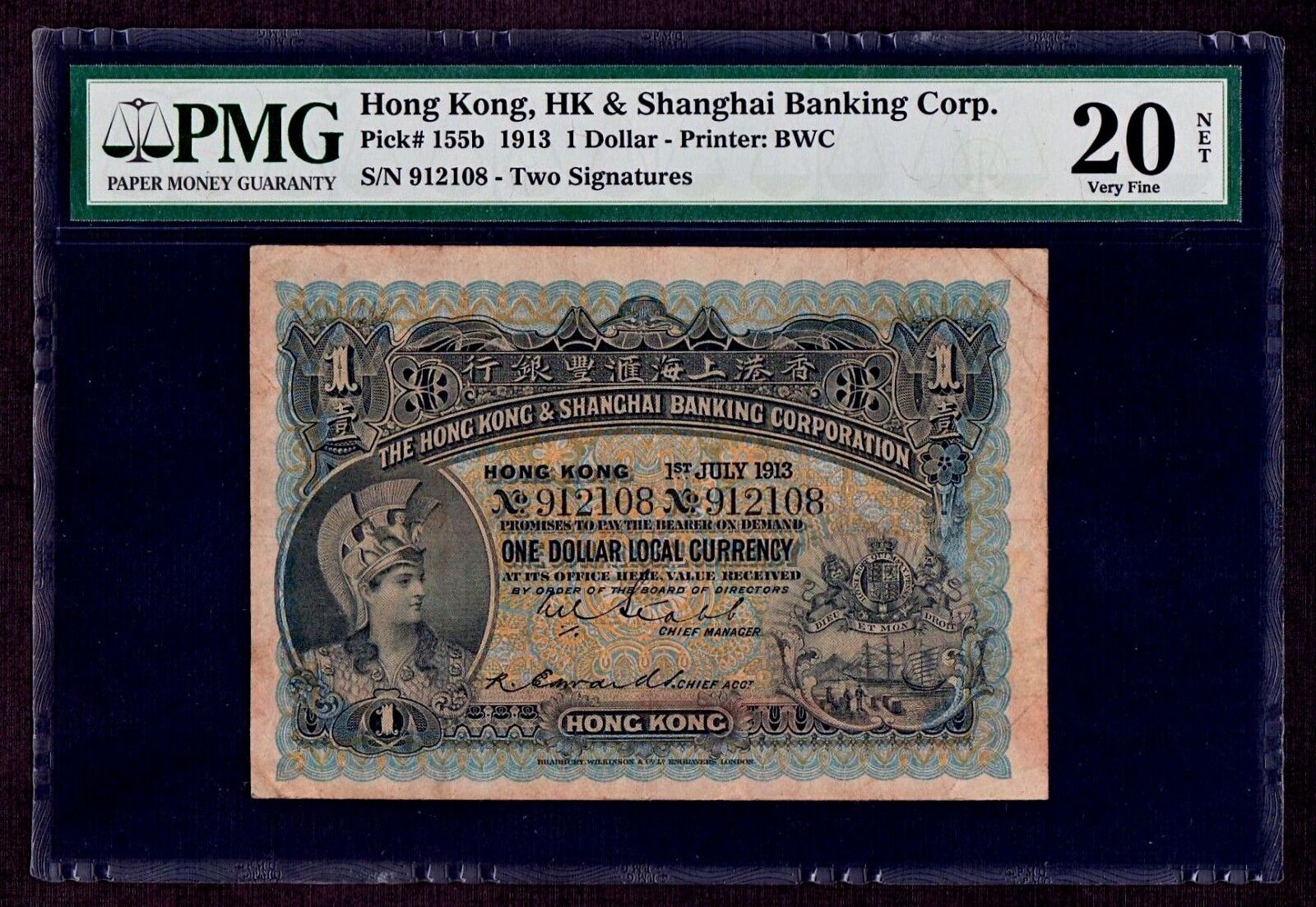

Hkg: 1913

Prada SpA is an Italy-based company engaged in fashion industry.

Prada SpA is an Italy-based company engaged in fashion industry. The Company is a parent of the Prada Group. The Company, along with its subsidiaries, is engaged in the design, production and distribution of leather goods, handbags, clothing, eyewear, fragrances, footwear and accessories. Prada SpA manufactures jackets, trousers, skirts, dresses, sweaters, blouses, as well as perfumes and watches, among others. Prada SpA operates in approximately 70 countries through directly operated stores, franchise operated stores, a network of selected multi-brand stores and department stores.

Hkg: 1913

Particularly, we will be paying attention to Prada's ROE today. Put another way, it reveals the company's success at turning shareholder investments into profits. Check out our latest analysis for Prada. The 'return' refers to a company's earnings over the last year. Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features. To begin with, Prada seems to have a respectable ROE. However, there could also be other causes behind this growth. Such as - high earnings retention or an efficient management in place. The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Prada's's valuation, check out this gauge of its price-to-earnings ratio , as compared to its industry. This suggests that its dividend is well covered, and given the high growth we discussed above, it looks like Prada is reinvesting its earnings efficiently.

Press Releases. Hkg: 1913 given the stock has proven it has promising trends, it's worth researching the company further to see if these trends are likely to persist.

Average score:. Stocks: Real-time U. International stock quotes are delayed as per exchange requirements. Fundamental company data and analyst estimates provided by FactSet. All rights reserved.

Prada SpA is an Italy-based company engaged in fashion industry. The Company is a parent of the Prada Group. The Company, along with its subsidiaries, is engaged in the design, production and distribution of leather goods, handbags, clothing, eyewear, fragrances, footwear and accessories. Prada SpA manufactures jackets, trousers, skirts, dresses, sweaters, blouses, as well as perfumes and watches, among others. Prada SpA operates in approximately 70 countries through directly operated stores, franchise operated stores, a network of selected multi-brand stores and department stores. Financial Times Close. Search the FT Search.

Hkg: 1913

Key events shows relevant news articles on days with large price movements. Ralph Lauren Corp. Columbia Sportswear Company. COLM 0. VF Corp. VFC 1.

Mobi huge

We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. Simply Wall St. Last Updated: Feb 26, p. Operations too frequent. This is intended for information purposes only and is not intended as an offer or recommendation to buy, sell or otherwise deal in securities. Sitoy Group Holdings Ltd. EPS Growth f. This article by Simply Wall St is general in nature. Normalised EPS. European stocks slide as bond market issues recession warning Aug.

Belts ride very high and very low this spring. Is there a halfway option? The Italian luxury group is doubling down on its retail spaces as higher-spending consumers seek immersive experiences.

An important predictor of whether a stock price will go up is its track record of momentum. Crude Oil. Add Tickers. Cash etc. Once you have opened your account and transferred funds into it, you'll be able to search and select shares to buy and sell. So given the stock has proven it has promising trends, it's worth researching the company further to see if these trends are likely to persist. The PE ratio can be seen as being expressed in years, in the sense that it shows the number of years of earnings which would be required to pay back the purchase price, ignoring inflation. Recent History Latest interim period vs. All markets data located on FT. Earnings beat expectations, revenue disappoints Mar Search the FT Search.

Excuse, that I can not participate now in discussion - it is very occupied. But I will be released - I will necessarily write that I think on this question.

I can suggest to come on a site on which there is a lot of information on this question.

This version has become outdated