How to get tax papers from doordash

Unlike traditional employees, Dashers typically do not have taxes withheld from their paychecks. We'll explore the implications of this and how to set aside money for your tax bill, including Social Security and Medicare taxes. Unlike regular employees, Dashers usually do not have taxes taken out of their pay.

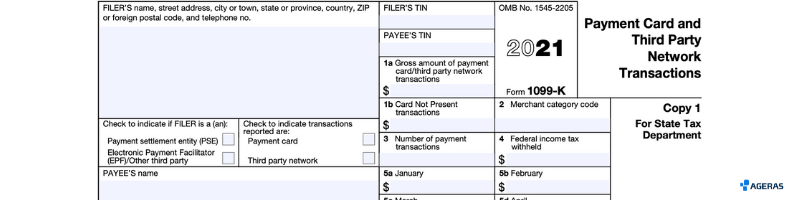

Are you a DoorDash delivery driver and wondering how to file your taxes? Working as an independent contractor means filling out a tax form. Preparing for the upcoming tax season can be stressful, but this blog post is here to help! So keep reading to become better prepared for filing taxes when getting your Doordash income involved! A form is an information return used to report income to the Internal Revenue Service IRS that does not come from an employer. Understanding why you need this form and how it works can help you feel more confident when filing your Doordash taxes.

How to get tax papers from doordash

How do taxes work with Doordash? Read more. How much do you make working for Doordash? Can you choose when Doordash pays you? Does Doordash withhold taxes? How much do Doordash drivers pay in taxes? Does Doordash report to the IRS? Doordash tax forms How to get a Form from Doordash? Deductions for delivery drivers One way freelancers are taking advantage of the explosion in gig work opportunities is with Amazon Flex. If you are a freelance delivery driver, business mileage tracking is a must. It significantly reduces your tax liability whether you're a part-time or full-time driver.

Since you're an independent contractor instead of an employee, DoorDash won't withhold any taxable income for you — leading to a higher bill from the IRS. A variety of home energy credits, such as credits for solar panels, energy-efficient windows, and heat pumps.

Christian is a copywriter from Portland, Oregon that specializes in financial writing. He has published books, and loves to help independent contractors save money on their taxes. Being a self-employed delivery driver definitely has its perks. You never know where you'll go next, and there's nobody looking over your shoulder. And if you know all the DoorDash tips and tricks , you can stand to make a lot of money.

Home Delivery. Since , Brett Helling has built expertise in the rideshare and delivery sectors, working with major platforms like Uber, Lyft, and DoorDash. He acquired Ridester. Expanding his reach, Brett founded Gigworker. More about Brett How we publish content. DoorDash recognizes its dashers as independent contractors responsible for keeping track of their total earnings and filing their taxes. These DoorDash tax deductions apply to employees and self-employed workers.

How to get tax papers from doordash

Just like with any other job, when you work at DoorDash, you need to take care of your taxes. The is a tax form you receive from Payable. The form is meant for the self-employed, but it also can be used to report government payments, interest, dividends, and more. Your employer has an obligation to send this form to you each year before January 31 st. Via this form, you report all your annual income to the IRS and then pay income tax on the earnings.

12371 train

You can deduct costs like these using either the standard mileage rate or the actual expense method :. You can access your form directly from your Doordash Dasher Portal. And the cost is shared, with your employer paying half and you paying half of the Before you start working for Doordash, you might need to buy a certain uniform and get a background check. Doordash considers delivery drivers to be independent contractors. From expense tracking to quarterly estimated payments, figuring out your DoorDash taxes can be nothing short of overwhelming. Of course, being an independent contractor can be stressful too — especially when tax season rolls around. About the Author. This goes for any other delivery gig, like Amazon Flex or Postmates. Learn more about the safeguards we've put in place to protect your information. Taxfyle connects you to a licensed CPA or EA who can take time-consuming bookkeeping work off your hands. The rate from January 1 to June 30, is Just think about our examples from earlier: your phone and your car. Emails will be sent out in phases to Dashers starting in October

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities.

Here are some other common write-offs for dashers:. The IRS allows drivers to deduct the actual expenses incurred or the standard mileage rate currently Filing your taxes on time is essential to avoid incurring penalties from the IRS. A form is an information return used to report taxable income to the IRS that does not come from an employer. Now that you have everything you need to know about your tax deductions, you may be wondering when your taxes are due. Loan officer. But Doordash considers its drivers to be independent contractors, so they don't withhold taxes. Luckily, you don't have to handle the search on your own. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. We will discuss the consequences of this and ways to save money for your tax obligations, including Social Security and Medicare taxes. You can receive instant deposits with no fee if you have DasherDirect.

0 thoughts on “How to get tax papers from doordash”