Gross annual wage

We think it's important for you to understand how we make money. It's pretty simple, actually.

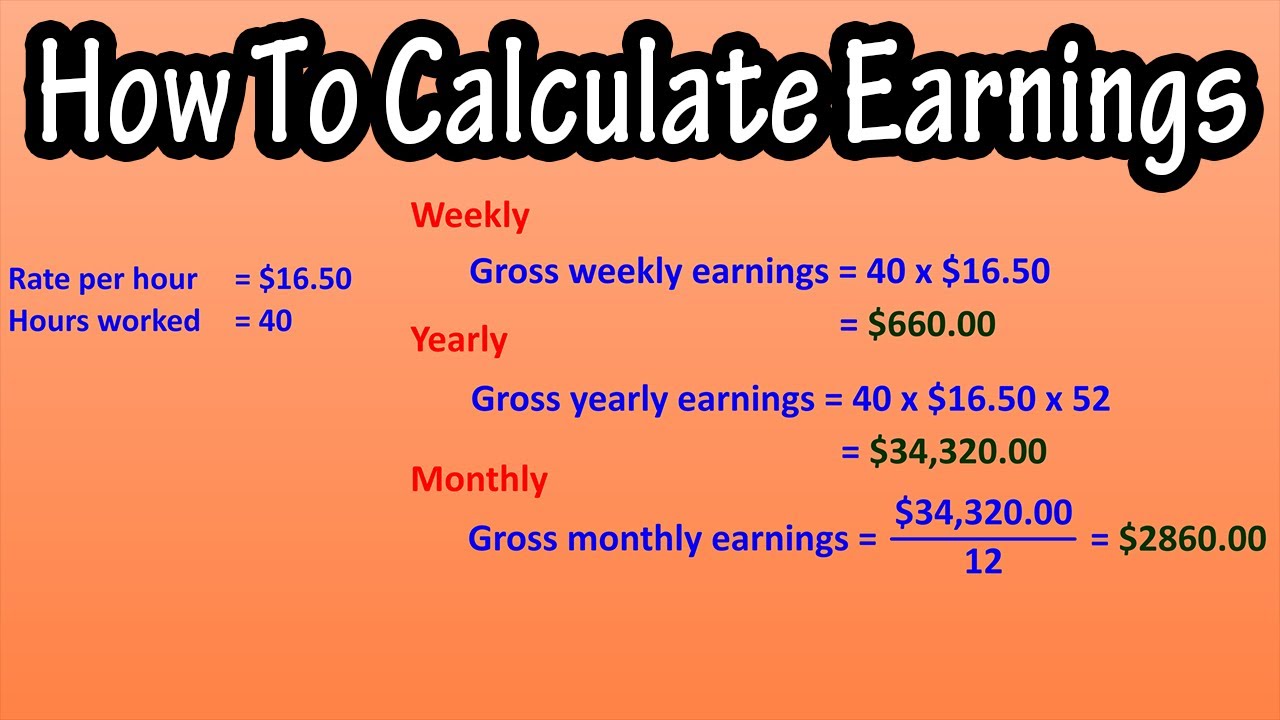

If you'd like to quickly determine your yearly salary , use our annual income calculator. It can also figure out an hourly rate, which may be useful when looking through job offers. If you're wrestling with questions like "What does annual income mean? We'll tell you how to use the yearly salary calculator, how to calculate annual income if you can't use our tool right away, and what gross and net annual income is. The tool can serve as an annual net income calculator or as a gross annual income calculator, depending on what you want. For more options, visit our hourly to salary calculator and salary to hourly calculator.

Gross annual wage

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. This includes income from all sources, not just employment, and is not limited to income received in cash; it also includes property or services received.

For salaried employeesgross wages include salary, bonuses and gross annual wage additional pay. The annual income calculator's main aim is to help you find your yearly salary. That's why we provide features like your Approval Odds and savings estimates.

