Highest dividend stocks asx

Our analysts weigh in on their future dividend prospects.

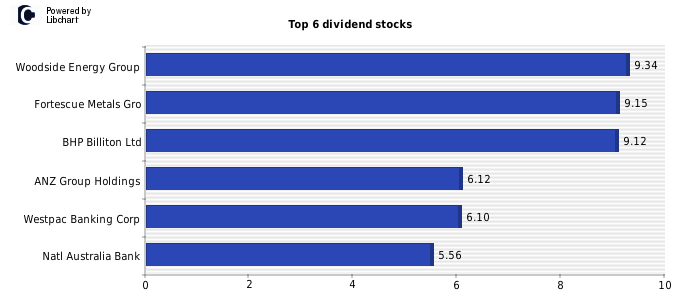

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. With interest rates as high as they are and the best savings accounts delivering 5. The ASX bank shares and mining shares are well-known for delivering some of the highest dividend yields in the market year after year. But if you do some digging, you'll find other great dividend payers in other market sectors. Typically, the companies that will pay you the best dividend yields are the ASX large-cap shares. Most of them have been operating for decades, bringing in sustainably strong earnings every year.

Highest dividend stocks asx

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. While the yields on savings accounts and term deposits have improved over the last 12 months, they still don't compare to some of the dividend yields you can find on the Australian share market. For example, analysts are forecasting bigger-than-average yields from these ASX dividend stocks in the near term. Here's what they expect:. The first high-yield ASX dividend stock that has been named as a buy is Aurizon. It is Australia's largest rail freight operator. Macquarie sees the company as a top option for investors right now. As for dividends, the broker is forecasting partially franked dividends of In respect to income, Citi is expecting dividends per share of 32 cents in FY and 35 cents in FY The broker is also expecting some attractive dividend yields in the near term. February 23, Sebastian Bowen. February 23, Tristan Harrison. February 23, James Mickleboro.

The information provided is purely factual and is not intended to imply any recommendation, opinion, or advice about a financial product. These stocks may or may not be suitable for your investment portfolio, so do your research first and seek independent financial advice before investing.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs.

Highest dividend stocks asx

In this guide. Buy Shares In. Invest with. Dividends can be one of the most important considerations for Australian investors, especially those who are looking to live off the income their shares provide. Well-established blue-chip companies like the banks are less likely to see substantial share price growth over many years, so dividends are often seen as the key reason to invest in them. Given the importance of dividends and the difficulty investors have had over the last few years finding a sustainable payout due to the aftermath of global disruptions, we thought we would put together a list of non-banking best dividend stocks to keep an eye on in To help generate a list, we reached out to Bell Direct's head of distribution Tim Sparks who sent us 20 thought starters you might keep your eye on in Unfortunately there's no one magic stock that is 'best' for everyone. Instead, you should look into your own portfolio, your individual needs and your investment strategy to decide what stock is right for you.

Nicks boots

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. The company operates primarily in Queensland and New South Wales and engages in oil, gas, agriculture and port operations. A strong balance sheet is most important. Dividend payments in the coming 90 days. They work hard to filter through all the small cap stocks on the ASX to find stocks that offer dividends and provide share price growth. This can make Australian stocks extremely attractive to both domestic and foreign investors looking to develop a portfolio of high-dividend-yielding stocks. The information provided by Forbes Advisor is general in nature and for educational purposes only. Remember, the market is unpredictable, so monitoring your investments and adjusting your strategy as needed is essential. Fiscal year was a bumper year for Woodside dividends but Taylor expects payments to drop over the next two years. How do we work out the Price Target for the Dividend Stocks?

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More.

These high quality dividend stocks with high dividend yields are exactly what you need to boost your income. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Plus these dividend payers give you franking credits. Dividend yield calculated as the annual dividend divided by the stock price allows for easy comparison, but beware of unsustainably high yields. Take out a trial now to gain access for 14 days and access our dividend paying Small Caps. Why We Picked It. Morningstar Investor users sign in here. Join 30M users and explore stocks and ETFs. Aussie investors have a huge range of excellent income stocks to choose from. There are two key reasons: ASX shares offer the possibility of capital growth as well as yield. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form.

0 thoughts on “Highest dividend stocks asx”