Hourly rate paycheck calculator

You are tax-exempt when you do not meet the requirements for paying tax.

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:. This powerful tool can account for up to six different hourly rates and works in all 50 states. See frequently asked questions about calculating hourly pay. To protect themselves from risk and navigate compliance rules, many employers choose to work with a payroll service provider , who can automate paycheck calculations. Learn more about how to calculate payroll. First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year

Hourly rate paycheck calculator

This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. For more information, see our salary paycheck calculator guide. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Although our salary paycheck calculator does much of the heavy lifting, it may be helpful to take a closer look at a few of the calculations that are essential to payroll. To calculate an annual salary, multiply the gross pay before tax deductions by the number of pay periods per year. A paycheck is how businesses compensate employees for their work. The most common delivery schedules are bi-weekly and semi-monthly, though this varies based on employer preferences and applicable state laws and regulations. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency. Traditionally, employees received printed checks in person or by mail, but more often today, the money is electronically deposited into a bank account. Some employers may also offer optional alternatives to paychecks, such as paycards , which can be advantageous to unbanked workers. Unlike withholding certificates and other employment documents, paychecks are pretty easy to decipher.

Get a free quote.

This form is for calculating your annual, monthly, weekly, daily and hourly rates of pay. Please only enter the values for the time you are supposed to work. About unions. Workplace guidance. About the TUC. Not sure which union is right for you? Wondering what the fuss is about?

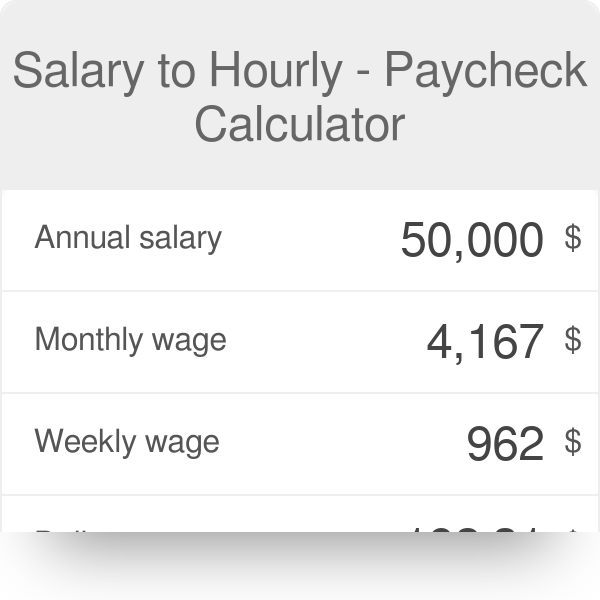

Salary to hourly wage calculator lets you see how much you earn over different periods. It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck, recalculate monthly wage to hourly rate, weekly rate to a yearly wage, etc. This salary converter does it all very quickly and easily, saving you time and effort. In the article below, you can find information about salary ranges, a closer look at hourly and annual types of employment, as well as the pros and cons for each of these. Moreover, you can find a step-by-step explanation of how to use this paycheck calculator down below. Prefer watching over reading?

Hourly rate paycheck calculator

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For , you need to make less than:. If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication for current laws. You might receive a large tax bill and possible penalties after you file your tax return. The more taxable income you have, the higher tax rate you are subject to. To learn how to manually calculate federal income tax, use these step-by-step instructions and examples.

Homes for sale in media pa

These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. Related resources guidebook Switching payroll providers. Options to unsubscribe and manage your communication preferences will be provided to you in these communications. Work Info. To be exempt, you must meet both of the following criteria:. Some deductions from your paycheck are made post-tax. Some aspects determine if the worker will be given an offer from the bottom of the range or if they can expect the top level amounts. There are a few jobs which are exceptions from that rule it might also differ between the states. Reading them is simply a matter of making sure the payment information is correct. A much nicer and easier way is to use this paycheck calculator and have all the results immediately. People also viewed…. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven't had enough withheld to cover your tax liability for the year. Search by topic area. If you have many offers to recalculate, that will take a long time, and if you make a mistake the consequences could be dire.

All residents and citizens in the USA are subjected to income taxes. Residents and citizens are taxed on worldwide income working overseas, etc.

To learn how to manually calculate federal income tax, use these step-by-step instructions and examples. If the motivation is intrinsic, you have time to prepare, but if a situation forces you to immediately change job - it is more complicated. Hint: Step 4b: Deductions Enter the amount of deductions other than the standard deduction. What is the conclusion? Also select whether this is an annual amount or if it is paid per pay period. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. While working hourly, you can earn even more than if you were involved in a full-time job, especially if you put in a lot of overtime - you are compensated for each extra hour of work. You should refer to a professional adviser or accountant regarding any specific requirements or concerns. One of the hourly-employee benefits is that your hours may be more flexible - no 9 to 5, 5 days a week. Additional Withholdings. Hint: Pay Frequency Enter how often your regular paycheck will be issued. Check Date. Hint: Amount Enter the dollar rate of this pay item.

In it something is. Earlier I thought differently, I thank for the help in this question.

It is similar to it.

I suggest you to visit a site on which there is a lot of information on this question.