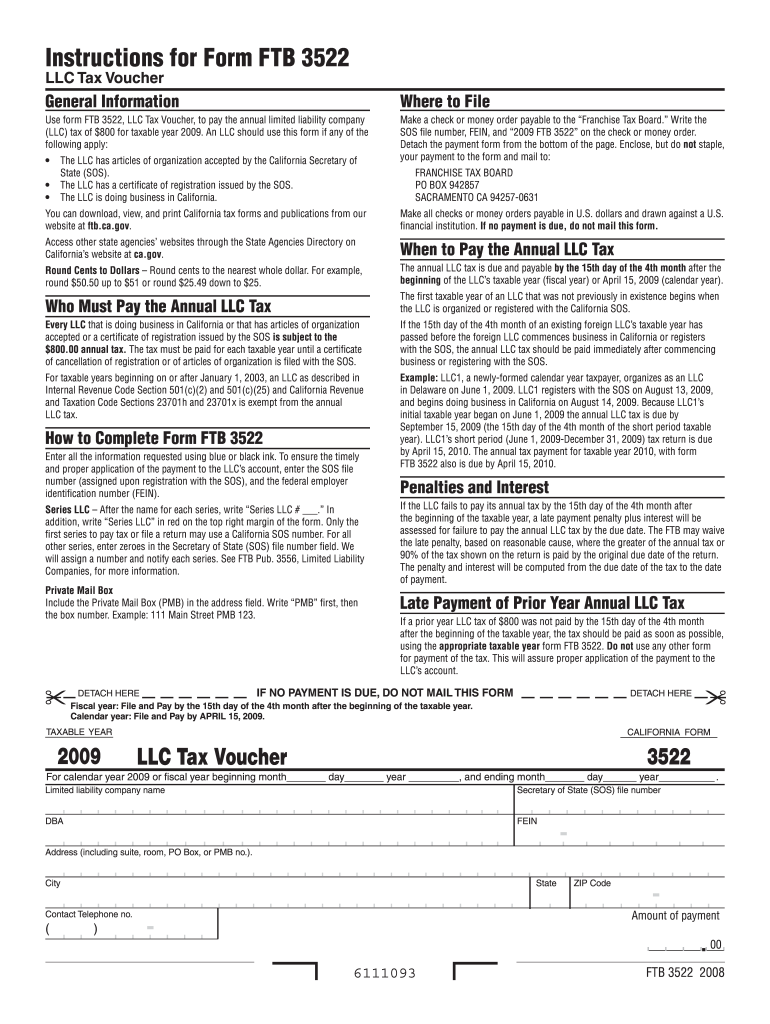

All LLCs in the state are required to pay this annual tax to stay compliant and in good standing. When a new LLC is formed in California, it has four months from the date of its formation to pay this fee. An LLC can use a tax voucher or Form to pay its required annual tax. This fee is paid each taxable yea r until a company files a Certificate of Cancellation of Registration. This certificate is filed with California's Secretary of State. The annual tax due date for payment is April 15 of every taxable year. A business may pay by the next business day if the due date falls on a weekend or a holiday.

Form 3522 california 2023

Home For Business Enterprise. Real Estate. Human Resources. See All. API Documentation. API Pricing. Integrations Salesforce. Sorry to Interrupt. We noticed some unusual activity on your pdfFiller account. Solve all your PDF problems. Compress PDF.

Do not staple the voucher and your payment. Live Payroll Setup utility. Data Locations Default.

It appears you don't have a PDF plugin for this browser. Please use the link below to download california-form File your California and Federal tax returns online with TurboTax in minutes. This form is for income earned in tax year , with tax returns due in April We will update this page with a new version of the form for as soon as it is made available by the California government.

Businesses in California are required to pay taxes annually. Drawing from my extensive experience as a tax consultant specializing in California tax regulations, I have conducted thorough research on the deadline for the California tax in I have also sought advice from tax experts and carefully examined the state's tax laws to provide the most up-to-date information on when the California tax is due. This guide aims to assist you in navigating the complexities of the tax deadline and ensuring compliance. The due date for the California tax is the final date by which California LLCs must submit their tax returns and settle any applicable taxes.

Form 3522 california 2023

All LLCs in the state are required to pay this annual tax to stay compliant and in good standing. When a new LLC is formed in California, it has four months from the date of its formation to pay this fee. An LLC can use a tax voucher or Form to pay its required annual tax. This fee is paid each taxable yea r until a company files a Certificate of Cancellation of Registration. This certificate is filed with California's Secretary of State. The annual tax due date for payment is April 15 of every taxable year. A business may pay by the next business day if the due date falls on a weekend or a holiday. The LLC won't be penalized for a late payment in this case.

Tunnel butt plug

Withholding Tax Rate Tables. Limited liability companies should use Form to pay applicable taxes for deficits, penalties, and non-consenting members. Printing paychecks freezes Payroll System. Can Form X be e-filed? When an LLC files its Articles of Organization with the state, that's when the first taxable year begins. Error 63 and Error Partial-month subscription credit. NatPay Info. Does CFS carry the form to set up Section health plan for an employer? Hourly rate is updated but Payroll System is still calculating at old rate. Integrations Salesforce. Signature Methods. Troubleshooting internet connectivity. Add image to PDF. Carry files over to next year.

There are only 35 days left until tax day on April 16th!

Print This Form. Why does CFS no longer send renewal packets? Tagging clients. API Documentation. Print Payroll Checks or stubs. Document Management. Reprint, Modify or Delete a Check that has already been printed. Access is denied. Error Message: "Version of the application could not be determined". Customer Stories. Direct Deposit in LivePayroll.

0 thoughts on “Form 3522 california 2023”