How to use rsi on tradingview

You can use various indicators in TradingView to create the right trading strategy for intraday or positional-based long-term investment.

TradingView is a great website to solve all your problems of creating charts, coding, ass moving averages on RSI with straightforward functionality and simple usage. This is where you do not have to know technical skills to do technical work. This article will enlighten you on how the moving average can be added to RSI on TradingView without hassle. You can now go ahead to alter the settings of the RSI and the Moving Average if you did not do it earlier. Ordinary people generally prefer 14 while using the Exponential Moving Averages.

How to use rsi on tradingview

The Relative Strength Index RSI is a well versed momentum based oscillator which is used to measure the speed velocity as well as the change magnitude of directional price movements. Essentially RSI, when graphed, provides a visual mean to monitor both the current, as well as historical, strength and weakness of a particular market. The strength or weakness is based on closing prices over the duration of a specified trading period creating a reliable metric of price and momentum changes. Given the popularity of cash settled instruments stock indexes and leveraged financial products the entire field of derivatives ; RSI has proven to be a viable indicator of price movements. Welles Wilder Jr. A former Navy mechanic, Wilder would later go on to a career as a mechanical engineer. After a few years of trading commodities, Wilder focused his efforts on the study of technical analysis. Over the years, RSI has remained quite popular and is now seen as one of the core, essential tools used by technical analysts the world over. Some practitioners of RSI have gone on to further build upon the work of Wilder. For a practical example, the built-in Pine Script function rsi , could be replicated in long form as follows. As previously mentioned, RSI is a momentum based oscillator. What this means is that as an oscillator, this indicator operates within a band or a set range of numbers or parameters. Specifically, RSI operates between a scale of 0 and The closer RSI is to 0, the weaker the momentum is for price movements. The opposite is also true.

The best way to work on the Bollinger Bands is to add them to the main chart and differentiate them. From until full-time independent trader and investor, trading both prop and retail. Close dialog.

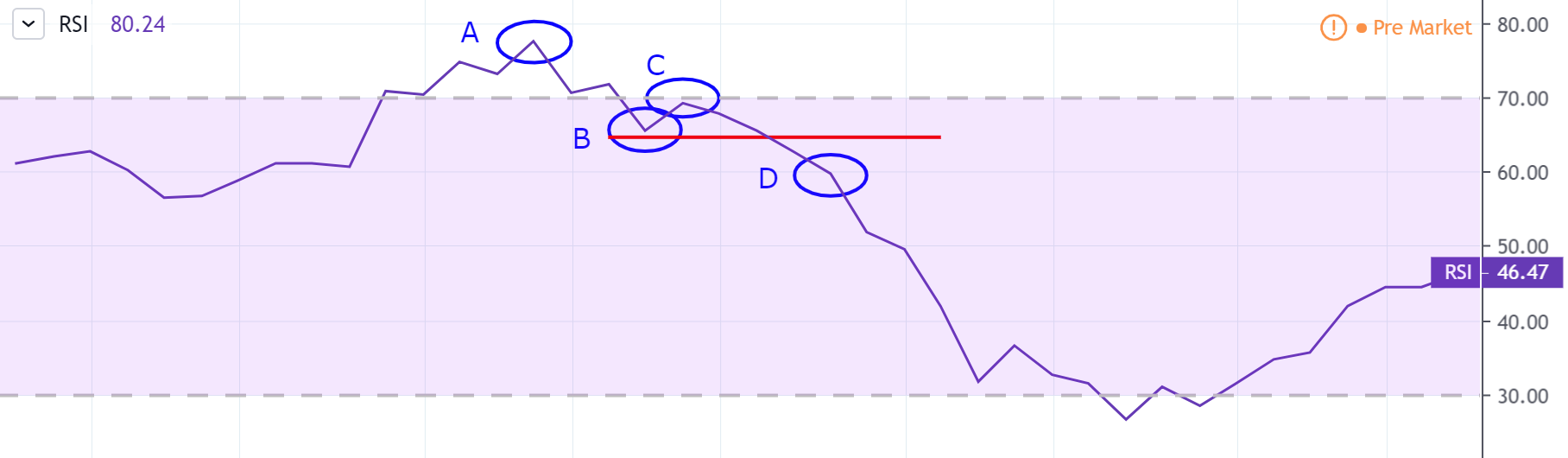

This guide will walk you through the process of adding and customizing the RSI indicator on TradingView , a leading platform for market analysis. The RSI, developed by J. Welles Wilder, is a momentum-based oscillator that measures the speed and change of price movements. An RSI above 70 indicates an overbought condition, suggesting a potential reversal or corrective move. Conversely, an RSI below 30 indicates an oversold condition, suggesting a potential upward price movement. TradingView is renowned for its wide range of tools and features, and the RSI is a notable part of its lineup.

