Ftse 250 predictions 2024

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resourcesand more.

Another pain point for the FTSE is the surge in bond yields, given its expectations for medium-term growth and its prolonged duration compared to the FTSE The index also has a sizable exposure to rate-sensitive sectors like real estate. The lack of mergers and acquisitions, attributed to elevated bond yields and economic sluggishness, has further hampered corporate investment. Goldman anticipates a shift in the situation no sooner than They mention that bond yields must stabilize and the economy must begin to recover before any major improvements are seen. The bank currently leans towards the FTSE , expecting higher interest rates and increased energy prices due to Middle Eastern conflicts.

Ftse 250 predictions 2024

If you choose to invest the value of your investment will rise and fall, so you could get back less than you put in. InterContinental Hotels. Hikma Pharmaceuticals. ME Group. Morgan Sindall. Pantheon International. Safestore Holdings. Deutsche Telekom. Jupiter Fund Management. Several of the biggest UK banks report fourth-quarter results next week and there are a few main themes running across the sector. Loan default levels and impairment charges will be key for investors.

In the UK, interest rates have most likely peaked most economists expect several cuts this year. Media and advertising giant WPP expects to post full year net-revenue growth of 0. Why is the BAE Systems share price dropping today despite reporting an exceptional ?

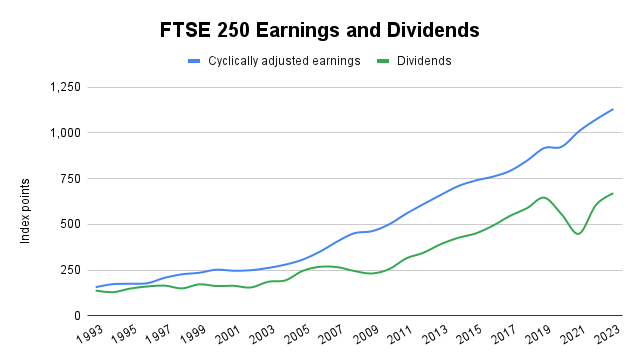

Investors will be hoping lower interest rates can inspire a change in fortunes for the unloved FTSE index in , having traded at a big discount to global peers in The lacklustre performance has left the FTSE index trading on a month forward price-to-earnings multiple of about As well as the benefit of earnings growth, it sees the potential for a slight re-rating as lower interest rates increase the present value of equity cash flow. Despite the outlook, the UK is still among the least preferred in its coverage because emerging markets equities are forecast to see double-digit earnings growth next year. The generally more upbeat view on UK equities is shared by interactive investor customers, with almost half of respondents to our recent survey seeing the FTSE between 7, and 8, this time next year. Those defensive characteristics may be needed again at the start of a year when major elections loom in the UK and US, geopolitical events remain a big worry and the full lag effect of interest rate rises is still to be felt. For now, however, the recent third-quarter results season in the United States has suggested that many companies have had their earnings recession, have cut costs and are now enjoying margin expansion.

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. If you choose to invest the value of your investment will rise and fall, so you could get back less than you put in. No-one has a crystal ball as to what will hold. They reflect on:.

Ftse 250 predictions 2024

Philip Coggan. Simply sign up to the Investments myFT Digest -- delivered directly to your inbox. Forecasting the economic and financial outlook for the coming year is always difficult. For , the known unknowns come in two categories: economics and politics. The likely good news comes in the form of falling inflation and the widespread expectation that the Federal Reserve, and other central banks, will start to cut interest rates during the year.

Seth everman

Of course, the debt here does add risk. Alongside our other analysts, he provides regular research and analysis on individual companies and wider sectors. It might take investors some time to assess whether the deal is a good one. The aim of Hargreaves Lansdown's financial content review process is to ensure accuracy, clarity, and comprehensiveness of all published materials. Media and advertising giant WPP expects to post full year net-revenue growth of 0. Sign up to newsletter. The author holds shares in BAE Systems. Firstly, the deal has yet to be finalised. The improved earnings potential should also help ensure that the dividend is sustainable over the long term. And it saw record traffic of These estimates are not a reliable indicator of future performance. Then please subscribe www.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More.

In terms of monetary policy, there appears to be good news on the horizon. Source: Bloomberg. BAE Systems occupies a key space in the defence market. BAE Systems shares have failed to ignite following the release of latest financials. Learn More. To try and help overcome this problem, figures have been produced by the two companies illustrating what the group would have looked like in Article history. Until now, consumers and corporations have remained relatively resilient to broader economic pressures. If you choose to invest the value of your investment will rise and fall, so you could get back less than you put in. If history is anything to go by, could be a big year for the FTSE An investment in this FTSE stock could provide a whopping For now, however, the recent third-quarter results season in the United States has suggested that many companies have had their earnings recession, have cut costs and are now enjoying margin expansion. Hikma Pharmaceuticals. And the Barratt-Redrow merger could spark further interest in the company — especially at its current valuation. Find out more.

Something at me personal messages do not send, a mistake what that