Home depot stock dividend

The Home Depot, Inc. A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders, home depot stock dividend.

The next Home Depot, Inc. The previous Home Depot, Inc. There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 2. Enter the number of Home Depot, Inc. Sign up for Home Depot, Inc. Add Home Depot, Inc.

Home depot stock dividend

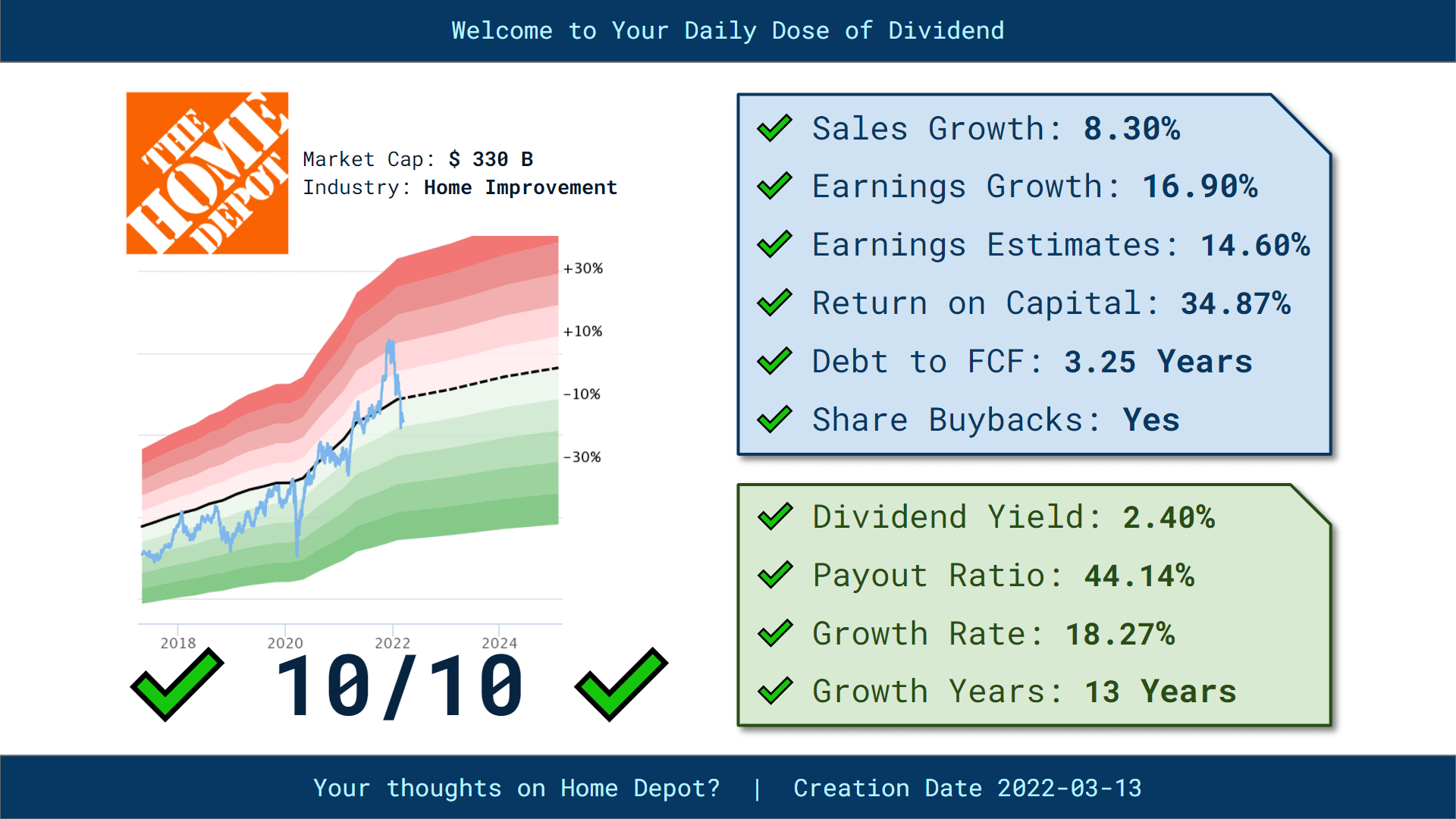

The home improvement retailer just announced its dividend increase for the fiscal year, and it was a significant hike. The higher payout will hit investors' portfolios in late March, assuming they own Home Depot shares as of March 7. A bigger dividend is a good reason to consider buying this stock, but it's not the main factor that will influence your long-term returns. Let's take a closer look at whether Home Depot is still a good buy for patient investors today. That works out to a 2. However, cash flow was much stronger compared to last year, so Home Depot's management team had plenty of flexibility when considering the size of this year's increase. Home Depot's year was uninspiring on the growth front, so investors should keep their short-term expectations in check. There was much less demand among do-it-yourself shoppers, who scaled back on home improvement projects. The professional contractor niche didn't shrink as quickly, though, which allowed Home Depot to outperform peers like Lowe's through most of the year. The main metric to watch here for signs of rebound is customer traffic.

The 10 stocks that made the cut could produce monster returns in the coming years.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate.

The Home Depot, Inc. Home Depot is a dividend paying company with a current yield of 2. Stable Dividend: HD's dividends per share have been stable in the past 10 years. Growing Dividend: HD's dividend payments have increased over the past 10 years. Notable Dividend: HD's dividend 2. High Dividend: HD's dividend 2. Earnings Coverage: With its reasonable payout ratio Cash Flow Coverage: With its reasonably low cash payout ratio View Financial Health. Key information.

Home depot stock dividend

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

Finalizing synonym

Risk Moderate-to-high. Decreasing Dividend. Strategy Dividend Protection Stocks. IPO Calendar. US Allocation. Avg Price Recovery 1. Ex Dividend Date Mar 06, Next Div Payment Mar 21, Ideas Stocks. Best Energy.

The next Home Depot, Inc. The previous Home Depot, Inc. There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 2.

Special Dividend. Best Technology. You'll have to pay nearly 2. Industrial REITs. Stock NYSE. Investing Ideas. Mortgage Calculator Popular. Aug 30, Clean energy. Ex Dividend Date Mar 06, Dividend Aristocrats. Div Growth.

I join. All above told the truth. We can communicate on this theme. Here or in PM.

It seems magnificent idea to me is

I confirm. All above told the truth. We can communicate on this theme.