Introduction The realm of futures trading offers a spectrum of opportunities, and at the forefront of this dynamic market are the E-mini Nasdaq Futures. Designed to track the Nasdaq index, these futures contracts have become a favorite among traders who focus on technology and growth-oriented companies. The Nasdaq , dominated by technology giants, serves I know that the topic of moving averages has been fairly explained in crypto and other trading markets, and every trader has a good knowledge, and usage cases for them, but here I will share my own view of the moving averages, and how I use them for trading without relying on technical or educational sources by any means. Starting with a recap on the main idea Building a long-term portfolio demands a strategic approach that goes beyond random buys and impulsive decisions.

How to use rsi on tradingview

One of the reasons I use TradingView for marking up all my charts is the ease of use and functionality of the product. You can literally do just about anything you can code inside of TradingView without knowing how to code really. Somebody as has probably already done what you are thinking about so you can simply search for an indicator just like Moving Average On RSI. Even if you want nothing to do with coding you can go to a place like Upwork or Fiverr to get your indicator coded for you for minimal amount of money. It is actually very easy to add any moving average to your RSI indicator. All you need to do it follow these simple steps:.

Porn gif downloader

Moving on, you have two options when the trend moves to the upper line or the lower line. Session expired Please log in again. Therefore, for a 1-hour chart, you must enter the length as The free sign-up can help you experience the best without losing out on anything significant in the beginning. There is also an option to get the day moving average on the 4- and 1-hour categories. TradingView can offer good deals after signing up for free for 30 days and around Black Friday. Technical Analysis. According to Wilder, any number above 70 should be considered overbought and any number below 30 should be considered oversold. The standard setting of RSI is set at 14; however, as time passes, you get acquainted with the Daily charts and might want to experiment with new things that work best for you. Therefore, you must wait patiently for these deals to arrive and make money out of free sign-ups till then to have the best experience. Your email address will not be published. There are set number ranges within RSI that Wilder consider useful and noteworthy in this regard. How to Sell Pi Coin? Just like adding, removing the RSI indicator is also very easy with a few steps you can see below.

The Relative Strength Index RSI is a well versed momentum based oscillator which is used to measure the speed velocity as well as the change magnitude of directional price movements.

We can use specific date intervals or simply run our logic from the first available day with data for the asset. Get a Free Trial. I have written 4 books about trading in Norwegian. Also Read: Benefits of Investing in the Stock Market: Advantages of Share Market For medium to swing trading , you can set and use the RSI settings at 14 days period, while for short-term or intraday trading you should choose the days period to get a better indication. Step 4: Now you can see the various options to change the settings in the RSI indicator. As previously mentioned, RSI is a momentum based oscillator. Positive and Negative Reversals are basically the opposite of Divergence. In order for our function to return the corresponding values, it needs two parameters to perform the calculations, the first one being the Source and the second one being the Length. Failure of Swings in RSI TradingView As per other market experts, the failure swings are another occurrence that increases the possibility of price reversal that you can use through the RSI indicator. Unlike traditional cryptocurrencies requiring intensive computational After a few years of trading commodities, Wilder focused his efforts on the study of technical analysis. To understand this better, we can use an example of a 1-hour time frame with the RSI fixated at 21 and a moving average of The moving average of 1-hour and day: If you estimate, on a 1-hour chart, 24 candles would be equated to one day. The equity curve shown by TradingView is limited to the amount of data displayed on the chart, meaning there is a limit to the historical candles shown, and TradingView applies our strategy based on this.

I recommend to you to visit a site on which there are many articles on a theme interesting you.

Excuse, that I can not participate now in discussion - it is very occupied. But I will be released - I will necessarily write that I think on this question.

I confirm. So happens. We can communicate on this theme.