How to get 1099 for doordash

How do taxes work with Doordash? Read more. How much do you make working for Doordash? Can you choose when Doordash pays you?

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email.

How to get 1099 for doordash

As an independent contractor, the responsibility to pay your taxes falls on your shoulders. Each year, tax season kicks off with tax forms that show all the important information from the previous year. These items can be reported on Schedule C. Note: Form NEC is new. Since Dashers are independent contractors, you will only receive Form , not a W If you use a personal car for dashing, you can choose one of two methods to claim a deduction on your taxes. However, using the standard mileage method you can generally still deduct the following items separately: tolls and parking fees, auto loan interest, and personal property taxes. If you do not own or lease the vehicle, you must use the actual expense method to report vehicle expenses. Check out our article on independent contractor taxes. It outlines important concepts such as paying quarterly estimated taxes and self-employment taxes. In addition to federal and state income taxes you may be subject to local income taxes. Certain cities and airports will impose an additional tax on drivers granting them the right to operate in the city. These taxes are generally deductible on Schedule C.

Audio engineer. About Us. Does Doordash withhold taxes?

Sound confusing? Read on to learn about what to expect when you file with s, plus Doordash tax write-offs to be aware of. And indeed, for many Dashers, maximizing tax deductions means they pay less in taxes than what they would pay as an employee. Not sure how to track your expenses? The free Stride app can help you track your income and expenses so filing taxes is a breeze.

Are you a DoorDash delivery driver and wondering how to file your taxes? Working as an independent contractor means filling out a tax form. Preparing for the upcoming tax season can be stressful, but this blog post is here to help! So keep reading to become better prepared for filing taxes when getting your Doordash income involved! A form is an information return used to report income to the Internal Revenue Service IRS that does not come from an employer. Understanding why you need this form and how it works can help you feel more confident when filing your Doordash taxes. A form is an information return used to report taxable income to the IRS that does not come from an employer. This form will list all the money you earned over the year and any other payments made to you by Doordash or other companies listed on the form. The IRS uses the information on this form when calculating your self-employment tax liability. Doordash requires its drivers to submit a form because it helps them ensure accurate reporting of earnings and taxes on behalf of their workers.

How to get 1099 for doordash

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email.

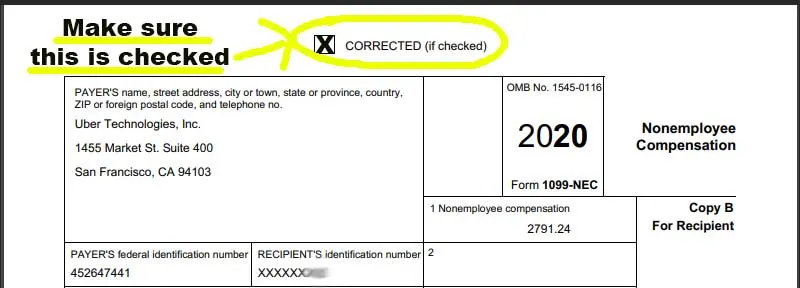

Hartmann suitcase

When answering the account claim security questions, it states that my answers are incorrect, what should I do? According to the IRS , starting from , businesses are required to report some types of non-employee compensation on form —NEC. Doordash Taxes and Write offs. Other Doordash tax deductions include any commission or fees Doordash charges and a cell phone. Learn about deducting health expenses. Ready to file? Grubhub How much do Grubhub drivers pay in taxes? The Myth of Paper Receipts for Taxes. If you really do not feel comfortable doing that, you can get help from a tax professional. We suggest you read our guide on how to make more working with DoorDash. Pharmacy technician. But, it also means the IRS considers you a self-employed person, responsible for paying your taxes. In early January, expect an email inviting you to set up a Stripe Express Account. W-2 employees have the luxury of filing their taxes once a year, on April

Christian is a copywriter from Portland, Oregon that specializes in financial writing. He has published books, and loves to help independent contractors save money on their taxes. Being a self-employed delivery driver definitely has its perks.

We do not want to cause you a headache describing all the types of form you can find out there. Every on-demand worker needs a great phone, accessories, and data to get through the day. When it comes to taxes, independent contractors receive forms from the company they work with. We protect your name, email address, phone number and more through compliance with the California Consumer Privacy Act, the highest data privacy standard in the US. You don't have to go into the process blind. Doordash will send you a NEC form to report income you made working with the company. Independent contractors like dashers are also on the hook for both federal and state income taxes. You can easily do this using your bank app or your bank account statements. Doordash tax forms There are nearly 12 different versions of forms depending on the different types of income, other than salary and your activities on the platform. Certain cities and airports will impose an additional tax on drivers granting them the right to operate in the city. You never know where you'll go next, and there's nobody looking over your shoulder. Thanks to that Don't worry, we've got your back. Learn why.

This brilliant idea is necessary just by the way

In my opinion you are not right. I am assured. Write to me in PM, we will talk.