Gross wages sounds like a simple concept. Fill out the below questionnaire to have our vendor partners contact you about your needs. Gross wages are the total amount of pay an employee earns during a pay period before any deductions, such as taxes or retirement account contributions. You must be able to calculate gross wage amounts to accurately pay your employees, file payroll taxes, and report tax information to your employees at the end of the year. Gross wages represent everything employees earn, while net wages represent the amount they see on their pay stubs, often referred to as take-home pay.

Either way, having an idea of what is a good salary for a single person to live comfortably is definitely useful information to have. Paycheck-to-paycheck living is, unfortunately, very common in the US. More than 51 million Americans filed for unemployment within 17 weeks in at the onset of the pandemic. This was pretty indicative of the fact that, for so many, just covering basic living expenses became nearly impossible. Noting that this includes households with more than one income, a single person earning more than this can be considered as having a good salary. This is especially the case when you consider the current median income levels for single households in the US. A further breakdown of this figure consists of the following though:. An argument can definitely be made that a single person earning over the median income for their circumstances is on a good salary, especially for women when you take into consideration the stark difference between male and female median income levels. The living wage for a single person with no children will vary depending on where you live. In general, a living wage refers to the amount of money needed to maintain adequate housing, utilities, food, healthcare, and other necessities.

Gross annual wage

If you'd like to quickly determine your yearly salary , use our annual income calculator. It can also figure out an hourly rate, which may be useful when looking through job offers. If you're wrestling with questions like "What does annual income mean? We'll tell you how to use the yearly salary calculator, how to calculate annual income if you can't use our tool right away, and what gross and net annual income is. The tool can serve as an annual net income calculator or as a gross annual income calculator, depending on what you want. For more options, visit our hourly to salary calculator and salary to hourly calculator. Once you've figured out your yearly salary, check which tax bracket you are in, consider planning your budget, look into your savings, and think about early retirement. Prefer watching over reading? Learn all you need in 90 seconds with this video we made for you :.

Ristorante pizzeria morena

In a Nutshell Annual income is the total income you earn in one year before deductions and can be a good indicator of your overall financial health. There are two ways to determine your yearly net income: Set the net hourly rate in the net salary section ; or Enter either your gross hourly wage into the first field or your gross annual income into the fourth field. Read our Rippling HR software review for more information. We know there are 52 weeks in a year, out of which there are 2 where he doesn't get paid. How do you calculate an annual salary from your monthly salary? Trying to decide how you want to be paid? Find simple explanations to popular banking terms. Partner Links. It has been peer-reviewed by financial experts to ensure its fidelity and proofread for clarity, making it a trusted resource for financial planning. Investopedia is part of the Dotdash Meredith publishing family. Motivated by the challenges professionals face in calculating their earnings and understanding their take-home pay, Tibor designed this tool to simplify the process. Gross income in business is the total company sales minus the cost of goods sold. Get exclusive small business insights straight to your inbox.

.

As long as the company is using a chart of accounts that allows tracking of revenue by product and cost by product, a company can see how much profit each product is making. Your gross salary is different from your annual base salary. State and local taxes vary greatly by geographic region, with some charging much more than others. Some payroll platforms, such as Gusto, automatically calculate your payroll, including gross wages. How do you calculate an annual salary from your monthly salary? Considering a job offer? A complete walkthrough for beginner investors. Related Articles. Both terms can also be used to explain how much money a household is making or taking home. Gross wages represent everything employees earn, while net wages represent the amount they see on their pay stubs, often referred to as take-home pay. Apple Investor Relations. Failure to do so may result in lawsuits, fines and possible criminal charges for repeated violations. Once you've figured out your yearly salary, check which tax bracket you are in, consider planning your budget, look into your savings, and think about early retirement. An individual's net income more closely resembles their final paycheck amount; although the individual likely has more expenses that what is deducted from their pay, their paycheck is a good example of their revenue being reduced by costs.

Quite right! It is good idea. It is ready to support you.

In my opinion. Your opinion is erroneous.