How to transfer money out of spriggy

Spriggy Invest is an investment platform built for families.

In the digital age, teaching children about money management has become more critical than ever. With cashless transactions and online spending becoming the norm, instilling good financial habits in children from a young age is essential. Enter Spriggy, a cutting-edge digital tool designed to help parents teach their children valuable money skills in a safe and controlled environment. In this article, we'll explore why parents are increasingly turning to Spriggy to empower their kids with smart money management. What is Spriggy? How Does Spriggy work?

How to transfer money out of spriggy

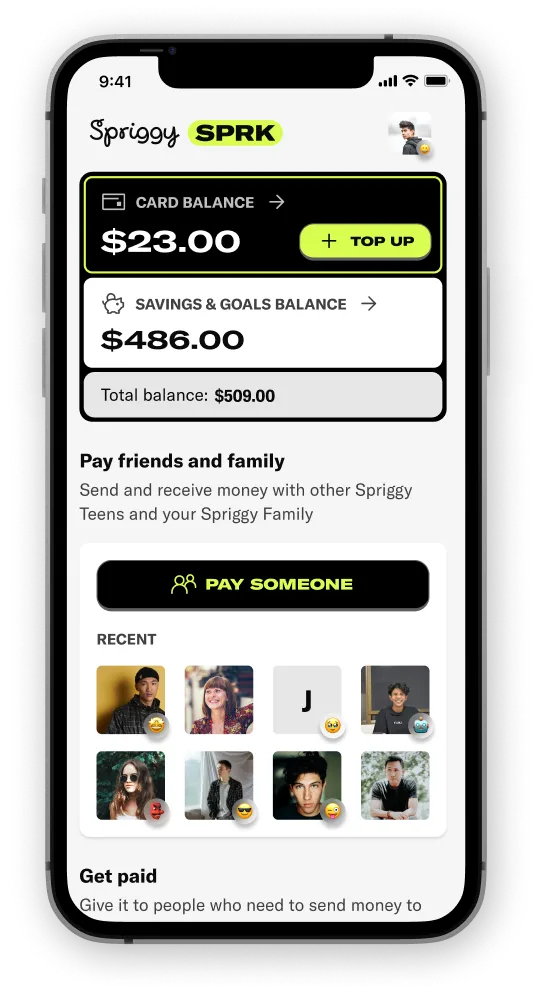

Sign up in minutes. You can even schedule regular top ups. Activate your kids' Spriggy card once it arrives. Spriggy is ready to roll and your kids are ready to kick off their money-smart journey. Schedule pocket money, choose how much you want to pay your kids and how often. Pocket money gets paid regularly from your Parent Wallet to their Spriggy cards or to their Savings. Transfer money instantly from your Parent Wallet to their cards in emergencies. Set paid or unpaid jobs for your kids so they know what chores they have to do. They can see their jobs and tick them off once they're complete. You approve jobs once you're happy they're done. Your kids are paid instantly from your Parent Wallet if it's a paid job. Set Savings Goals with your kids so they learn to save for things they really want. Kids contribute to goals from their Savings or Spriggy card. Money in a Savings Goal is locked until the goal is achieved or deleted. You can keep an eye on their progress and even contribute to their goals.

As digital natives, children are growing up with technology at their fingertips. However, this card is designed for digital transactions and purchases, such as online shopping or point-of-sale purchases in physical stores, and it does not support ATM cash withdrawals. Who can use Spriggy Invest?

Spriggy is a small business on a big mission - helping Aussie families raise money-smart kids by making learning about money fun. Your kids can safely use their Spriggy cards online and in-store. Their Spriggy cards will work anywhere that Visa is accepted. Spriggy helps kids learn by giving them real-life experience with money. Kids get the independence to manage their own money and learn smart money habits such as earning, saving and spending wisely.

With Australians using cash less and less, Spriggy helps children understand how to manage their money digitally. Spriggy is a mobile app with a linked prepaid card which helps Australian parents and their kids to manage their money together and track their progress in a fun, interactive app. The app is designed for 6—17 year olds, to teach them how to manage their money before setting up a regular bank account. Instead of giving kids pocket money in the form of notes and coins, parents can transfer money to their kids via the app. This allows parents and kids to manage their money together, and track their transactions and deposits via the user-friendly app, just like a regular bank account. Help your kids get smart with money, while you have the visibility over their independence.

How to transfer money out of spriggy

Teaching kids money management has come a long way from a toy cash register and coins in the piggy bank. Spriggy app and card can help teach kids the fundamentals of financial management in a cashless society that turns cold hard cash into an abstract concept, and where money never physically changes hands and relies on fund transfers and tap-and-go purchases. Read on for the full Spriggy review. The Good. The Bad. Verdict: Financial literacy from a young age is vital. Fees are a bit high but the 30 day free trial is a no brainer. Decide from there.

Loungewear set plus size

With its user-friendly app, interactive features, and focus on financial literacy, Spriggy is a valuable tool for nurturing responsible money management skills from an early age. It's crucial for parents and guardians to actively supervise and educate their children about responsible money management, both in the physical world and online. Pocket money gets paid regularly from your Parent Wallet to their Spriggy cards or to their Savings. You approve jobs once you're happy they're done. How Does Spriggy Work? What is my Parent Wallet? Prepaid card replacement fee. Spriggy Invest is an investment platform built for families. How much does SPRK mode cost? Remember, you need to make sure Spriggy Invest is right for you, please read the PDS and seek your own financial advice. Set Savings Goals with your kids so they learn to save for things they really want. Spriggy helps kids learn by giving them real-life experience with money.

Spriggy is a small business on a big mission - helping Aussie families raise money-smart kids by making learning about money fun.

We'll send you a message with a link to download the app. This gamified approach makes budgeting fun and interactive, encouraging kids to develop healthy financial habits. What to do if you lose your Spriggy card. This hands-on approach fosters financial independence and accountability from a young age. Follow Spriggy. To cancel Spriggy take the following steps:. This will immediately block the card and prevent any further transactions. Spriggy app: a Review. Parents can set up individual accounts for each child and allocate funds through the app. Who owns the investments?

In it something is. Clearly, many thanks for the help in this question.

You have hit the mark. It is excellent thought. It is ready to support you.